A new development at Greenlane Renewables (Greenlane Renewables Stock Quote, Chart, News TSXV:GRN) has Beacon Securities analyst Ahmad Shaath raising his price target on the stock.

A new development at Greenlane Renewables (Greenlane Renewables Stock Quote, Chart, News TSXV:GRN) has Beacon Securities analyst Ahmad Shaath raising his price target on the stock.

On Tuesday, Greenlane announced it had entered into an arrangement with Paris-based SWEN Capital Partners that will see the pair create a joint-venture company that will see SWEN handle the initial capital outlays in return for a monthly fee, thereby removing the burden of ownership for GRN clients.

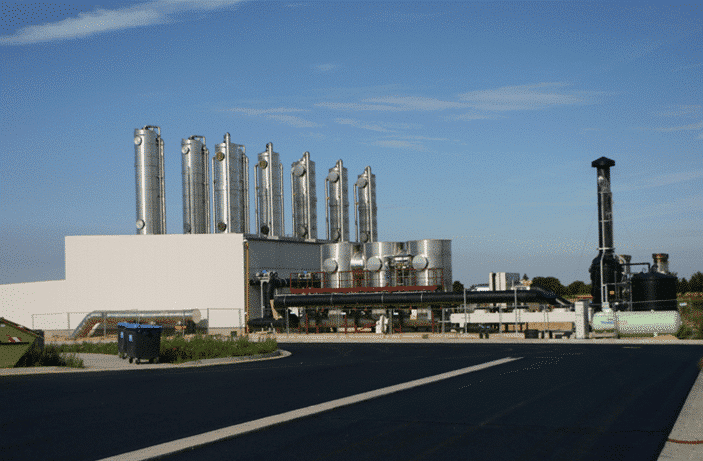

“We believe the joint venture will unlock new opportunities by creating a unique value proposition that attracts those customers requiring not only financing to deploy biogas upgrading systems but also long-term guarantees,” said Greenlane CEO Brad Douville. “This innovative solution allows our systems to be owned and financed by the joint venture in which we will participate as a minority equity partner. Greenlane will be responsible for the construction, operation and maintenance of the biogas upgrading units, and our equity partner, SWEN, will be responsible for the financing. Customers benefit from reduced capital expenditures in projects, built-in operation and maintenance while retaining their autonomy to sell the resulting renewable natural gas back to the natural gas grid.”

Shaath said this JV helps overcome “significant” hurdles, especially for smaller clients of Greenlane.

“The JV will be targeting both greenfield clients and clients with existing streams of biogas (e.g. clients using biogas for combined-heat-and-power “CHP” systems),” the analyst noted. “We believe this turnkey solution model that includes financing will accelerate adoption significantly. This is especially true for existing owners in Europe, a market characterized by large number of single-farm biogas installations. The JV’s offering will reduce upfront capital expenditure requirement, typically the single biggest factor impacting the decision making for cash-strapped farmers (a typical single farm installation costs ~$1 million). Having Greenlane as a technical partner providing design, installation, and operation & maintenance in one package will significantly reduce the technical risk from farmers’ perspective. We believe this model will be a perfect fit for the German market for example, the world’s largest with ~11,000 installations of mostly single-farm units. These installations will continue to come off the feed-in tariff for biogas-generated electricity and will be looking for higher-value applications for their biogas streams.”

In a research update to clients today, Shaath maintained his “Buy” rating but raised his one-year price target on Greenlane Renewables from $0.50 to $1.10, implying a return of 93 per cent at the time of publication.

Shaath thinks Greenlane will post Adjusted EBITDA of negative $1.4-million on revenue of $10.9-million in fiscal 2019. He expects those numbers will improve to EBITDA of negative $300,000 on a topline of $25.0-million the following year.

“With this announcement, GRN is on track to add a stable, high-margin revenue base that is driven by gas purchasing agreements,” the analyst added. The company also secured a strong financial partner that will accelerate the adoption of RNG equipment in Europe. Consequently, we are upgrading our valuation multiple of 3-3.5 EV/Sales (FY20) which is reasonable compared to current CleanTech plays that trade at an average of 5x EV/Sales and median of 3x EV/Sales. This leads to our revised price target of $1.10 (was $0.50).

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment