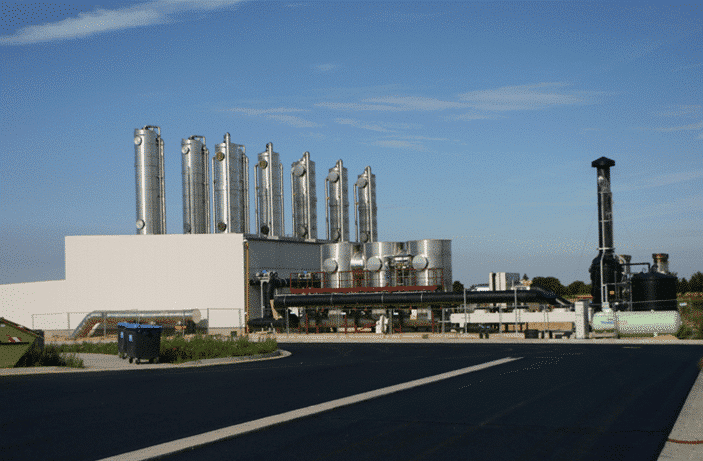

When it comes to the cleantech sector, portfolio manager Robert McWhirter says biogas upgrading is the place to be, which means that Burnaby, BC’s Greenlane Renewables (Greenlane Renewables Stock Quote, Chart, News TSXV:GRN) has lots of room for growth.

Penny stock Greenlane has been on a tear over the past month, starting with the company’s first full quarter of earnings delivered in late November. There Greenlane posted revenue of $5.0 million and an adjusted EBITDA loss of $0.9 million. With an order backlog as of September 30 of $9.6 million, the company’s prospects in renewable natural gas (RNG) are strong, with the global biogas upgrading market outlook expected to grow at a minimum of 30 per cent CAGR over the next five years, said Greenlane

management.

“We have made tremendous strides since launching as a public company, including posting our first full quarter of revenue,” said Brad Douville, President and CEO of Greenlane, in the quarterly press release on November 27.

“We continue to see an acceleration of activity in the RNG industry through various announcements and declarations with respect to new RNG volume commitments made by major gas utilities, developments related to easing access to gas distribution networks and new project development activity. This is encouraging for us as evidence that the RNG market is positioning for rapid growth from what is still a low base,” Douville wrote.

McWhirter says Greenlane should continue to do well, although he is less sure about the company’s prospects than those of RNG competitor Xebec Adsorption, another name that has performed very well in recent months.

“The challenge is that unlike Xebec, Greenlane doesn’t go out there and pound the drum and say, ‘We have a huge backlog,’” said McWhirter, president of Selective Asset Management, who spoke to BNN Bloomberg last Friday. “So, yes, they’re bidding on this great opportunity and yes they have an extremely large install base. They have the world’s largest installed system operating in Montreal —they pull the most gas off of any garbage dump in the world, from recollection.”

“Great technology and really good history, great opportunity in bidding on a book of business of over $700 million,” says McWhirter. “Analysts have suggested that it appears to be relatively inexpensive compared to Xebec. My greatest concern is that there is not enough visibility on the backlog [compared to] Xebec.”

Last week, Greenlane announced an $8.3-million contract with a California-based landfill company, with Greenlane targeting 100-per-cent methane capture which will be upgraded and then supplied to SoCalGas’ natural gas grid.

Over the last reported quarter, Greenlane also secured a $2.7-million upgrading contract with the Metropolitan Wastewater Management Commission in Lane County, Oregon.

Greenlane’s sales pipeline has shot up 47 per cent to $660 million since the beginning of 2019, according to management.

McWhirter says the trend towards RNG should keep growing.

“There’s a huge market, particularly if you look at the book of businesses that both Greenlane and Xebec are bidding on — it has grown more than 50 per cent in the last 12 months. There’s a real need to get renewable energy and getting greenhouse gas emissions reduced along with capturing methane from agricultural sources as well,” McWhirter said.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment