Paradigm Capital launches coverage of Spectral Medical with a “Buy”

The clinical-stage medical device company was rated a “Speculative Buy” by analyst Corey Hammill, who said that with clinical validation efforts for its septic shock product line forthcoming and the progression of regulatory approvals for its dialysis products, Spectral Medical has multiple value-defining inflection points ahead in the near term.

Toronto-based Spectral Medical has been a publicly traded company for 25 years, while in 2010 it altered its focus toward treating septic shock and then added dialysis equipment to its pipeline in 2013.

Historically trading in sub-$0.50 territory, Spectral was on the rise in 2015 and 2016 before news broke in October 2016 that its experimental treatment for sepsis failed a late-stage study.

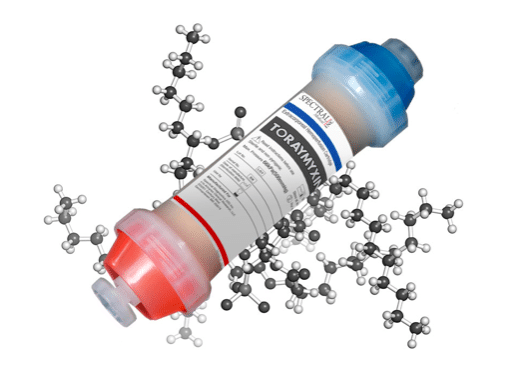

Spectral holds the North American rights to a toxin extraction system developed by Toray Industries of Japan. Spectral’s Toraymyxim (PMX) device filters septic shock-inducing endotoxin from the blood of patients who are in critical condition.

Hammill notes that sepsis is one of the world’s largest unmet medical needs, one which impacts some 330,000 patients in the United States each year and has a mortality rate of over 40 per cent. The analyst estimates the market for septic shock treatment — for which there are currently no effective therapies — at C$1.6 billion.

Spectral is currently in a Phase 3b trial, termed Tigris, which is a follow-up study which is looking to confirm earlier results of a Phase 3 trail and is planned for completion by the end of 2021. If successful in the ongoing trial for Toraymyxim (PMX), Spectral could launch the only FDA-approved treatment for septic shock patients in 2022.

“By commercializing products focused on treating septic shock and simplifying dialysis treatment, EDT could redefine treatment and improve outcomes for critical care patients in the near future. Considering these key differentiators, we see EDT as a compelling investment opportunity,” writes Hammill.

For dialysis, EDT’s SAMI device for acute dialysis is FDA-approved for hospitals and achieved its first sales in the second quarter of 2019. As well, the company’s DIMI device for chronic dialysis is currently being prepared for 510(k) FDA applications that would enable in-centre and home-use, with commercial launch of in-centre projected for 2020 and in-home for 2021.

Hammill says recent US policy changes are set to significantly shift the market toward home care and thus leading to an increase in the percent of patient on home dialysis from the current 12 per cent to 80 per cent by 2025.

“This drastic shift provides a unique opportunity for EDT to enter this changing market with its DIMI home dialysis product,” says Hammill.

The analyst values EDT using a sum-of-the-parts approach which ends up with a 12-month target of $2.00 and translates to a projected return of 304 per cent at the time of publication.

Looking ahead, Hammill sees Spectral generating fiscal 2019 revenue and EBITDA of $3.2 million and $5.4 million, respectively, and fiscal 2020 revenue and EBITDA of $3.2 million and negative $11.4 million, respectively.