Cresco Labs is delivering on the bottom line: Beacon Securities

Showing signs of profitability and continued organic growth, Cresco Labs (Cresco Labs Stock Quote, Chart, News CSE:CL) put in a favourable quarter, according to Beacon Securities analyst Russell Stanley, who reviewed the company’s third quarter results in an update to clients on Wednesday.

Showing signs of profitability and continued organic growth, Cresco Labs (Cresco Labs Stock Quote, Chart, News CSE:CL) put in a favourable quarter, according to Beacon Securities analyst Russell Stanley, who reviewed the company’s third quarter results in an update to clients on Wednesday.

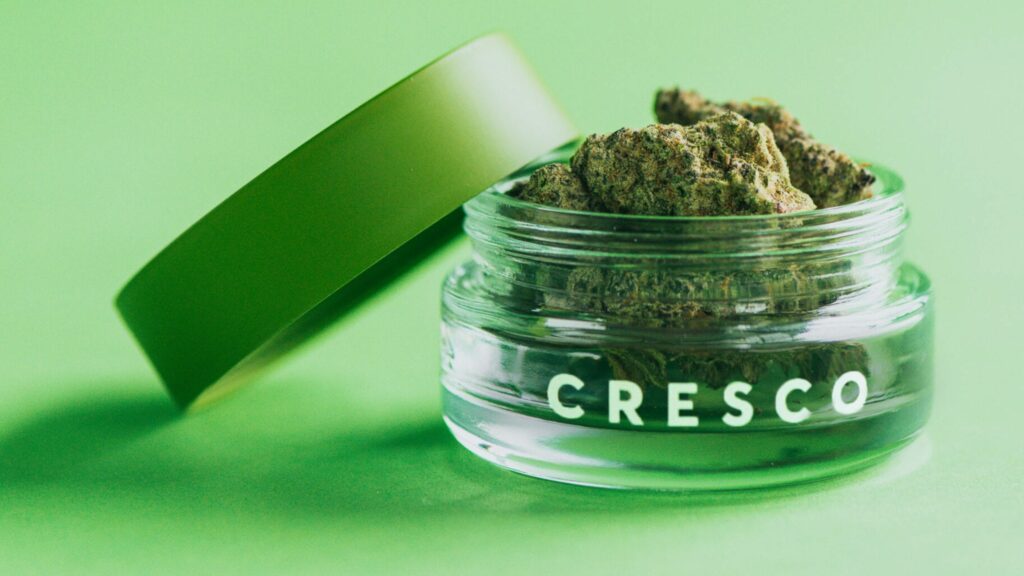

Chicago-based Cresco, which has interest in 11 states including 21 dispensaries and licenses for ten more, released its third quarter ended September 30, 2019, results on Tuesday. The company generated third quarter revenue of $36.2 million, which was up 184 per cent year-over-year and up 21 per cent sequentially. Adjusted EBITDA including the impact of biological assets climbed to $11.1 million, up from $9.7 million a year earlier, while adjusted EBITDA excluding those assets was $3.1 million. Cresco closed the quarter with $416.5 million in total assets and $73.7 million in cash and cash equivalents. (All figures in US dollars unless where noted otherwise.)

“In Q3, our team delivered another quarter of positive adjusted EBITDA while growing top-line revenue 21 per cent over Q2 on an identical asset base, demonstrating the value of our long-term strategy of going deep, in the most populous states, and capturing significant market share through wholesale,” said Charles Bachtell, Co-founder and CEO.

The quarterly revenue came in under Stanley’s forecast of $40 million and the consensus expectation of $38 million, but the analyst was more interested in the EBITDA beat which at $3.1 million was better than his $1-million forecast and the Street’s $2-million.

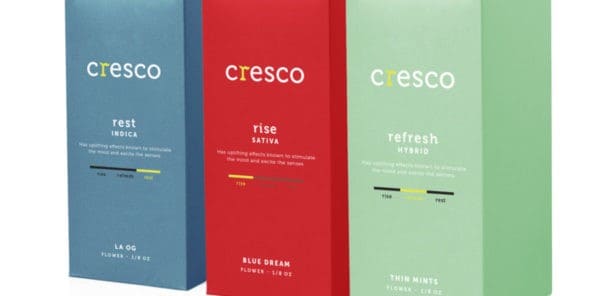

“Given the market’s increasing focus on margins and profitability, we believe the EBITDA beat more than outweighs the slight revenue shortfall, and that investors should view these results favourably. Importantly, CL delivered 21 per cent q/q growth on the same asset base it had in Q2/19, which produced 28 per cent q/q growth in wholesale revenue (now 65 per cent of total revenue, up from 62 per cent in Q2/19) and ten per cent q/q growth in retail revenue,” writes Stanley.

The analyst noted that Cresco is maintaining its leading market share in both Illinois and Pennsylvania at 25 per cent and 30 per cent, respectively, while its wholesale business continues to have 100 per cent penetration of third party dispensaries in each state. As well, management has indicated that it will aim to double its dispensary count in each market by the end of Q1 2020.

“Cresco is particularly well positioned in Illinois, where it is the only company with three licensed cultivation/manufacturing facilities. Given current regulations, we expect CL to build on its wholesale strength here as ongoing expansion efforts will give it a 50% capacity lead on the only peer with two facilities, and 3x the capacity of everyone else in Illinois,” writes Stanley.

Looking ahead, the analyst thinks that Cresco will generate fiscal 2019 EBITDA Net NCI of $16 million on revenue of $131 million and fiscal 2020 EBITDA Net NCI of $153 million on a top line of $592 million.

Stanley says Cresco is currently trading at a 61 per cent discount to its broader cannabis peer group and at a 25 per cent discount to the average among US operators.

With the report, Stanley is maintaining his “Buy” rating and C$24.00 target, which at press time represented a projected return of 223 per cent.