Why you should know the Shopify Fulfillment Network: National Bank explains

Another year brought another new high for Shopify (Shopify Stock Quote, Chart, News NYSE:SHOP) in 2019, as analyst scrambled to re-rate the stock at a record pace.

Another year brought another new high for Shopify (Shopify Stock Quote, Chart, News NYSE:SHOP) in 2019, as analyst scrambled to re-rate the stock at a record pace.

But what’s driving the profound growth for the Ottawa-based eCommerce giant? More importantly, what will allow it to continue?

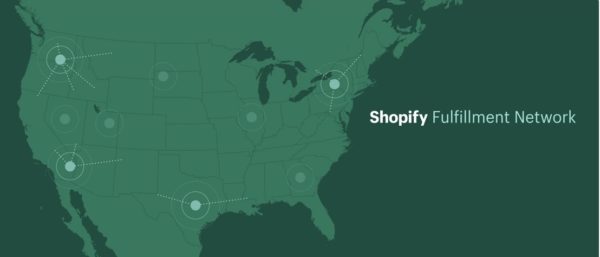

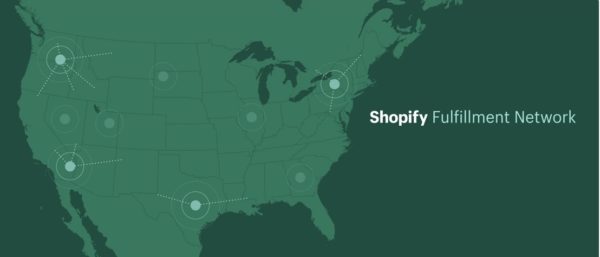

National Bank Financial analyst Richard Tse says there is a part of the story that has gone relatively unexplained: the Shopify Fulfillment Network (SFN).

In a research report to clients today, Tse dove into the SFN, explaining how it is a critical part of SHOP’s offering.

“With the holidays just a few weeks behind us, what’s still fresh in our memories is the lead up to Christmas,” the analyst said. “If you’re like us, you likely spent time on your laptop, tablet or smartphone making a few last-minute purchases. On that note, if part of your decision-making process included how quickly you could get your items delivered and at what price, you’re not alone. According to a survey by Digital Commerce 360 / Bizrate Insights, about two-thirds of consumers claim shipping is one of the most important factors in choosing retailers. In a separate survey, 91% of respondents indicated they would not buy something unless shipping was free. No doubt retailers know that too with many of the top retailers offering free or discounted shipping over the holiday season for purchases above a certain dollar threshold.”

Tse explains that online sales has become a battleground of giants who are paying more than close attention to detail. In Amazon’s case, this recently meant a brush with antitrust accusations.

“With eCommerce sales up 19% Y/Y this holiday season according to Mastercard SpendingPulse (vs. 1.2% in-store), the reality is that shipping and fulfillment is becoming a critical last-mile differentiator for retailers selling online,” he said. “Amazon recognized this early on making aggressive moves to further its position and over the recent holiday season, it’s reported to have forced some of its retailer customers to use its logistics services over providers like FedEx so that Amazon could control the quality and timing of delivery given this important differentiator. No doubt, Shopify has seen this too with its retailers and it’s why the Company has embarked on this strategy that has it targeting $1 billion in investment in its Shopify Fulfillment Network (SFN).”

If customers were fine with three day delivery, one major fulfillment centre could reach 90 per cent of them. But want to reach them same day? The same merchant would need a whopping 70 fulfillment centres to reach just 70 per cent of the population…

The National Bank Financial analyst says its not surprising that not many know about the Shopify Fulfillment Network.

“The reality is the data and rationale around SFN have been very limited, which is why we’re publishing this note to provide some perspective on what it could mean for Shopify when it comes to driving equity value,” Tse explained.

Tse says the SFN is important because it addresses a growing challenge and opportunity for the company’s merchants. The reality, he says, is that shipping and fulfillment is becoming a key advantage, if not mere table stakes in the eCommerce game.

“We’d go as far to say that fulfillment (warehousing, order packing, mailing, tracking and handling returns) helps drive scale into the “Brand” stage as retailers move from managing larger volumes in-house,” said the analyst.

Tse says that as customers become more demanding, you might call fulfillment the “Last Mile” to eCommerce success.

Why is the Shopify Fulfillment Network so important?

Consider this: Tse says if customers were fine with three day delivery, one major fulfillment centre could reach 90 per cent of customers, no problem.

But want to reach them same day? Tse says the same merchant would need a whopping 70 fulfillment centres to reach just 70 per cent of the population.

This, he says makes Shopify’s investment in the SFN, including its notable acquisition of 6 River Systems, so important. Shopify merchants, he offers, will be the big winners.

“Overall, we found that SFN could bring material costs savings for merchants as it could reduce expedited shipping costs (2-day or next-day delivery) by 41%. When it comes to same-day shipping, the cost savings could be as much as 49%. Assuming an average order price of $83 (from the latest Shopify BFCM data), we estimate customers could save ~10%-15% off the final order price. If merchants offer free shipping, that means a similar lift in margin. Apart from savings from shipping costs, we note savings could also come from storage, handling and package as economy of scale kicks in.”

Tse today maintained his “Outperform” rating on Shopify, but raised his one-year price target on the stock from (US) $400.00 to $450.00, implying a return of 10 per cent at the time of publication.

Tse thinks SHOP will post EBITDA of (US) $54-million on revenue of $1.56-million in fiscal 2019. He expects those numbers will improve to EBITDA of $119-million on a topline of $2.12-billion the following year.

“We continue to believe Shopify is in the early stages of a rapidly growing eCommerce market. Like other disruptive leaders, we believe the upside in the stock comes from organic growth and from incremental growth drivers like SFN, International, new Merchant Services and Shopify Plus (larger

enterprises),” the analyst concluded.

Nick Waddell

Founder of Cantech Letter

Cantech Letter founder and editor Nick Waddell has lived in five Canadian provinces and is proud of his country's often overlooked contributions to the world of science and technology. Waddell takes a regular shift on the Canadian media circuit, making appearances on CTV, CBC and BNN, and contributing to publications such as Canadian Business and Business Insider.