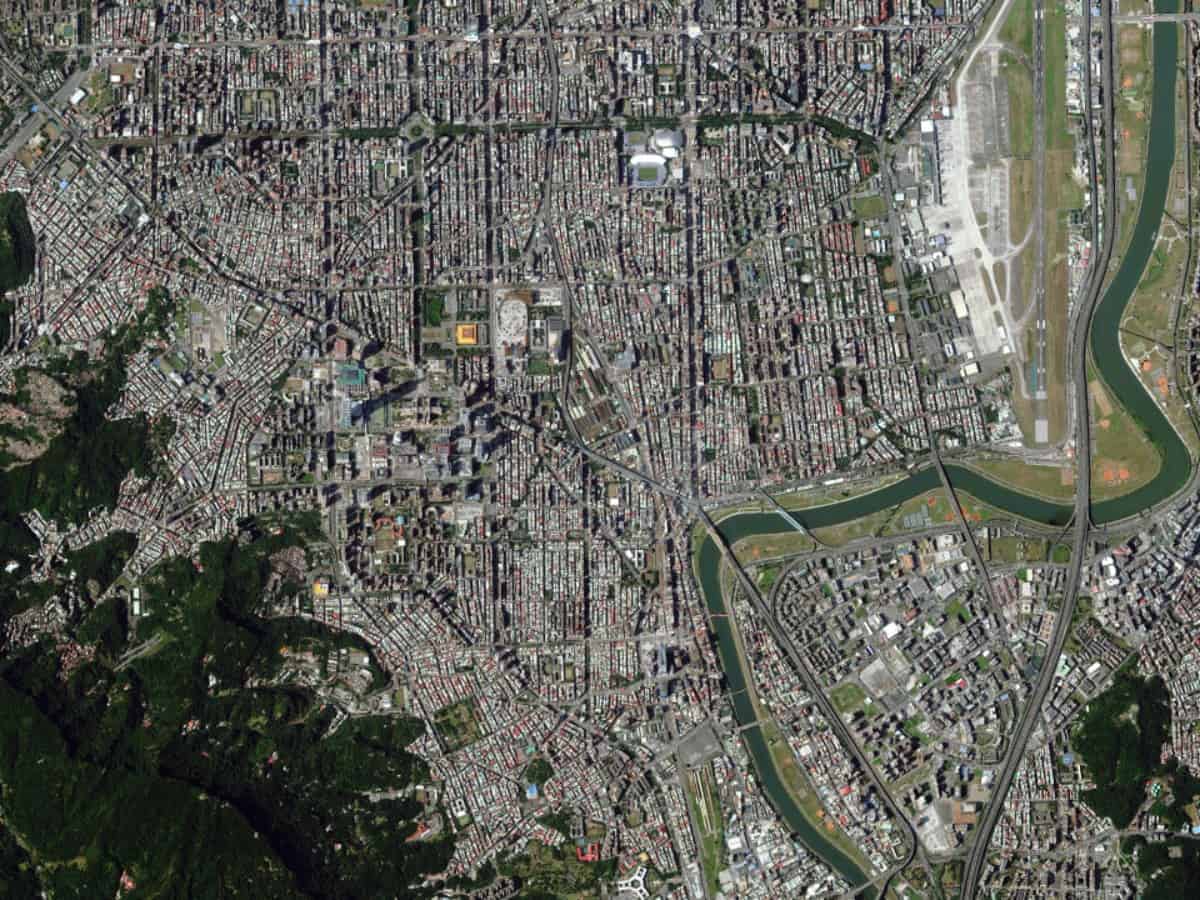

Space company Maxar Technologies (Maxar Technologies Stock Quote, Chart, News NYSE:MAXR) may have a new cheerleader in JP Morgan but there’s still too much uncertainty surrounding the company to merit your hard-earned dollars.

Space company Maxar Technologies (Maxar Technologies Stock Quote, Chart, News NYSE:MAXR) may have a new cheerleader in JP Morgan but there’s still too much uncertainty surrounding the company to merit your hard-earned dollars.

So says Stephen Takacsy, CEO and chief investment officer at Lester Asset Management, who claims that looming debt is still a bit problem.

Shares of Maxar have spiked over the past two days on news that JP Morgan had launched coverage of the stock with an “Overweight” rating and $12 target price, representing an upside of 70-per-cent.

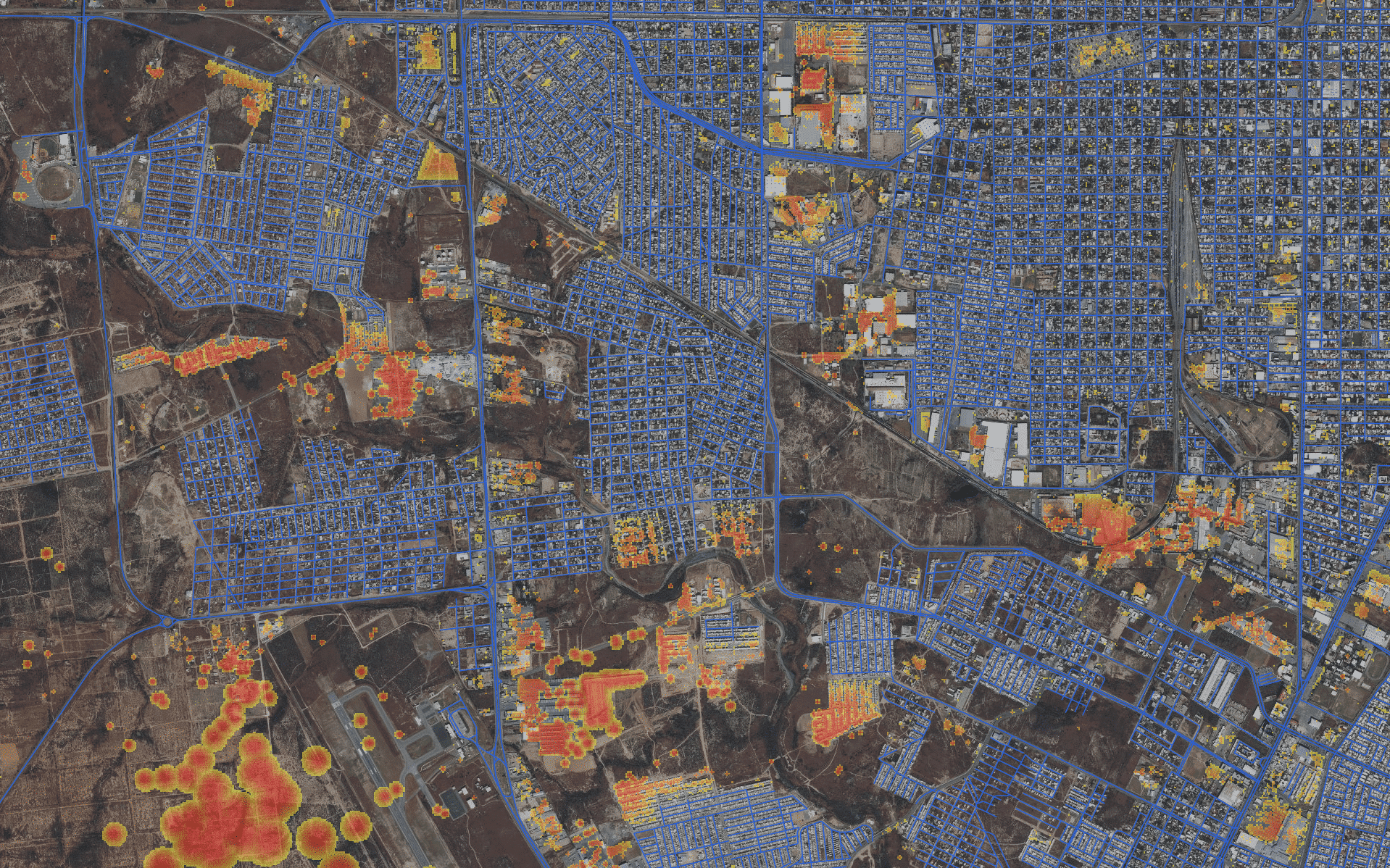

The company has had a hard time finding its feet after mergers in recent years with Digital Globe and satellite company Space Systems Loral (SSL) saddled Maxar with debt, followed up last year by a writedown in its satellite operations and, earlier in 2019, the loss of one of its key imaging satellites.

All told, the events served to tear down Maxar’s stock price which fell from the $50.00 range last summer to sub-$10 territory by January. Over the past two days, MAXR has gained about 28 per cent in value, climbing to $9 by midday on Wednesday. (All figures in US dollars.)

“We see Maxar as a high-risk/high-reward opportunity in the Space industry. We believe the next 24 months are critical as the company progresses on its turnaround plan and addresses its high leverage and debt levels, which should create value for equity holders,” said JP Morgan analyst Benjamin Arnstein said in a coverage launch.

Maxar Technologies could hit $20, says JP Morgan…

“Maxar is not yet out of the woods but we see a viable path forward as the investment cycle tapers off and cost reduction efforts offset lower volumes at SSL,” Arnstein said.

JP Morgan has a “blue-sky scenario” target of over $20 per share, whereas the downside case for the stock is pegged at $5 per share or “potentially zero.”

But it’s that downside risk that should keep investors clear of the stock, says Takacsy, who spoke to BNN Bloomberg on Tuesday.

“It’s very much a turnaround story and you’ve got to be careful when you invest in turnaround stories. The company has a fair bit of debt, said Takacsy.

“We looked at the old company MacDonald, Dettweiler at the time and passed on that, and then they went out and made a really ill-fated decision and loaded the company with debt,” he says.

“It’s really not for the faint of heart. A lot of analysts who were touting it to go a lot higher into the $80s $90 and $100 [level] have fled the scene. You’re really on your own with this one,” Takacsy says.

Speaking at the G.research Aerospace & Defense Conference in New York last week, Maxar president and CEO Dan Jablonsky said that while his company has had an admittedly rough year, they’re now “on a recovery path.”

“This is a reset and stabilization year as we get ready to return to growth on a better, more nimble cost basis and organization model,” Jablonsky said.

In May, Maxar announced that it had won a contract with NASA to help build its Gateway lunar orbit platform, while the company has also said that it is exploring options on selling its space robotics business, which could be worth over $1 billion, in aid of paying down some of its debt, which currently sits at the $3-billion mark.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment