![]() As a stock, Zoom Communications (Zoom Communications Stock Quote, Chart, News NASDAQ:ZM) may be too hot to handle right now but investors might want to bet on the technology having staying power, says Scotia Wealth’s Mike Newton, who says there are still many chapters to play out in the rapidly developing video conferencing space.

As a stock, Zoom Communications (Zoom Communications Stock Quote, Chart, News NASDAQ:ZM) may be too hot to handle right now but investors might want to bet on the technology having staying power, says Scotia Wealth’s Mike Newton, who says there are still many chapters to play out in the rapidly developing video conferencing space.

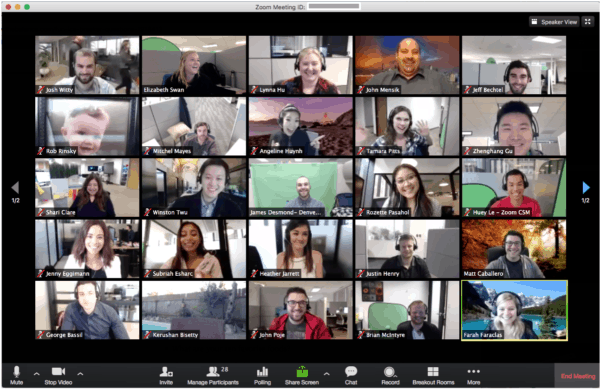

As everyone and their grandmother knows, Zoom meetings are everywhere these days, as people caught in COVID-19 lockdown are finding the platform a handy replacement for the real thing. And while not necessarily an obscurity pre-pandemic, Zoom’s emergence into the public consciousness has led to now an almost tripling of the stock’s value in the space of a few months.

And while that growth trajectory might raise some eyebrows, the platform itself has definitely taken root, so much so that it’ll be hard to unseat the current conferencing champion, says Newton, portfolio manager and director of wealth management for Scotia Wealth.

“I actually do own the name. It’s kind of central to one of my philosophies that if I’m using it, my family’s using it and my friends are using it, I get really interested in what’s going on there,” Newton said, in conversation with BNN Bloomberg on Friday.

“The question will be whether this is a going concern and is all the rage after, or if, things return to normal,” Newton said. “Zoom is come out of nowhere, obviously … and it’s another work from home phenomenon and there’s a whole basket of them.”

“I would caution that, [while] we own the name and it’s worked out really well for us, we’re obviously trailing it up with a stop in the event that this thing turns around on us,” Newton said.

Newton says Zoom’s new security features, aimed at cutting out the earlier problem of hackers breaking in on meetings, are a step in the right direction for the company, but Zoom is still a bit of an outsider when it comes to acceptance by corporations and established organizations.

“If you look at the S&P 500 or Fortune 500 or the TSX 60, businesses … generally Zoom isn’t going to be on their approved communication list. So, you might be using Cisco’s WebEx or you might be using something from Microsoft’s family, Skype or Teams,” Newton said. “This will be very interesting. I think Zoom is going to be a habit it’ll be hard to break and I think zoom has a lot of legs here.”

“[But] it’s up around 52-week highs right now, so you have to tread carefully,” Newton said.

Ahead of Zoom’s first quarter fiscal 2021 results due on June 2, the company last reported in early March where its fiscal fourth quarter showed revenue up 78 per cent to $188.3 million for the quarter and up 88 per cent for the year at $622.7 million. Earnings came in at $0.15 per share compared to $0.04 per share a year earlier.

The quarterly revenue beat analysts’ average forecast at $176.6 million while the consensus on earnings was $0.07 per share.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment