Shopify is vulnerable to a market downturn, this investor says

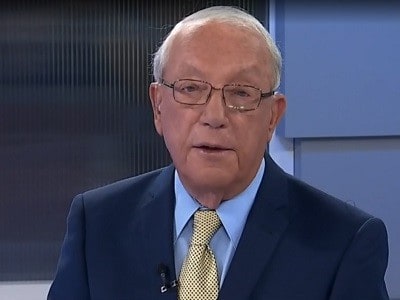

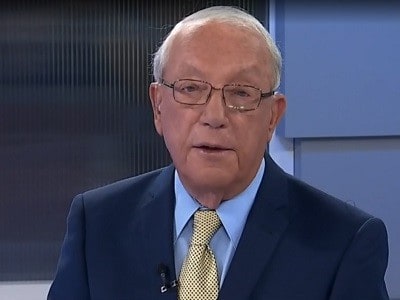

Wait for it, says David Cockfield, who thinks caution is in order with a high-growth stock like Shopify.

Canadian e-commerce story Shopify wowed the market in 2019 with incredible gains and has kept the party going into 2020, climbing 19 per cent since the start of January and a whopping 66 per cent since early November.

SHOP pulled back a little on Friday, ending the day down two per cent. But that shouldn’t be read as a Buy signal, says Cockfield, managing director at Northland Wealth Management, speaking to BNN Bloomberg on Friday.

Cockfield worries that a downturn in the market will hit growth stocks like Shopify hard.

“We owned some Shopify and sold it way too soon, I’ll have to admit to that,” said Cockfield. “It’s the kind of stock that’s pretty vulnerable to general market sell-offs because it’s trading at an astronomical multiple — well, an unknown multiple since it doesn’t have any significant earnings. It’s going to be vulnerable it this market continues to correct.”

“I would certainly sit on the sidelines until it actually finds a point where other buyers are coming in. Otherwise, you could buy and see some of your market value evaporate quite quickly,” he says.

“[But] it’s a great company, great concept,” says Cockfield.

Sparks could fly next week as Shopify is set to announce its fourth quarter and full fiscal 2019 financials on February 12. For its Q3 posted in late October, Shopify had another record quarter for revenue, growing its top line by 45 per cent year-over-year to $390.6 million for its third quarter. That topped analysts’ projections, as did management’s

guidance for its Q4, which aimed at revenue between $472 million and $482 million, above analysts’ average estimate of $470.6 million.

“Our strong results in the quarter were driven in part by the success of our international expansion, which is just one of the many ways we are investing in the platform,” said Amy Shapero, Shopify’s CFO, in the company’s third quarter report.

At the same time, Shopify’s third quarter involved a substantial earnings loss of $0.25 per share, well below the expected gain of $0.11 per share and said to have been caused by a one-time tax item. The loss prompted an immediate drop in the share price but the stock quickly recovered and went on its months-long streak.

Shopify has had international expansion on the brain since Day One and this year is proving no different, with the company announcing last week plans to open a permanent office in Vancouver with 1,000 new staff. Shopify is also increasing its logistics presence, spreading out a network of fulfillment centres across the United States to help its retailers with shipping and delivery, while around the world, the company says it has now 4,000 employees in 15 cities globally.