Planet 13 Holdings is creating “tremendous” value for shareholders, Beacon says

Doug Cooper of Beacon Securities is holding steady on Las Vegas cannabis play Planet 13 Holdings (Planet 13 Holdings Stock Quote, Chart CSE:PLTH), saying in a client update on Wednesday that the company’s strategy to grow its brand portfolio is the key takeaway from its latest earnings report.

Doug Cooper of Beacon Securities is holding steady on Las Vegas cannabis play Planet 13 Holdings (Planet 13 Holdings Stock Quote, Chart CSE:PLTH), saying in a client update on Wednesday that the company’s strategy to grow its brand portfolio is the key takeaway from its latest earnings report.

Planet 13 announced on Tuesday its financials for the three and 12 months ended December 31, 2018, coming in with quarterly revenue and EBITDA of $8.2 million and negative $1.9 million, respectively. (All figures in US dollars unless noted otherwise.)

Cooper says the results, which feature a cash position of $19.4 million at the end of the period, are not particularly relevant in and of themselves, as the Q4 was a transition spell between the closing of the company’s Medizin dispensary and the opening of its cannabis SuperStore in Vegas on November 1.

The analyst makes note of the fact that the ramp up at the SuperStore has reached an annualized run-rate of $66 million in March, highlighted by 6,000 visitors and approximately $320,000 in revenue on 4/20 day alone. Cooper is calling for Q1 2019 revenue of approximately $14 million, up 71 per cent over the previous quarter.

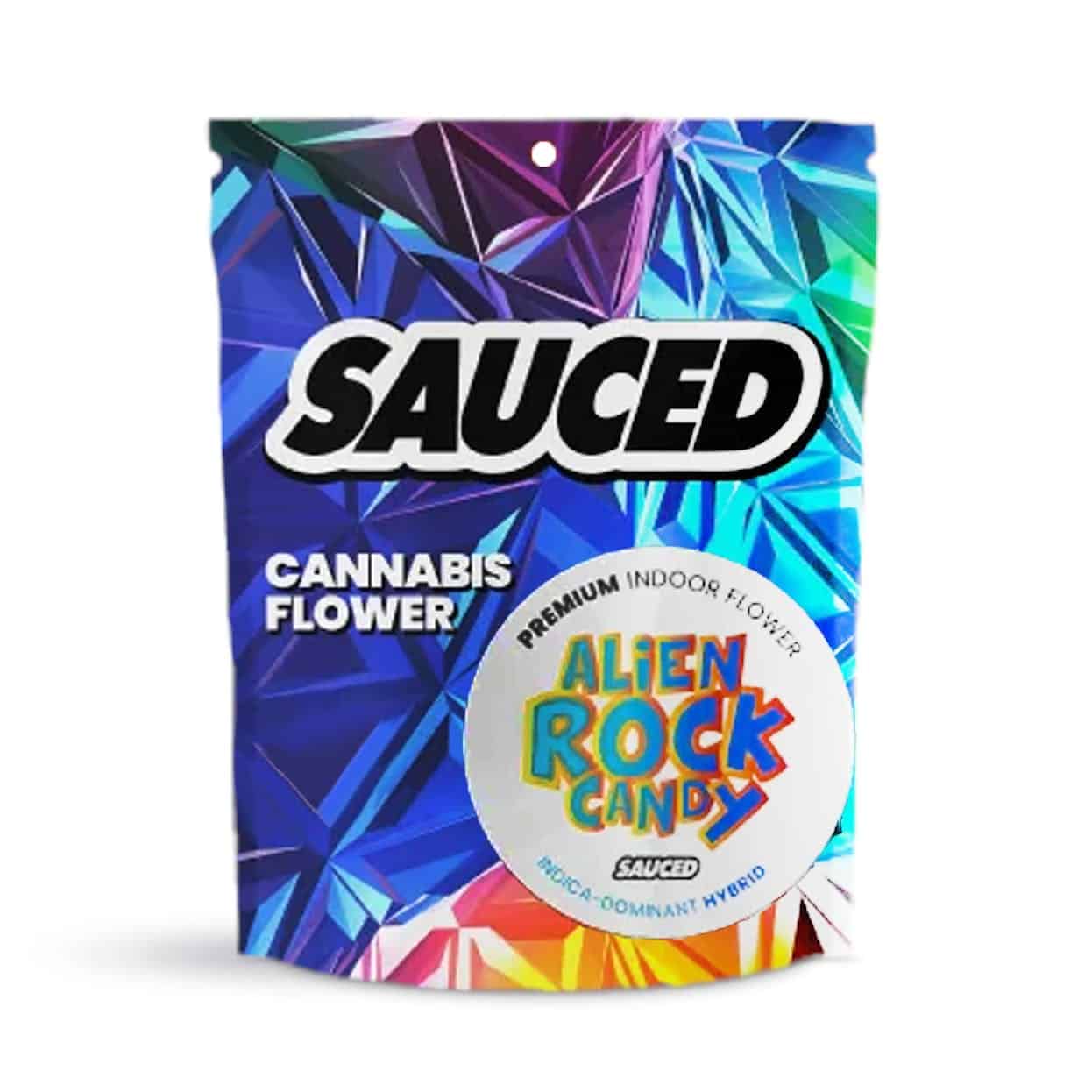

“The growth of its branded portfolio within its store and in the wholesale market should result in tremendous value creation for shareholders and it represents not only growth and margin expansion but also another tremendous asset that potential acquirers would covet,” says Cooper.

“In particular, traffic at the SuperStore is 14 per cent local, 71 per cent from other states and 15 per cent international. Those visitors from other states are what will makes P13’s brands valuable to out-of-state acquirers who not only will get the market share leader in Nevada but a recognizable brand portfolio they can port back to their other states of operation,” he says.

Cooper is maintaining his “Buy” recommendation and C$7.25 target price, representing a projected return of 127 per cent at the time of publication. Cooper thinks that PLTH will generate fiscal 2019 revenue and Adjusted EBITDA of $82.1 million and $20.5 million, respectively, and fiscal 2020 revenue and Adjusted. EBITDA of $109.5 million and $38.0 million, respectively.