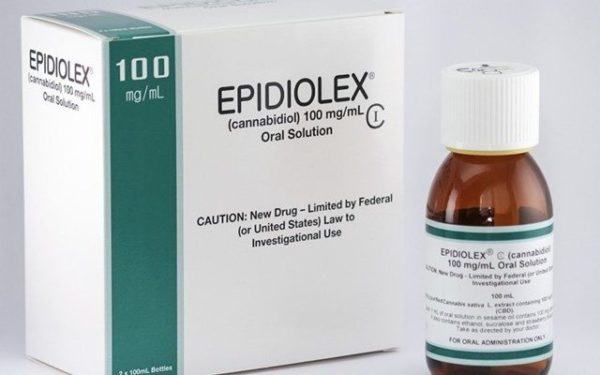

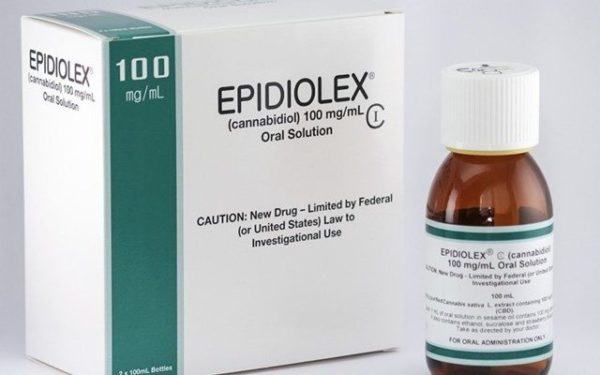

Impressive Epidiolex sales led to sparkling results for GW Pharmaceuticals (GW Pharmaceuticals Stock Quote, News, Chart NASDAQ:GWPH) in its latest quarter which in turn helped prompt AltaCorp Capital analyst David M. Kideckel of to raise his target price for GWPH.

Impressive Epidiolex sales led to sparkling results for GW Pharmaceuticals (GW Pharmaceuticals Stock Quote, News, Chart NASDAQ:GWPH) in its latest quarter which in turn helped prompt AltaCorp Capital analyst David M. Kideckel of to raise his target price for GWPH.

GW Pharmaceuticals gets price target raise

In an update to clients on Wednesday, Kideckel maintained his “Outperform” rating with the new target of $230.00 (previously $221.00), representing a projected 12-month return of 51 per cent at the time of publication. (All figures in US dollars.)

GW Pharma, which develops and commercializes novel therapeutics from its proprietary cannabinoid product platform, reported its Q2 ended June 30, 2019, on August 6, which featured consensus beats on both the top and bottom lines. The company posted $72.0 million in revenue, which was considerably better than the $47 million consensus estimate and the $42.4 million estimate from Kideckel. EPS for the quarter was $0.21 per share, also better than the Street’s $0.01 per share and Kideckel’s negative $0.15 per share.

GW Pharma added about 4,400 new Epidiolex patients in the US over the quarter, a 58-per-cent increase from the previous quarter. Epidiolex, GW’s cannabis-derived epilepsy drug, showed net sales for the quarter of $68.4 million, amounting to $101.9 million in net sales for the first half of 2019.

“We are pleased to report a strong second quarter of sales of Epidiolex in the US, reflecting high demand by US patients, increased prescribing by healthcare providers, and ongoing progress in payor coverage determinations,” wrote CEO Justin Gover, in a press release.

“With the recent positive Phase 3 trial in Tuberous Sclerosis Complex, we expect to submit an sNDA by the end of 2019 with the goal of expanding the Epidiolex label and market opportunity to include both children and adult patients with TSC, a highly treatment-resistant condition,” Gover added.

Along with noting the continuing ramp-up in Epidiolex demand, which Kideckel views as “highly positive” for the stock, the analyst also pointed towards GW’s announcement on July 26 that it had received a positive CHMP (Committee for Medicinal Products for Human Use) opinion for Epidyolex marketing authorization for use as an adjunctive therapy of seizures associated with Lennox-Gastaut syndrome (LGS) and Dravet syndrome, in conjunction with clobazam, for patients two years of age and older, a potential addressable patient population in Europe of 46,750.

Kideckel also pointed to GW’s development pipeline, saying, “GW has a robust drug development pipeline and is progressing through several clinical trials, which will provide the Company with a strong pipeline of growth opportunities over the mid to long term. To date, GW has reported positive results in the Phase 3 Tuberous Sclerosis Complex (TSC) trial, commenced the Phase 3 trial in Rett syndrome, and is advancing its Sativex program in the US, as well as other clinical studies, including the development of the cannabidivarin (CBDV) molecule in the field of autism spectrum related disorders.”

Kideckel sees room for meaningful growth for GW over the next few quarters, with the company launching several initiatives to help drive and withstand Epidiolex sales growth momentum, including clinician education, market education and enhanced payor interaction.

As for catalysts going forward, the analyst points to continued US growth in sales for Epidiolex, a positive decision expected in early October from the European Commission related to the marketing authorization of Epidyolex, the subsequent European launch, the start of Sativex’s Phase 3 MS trial in Q4/2019, the TSC data presentation and the TSC FDA sNDA submission and the commencement of a Phase 2 clinical trial for NHIE.

Kideckel has updated his fiscal 2019 estimates, now calling for net revenue of $302 million (previously $191 million) and adjusted EPS of negative $0.04 per share (previously negative $0.61 per share). For fiscal 2020, he is calling for net revenue of $604 million (previously $473 million) and adjusted EPS of $0.10 per share (previously negative $0.61 per share).

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment