Skies remain dark for Maxar Technologies, this portfolio manager says

Shares of Maxar Technologies (Maxar Technologies Stock Quote, Chart TSX:MAXR) popped last week on good news regarding an insurance payout, but is the stock still a buy? Not likely, says Rick Stuchberry of Wellington-Altus Private Wealth, who admits that he made a mistake in holding onto it.

Shares of Maxar Technologies (Maxar Technologies Stock Quote, Chart TSX:MAXR) popped last week on good news regarding an insurance payout, but is the stock still a buy? Not likely, says Rick Stuchberry of Wellington-Altus Private Wealth, who admits that he made a mistake in holding onto it.

“We used to own this thing a year or two ago. We held on too long when it got into trouble. We did exit it — it’s one of those things where you say, well, when do I cut and run and when do I stay?” says Stuchberry, in conversation with BNN Bloomberg on Monday. “We just couldn’t see light at the end of the tunnel.”

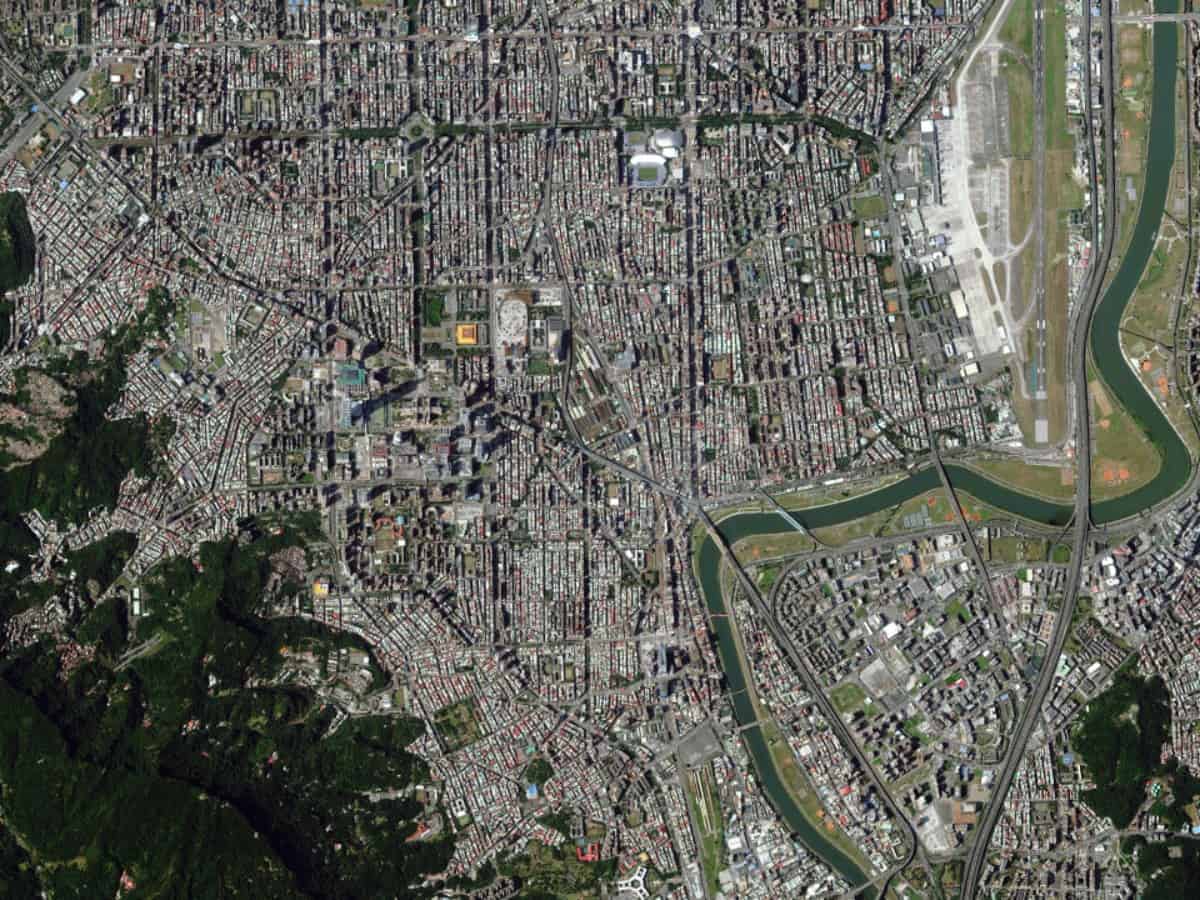

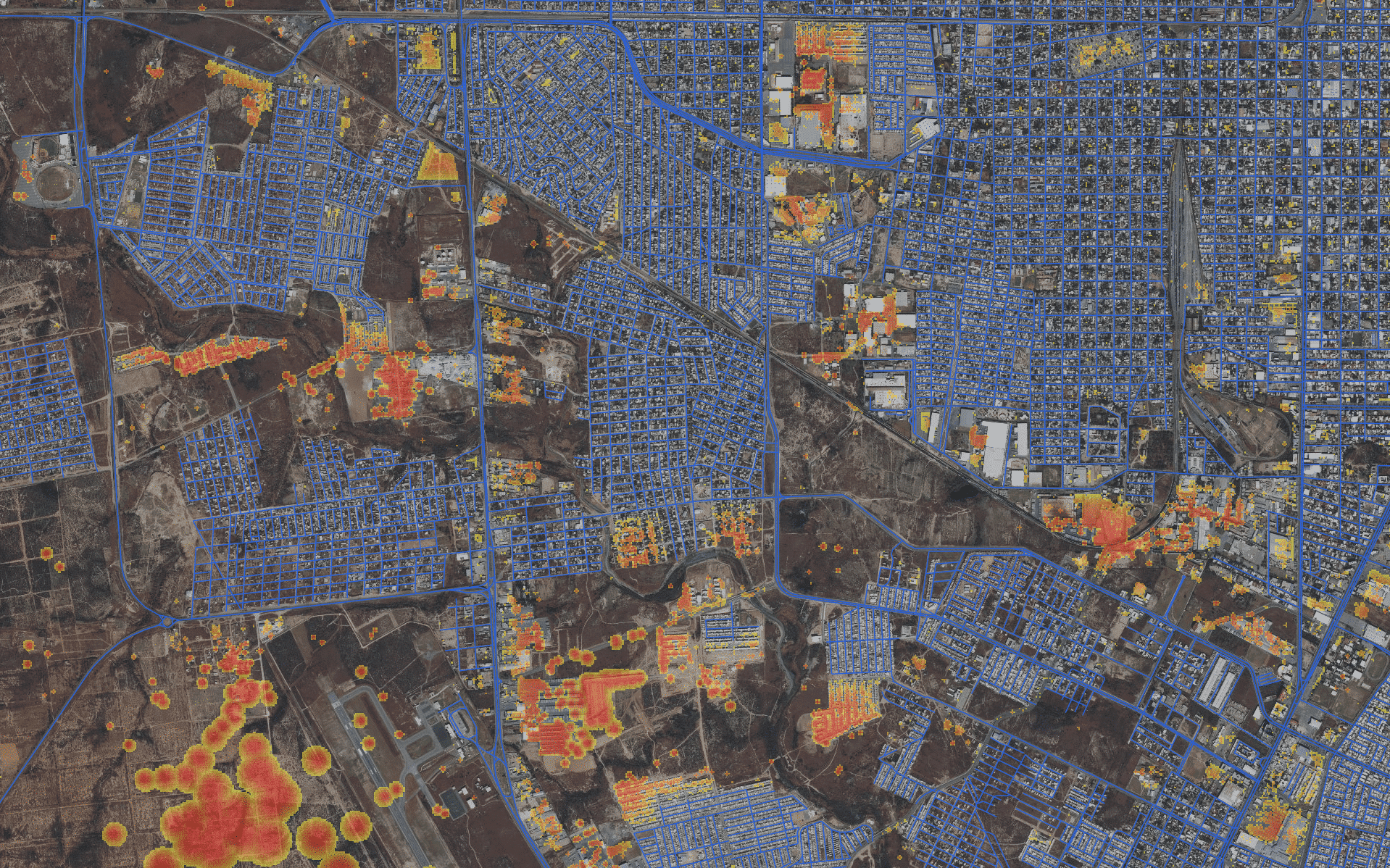

Maxar Technologies announced last week that its insurance carriers had accepted the full $183-million claim for the loss of its WorldView-4 satellite, which in January of this year was found to have an irreversible defect, a major blow, as the image satellite was to be a prime money-maker for the company. Management says that it will use the funds to invest in its pre-existing capital priorities, which include its WorldView Legion constellation of satellites scheduled to replace three of its older models. (All figures in US dollars.)

The market reacted positively to the news, bumping up the stock by 36 per cent over the past few trading days. Last year, Maxar’s share price started to nose dive in July as investors responded to a number of issues befalling the company, including a write-down of its satellite business and a short-seller attack. The start of 2019 proved to be no better, with the loss of the satellite and the departure of its CEO both coming in January.

Stuchberry says there might be a turnaround in store, but it’s tough to call.

“We recognized that we made a mistake and exited, took our money and redeployed it in different areas. [But] if you think there’s light at the end of the tunnel here, then you could hold or even add some,” he says.

Ahead of Maxar’s quarterly results due on Thursday, Maxar’s last quarter was reported on February 28, where it posted fourth quarter revenue of $496 million, which came in below analysts’ average forecast of $560.3 million, along with a net loss of $950 million or $16.10 per share.