Tesla could fall back to $200, this analyst says

Tesla back at $200? It could happen, says one analyst.

Tesla (Tesla News, Stock Quote, Chart NASDAQ:TSLA) has done well to rally since early June, gaining 43 per cent over that period, but the proof will be in the pudding this week as the electric car maker releases its second quarter earnings.

“The sentiment was getting really bad [before the June rally] and at that point it had just seemed like a coiled spring,” said Dan Nathan of CNBC on Friday. “[But] just as it overshot to the downside when it broke $250 in early May and went straight to $175, it had the potential to do so to the upside. It looks like a really interesting story.”

Tesla fans were rejoicing earlier this month when the company released its Q2 delivery and production numbers, showing a record-breaking 95,200 deliveries for the quarter, 5,000 higher than the previous high and boosting investor confidence in the stock. Tesla’s share price had been in a tailspin since mid-December, dropping from $375 to a low of $179 per share by June 3. (All figures in US dollars.)

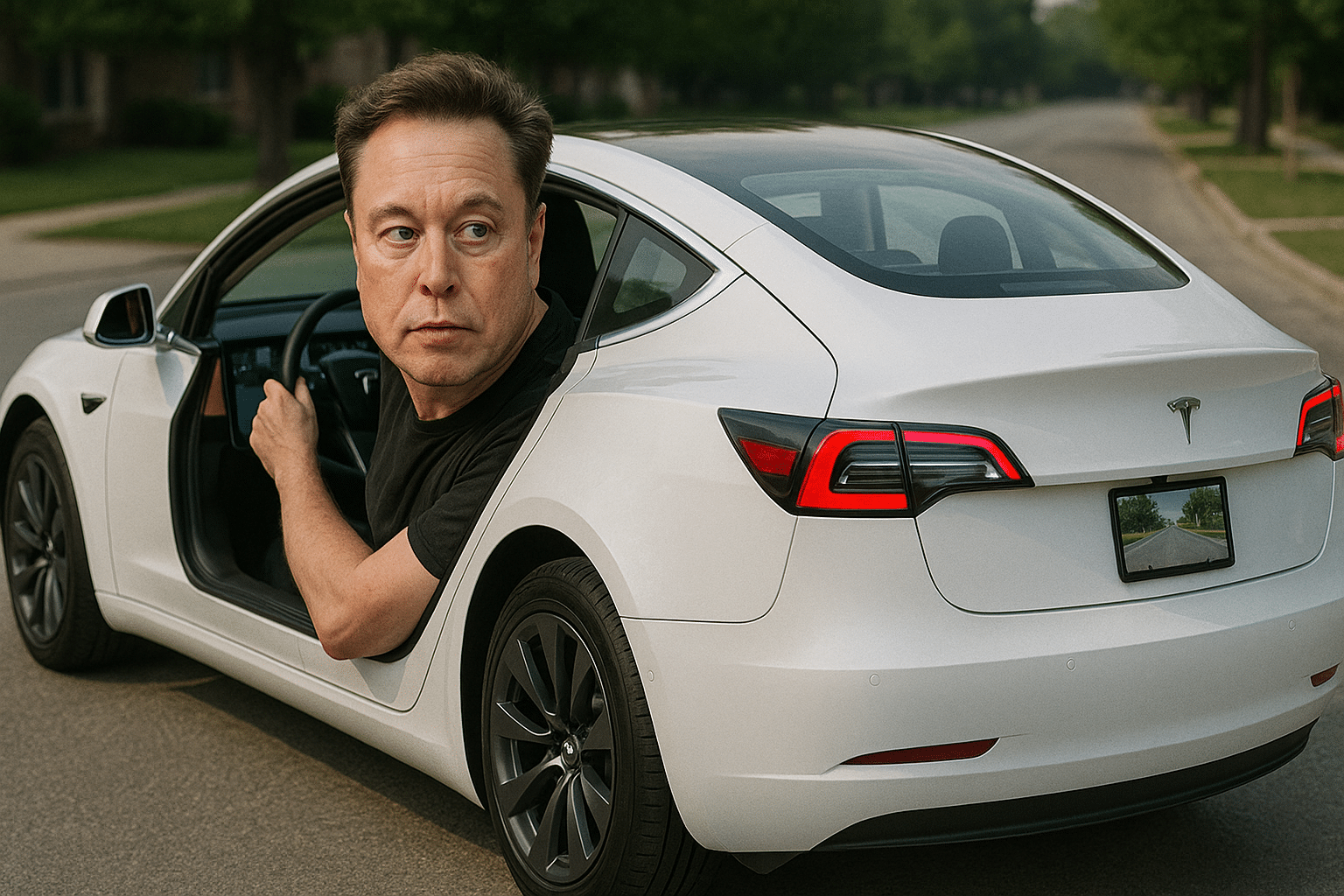

The company has remained firm on its projections for the year, calling for 380,000 vehicles, with CEO Elon Musk urging his employees in a open letter in June to go “all out” in production.

“We already have enough vehicle orders to set a record, but the right cars are not yet all in the right locations,” Musk wrote on June 25. “Logistics and final delivery are extremely important, as well as finding demand for vehicle variants that are available locally, but can’t reach people who ordered that variant before the end of the quarter.”

Nathan says the stock is likely to swing considerably on the Q2 report on Wednesday but it’s anyone’s guess whether it’ll be up or down.

“In their prior guidance they’ve only delivered 175,000 cars [but] they’ve guided to 380,000 for this year — they’ve got a lot of stuff to do. That’s why earnings [this week] are really important,” says Nathan. “The options market is implying about a $20 move in either direction. That’s about 7.5 per cent which is how much the stock has moved over the last four quarters.”

” (Tesla) is going back down, probably on the way back to $200”

“Here’s the trade to me: if you’re long this thing you might want to consider some protection because if they do tweak down that full-year guidance in any way, shape or form — maybe it’s margins, maybe it’s full-year deliveries — that stock is going back down, probably on the way back to $200,” he says.

“I don’t think that it’s going to be a disaster but I think that some minor tweaks after the run that this stock has had, you can get this stock going back the other way pretty quickly,” he says.

Analysts are expecting Tesla’s Q2 to feature an adjusted quarterly loss of $0.39 per share and sales of $6.5 billion, according to FactSet.

Staff

Writer