After reviewing fourth quarter results from Maxar Technologies (Maxar Technologies Stock Quote, Chart, News TSX:MAXR), National Bank Financial analyst Richard Tse thinks the stock is fairly valued as it is.

After reviewing fourth quarter results from Maxar Technologies (Maxar Technologies Stock Quote, Chart, News TSX:MAXR), National Bank Financial analyst Richard Tse thinks the stock is fairly valued as it is.

In a report to clients on Tuesday, Tse reiterated his “Sector Perform” rating and $20.00 target, which as of publication date represented a projected return of 26 per cent, including dividend.

Space and defence communications company Maxar has had its share of drama over the past couple of years, with a write-down of its satellite business and a short-seller attack on its accounting practices back in 2018, which was followed up by the loss of a crucial revenue-generating satellite, a cut to the company’s dividend and, in December of 2019, the announced sale of its Canadian aerospace unit, MDA, to a Toronto-based investment firm.

The stock fell from as high as $86.67 in late 2017 to as low as $5.10 per share as of January 2019, after which MAXR picked up the pace and ended 2019 at $20.36. So far this year the stock is up eight per cent to $22.00.

On Monday, Maxar reported its fourth quarter and year-end results, posting revenue of $480 million for the Q4 compared and adjusted EBITDA of $121 million. (All figures in US dollars.)

In the commentary on the year that was, management underlined its efforts to right the ship and bring the company’s debt under control.

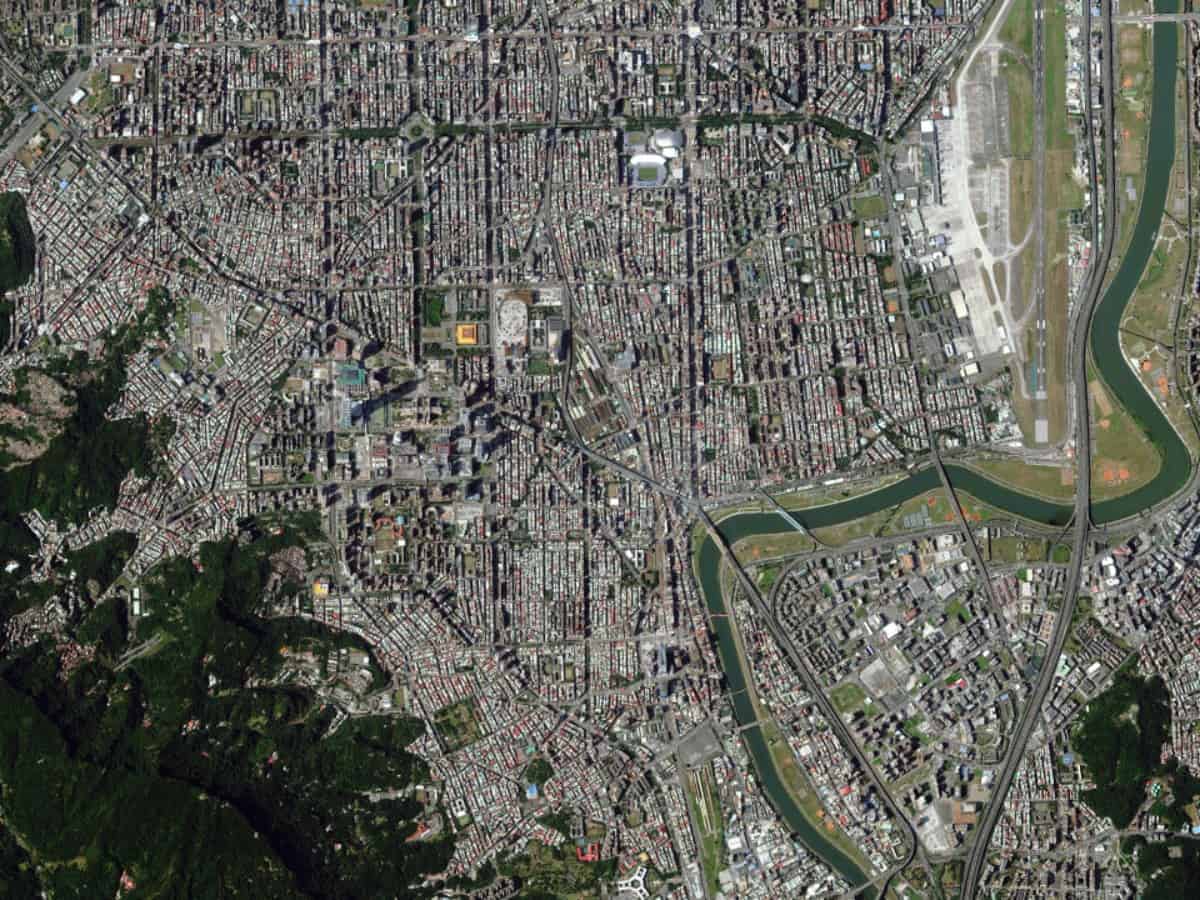

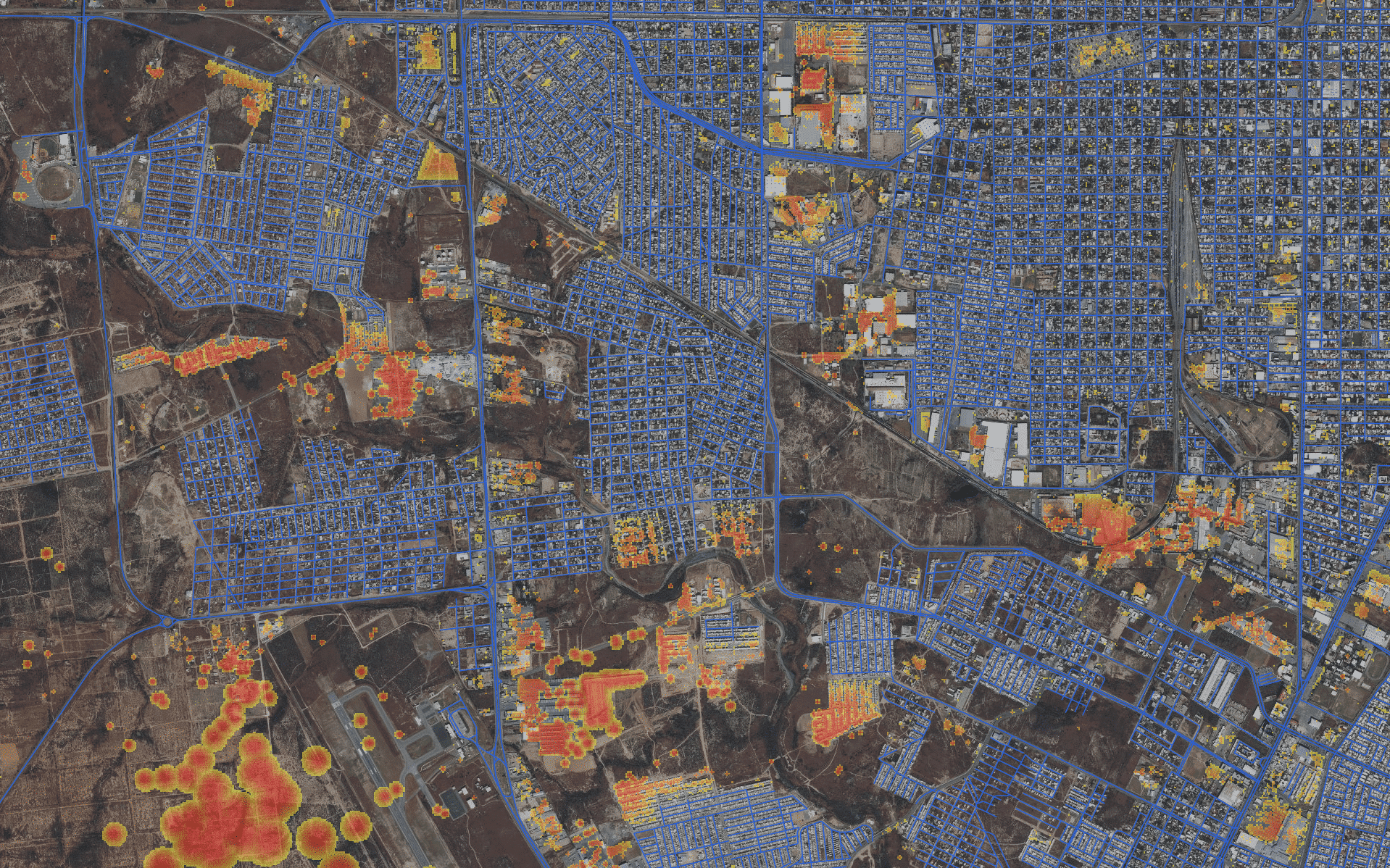

“We made solid progress during the year in positioning Maxar for sustained top and bottom-line growth, including efforts to reduce debt and leverage levels, re-engineer the Space Infrastructure business, position our Earth Intelligence and MDA businesses for long-term growth, and create a leaner, more agile organization with a reduced cost structure,” said president and CEO Dan Jablonsky.

On the Q4 results, Tse was calling for $454 million in revenue and adjusted EBITDA of $143 million, while the consensus was a $448 million top line and EBITDA of $122 million.

Overall, Tse called the quarterly results mixed, saying that dim growth prospects over the next couple of years should make for little upside to the name.

“We like the fact that Maxar has moved to de-lever its balance sheet and synchronize its debt maturities with future cash flow. With a current leverage ratio at 6.9x, we expect that ratio will decline to 5.1x following the sale of MDA. Looking ahead, the question then becomes whether we believe Maxar can execute, and if so, how much of that execution should we price in today and at what valuation,” Tse wrote.

“On that basis, we see flat revenue and EBITDA growth this year (fiscal 2020) with negative free cash flow of $156 million. In fiscal 2021, we see growth of three per cent and two per cent for revenue and EBITDA, respectively, with free cash flow of $54 million. What valuation should we ascribe to that? If we look at the comparable groups relative to Maxar’s current valuation – it would suggest given the history, forward growth rate and long-time horizon before WorldView Legion scale (three years), the stock is

reasonably valued,” he wrote.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment