Ballard Power is still a stock to avoid, this investor says

Clean tech name Ballard Power Systems (Ballard Power Systems Stock Quote, Chart, News TSX:BLDP) has had a great run over the past few months but with the market correction the stock is down considerably.

Clean tech name Ballard Power Systems (Ballard Power Systems Stock Quote, Chart, News TSX:BLDP) has had a great run over the past few months but with the market correction the stock is down considerably.

A good time to buy on the pullback? Not really, says Alex Ruus of Arrow Capital Management, who claims Ballard was already way ahead of itself.

Like many names in the renewable energy sector, Ballard was on a tear over the last stretch of 2019 and into 2020.

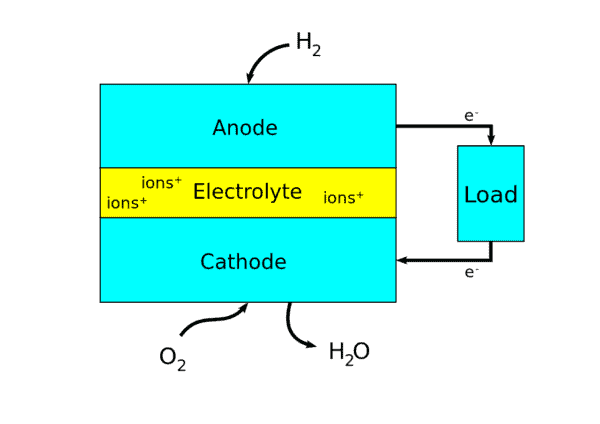

Ballard, which makes hydrogen fuel cells for vehicles ranging from passenger cars to buses, trains and commercial trucks, saw its share price shoot up 73 per cent over the second half of 2019, followed up by a doubling of the stock over the first month and a half of 2020.

But the drop in the market took a toll of BLDP, taking it from a high of $18.78 on February 18 to where it now sits in the $13 range. That type of dip might signal an opportunity but Ruus says no.

“Ballard is a very interesting Vancouver-based company in the fuel cell business and is really the gold leader in fuel cells,” said Ruus, portfolio manager for Arrow Capital, in conversation with BNN Bloomberg on Tuesday. “They have a great niche business in this in this area. But if you look at the how the stock has performed you saw it had a huge run up and now it’s starting to correct. I think if you look at the actual fundamentals underlying it, the stock got way ahead of itself here,” says Ruus. “This is one of these these stocks that has really ripped in the last three four months on the back of ESG and clean power and that sort of thing.”

“But unfortunately, the profitability potential of this business is not that big. And so, if you've been fortunate enough to be in the stock there's a great profit opportunity for you here. I would not own it here though,” he said.

Ahead of Ballard’s fourth quarter 2019 financials due on Thursday, the company last reported in late October where its Q3 featured revenue up 15 per cent year-over-year to $24.8 million. On a segment basis, Ballard saw improved results from its Technology Solutions platform which generated $16.8 million in revenue, up 61 per cent, which more than offset declining results from Power Products which brought in $8.0 million, a 28 per cent decline year-over-year.

Ballard’s adjusted EBITDA for the quarter was a $7.2-million loss, which compared to a loss of $6.0 million a year earlier. The company ended the Q3 with cash reserves of $153.4 million, while management reaffirmed its full-year 2019 guidance.

Ballard in December announced a $19.2-million order for its joint venture with China’s Weichai Power, along with a new sales agreement from German telecom company adKor and power company SFC Energy. For the upcoming fourth quarter, analysts are estimating revenue of $31.1 million and EPS of negative $0.05 per share.