While Maxar Technologies (Maxar Technologies Stock Quote, Chart TSX, NYSE:MAXR) delivered better-than-expected first quarter results, National Bank analyst Richard Tse thinks the company still has a ways to go to reach a point of consistent execution.

While Maxar Technologies (Maxar Technologies Stock Quote, Chart TSX, NYSE:MAXR) delivered better-than-expected first quarter results, National Bank analyst Richard Tse thinks the company still has a ways to go to reach a point of consistent execution.

In a daily bulletin to clients on Friday, Tse maintained his “Sector Perform” rating while raising his target price from $6.00 to $7.00. (All figures in US dollars.)

Space technology company Maxar released its first quarter ended March 31, 2019, financials on May 9, coming in with revenue of $504-million versus Tse’s estimate of $458 million and Adjusted EBITDA of $117 million compared to Tse’s $96 million and margins improving from 17 per cent to 23 per cent.

Tse noted that Maxar’s order backlog shrank from $2.4 billion last quarter to $1.9 billion, which the analyst says suggests that the outlook for the remainder of the year will be challenged.

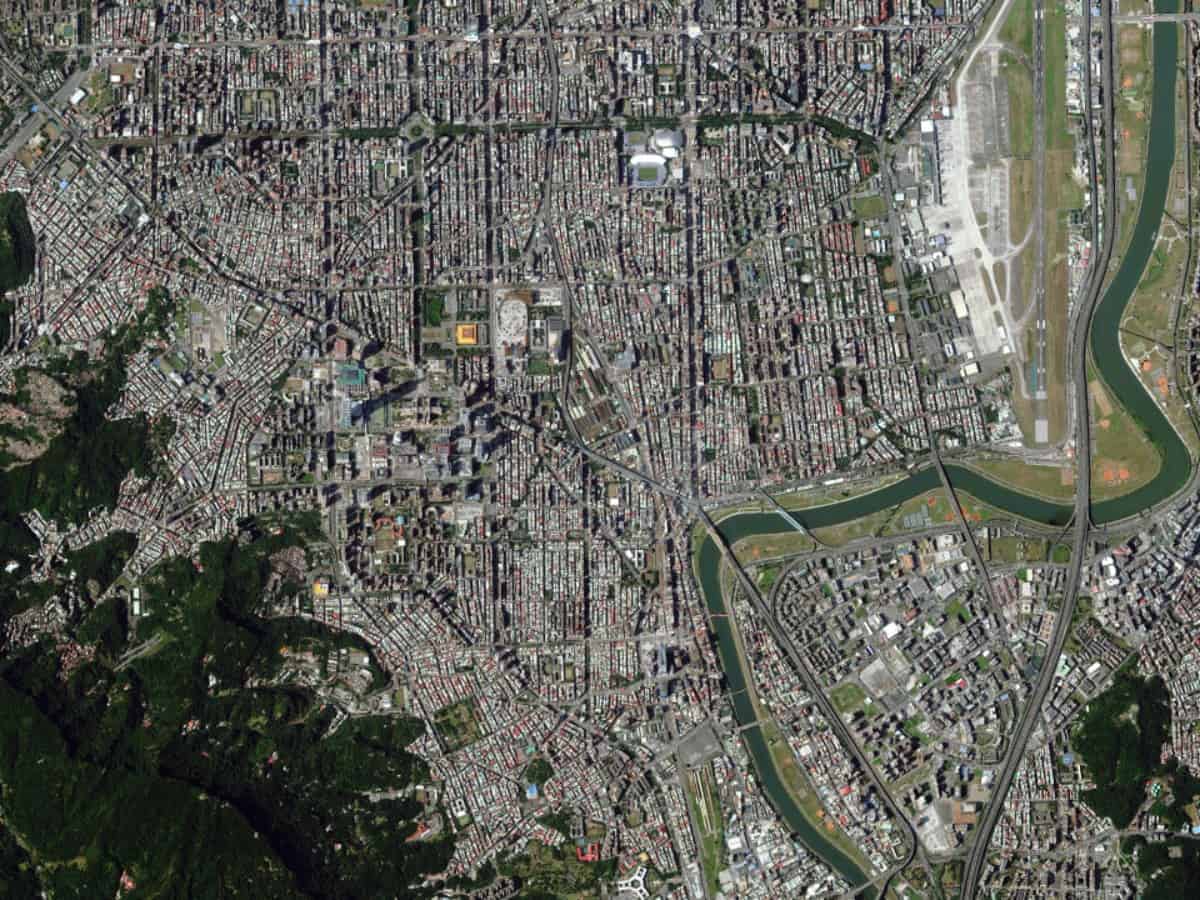

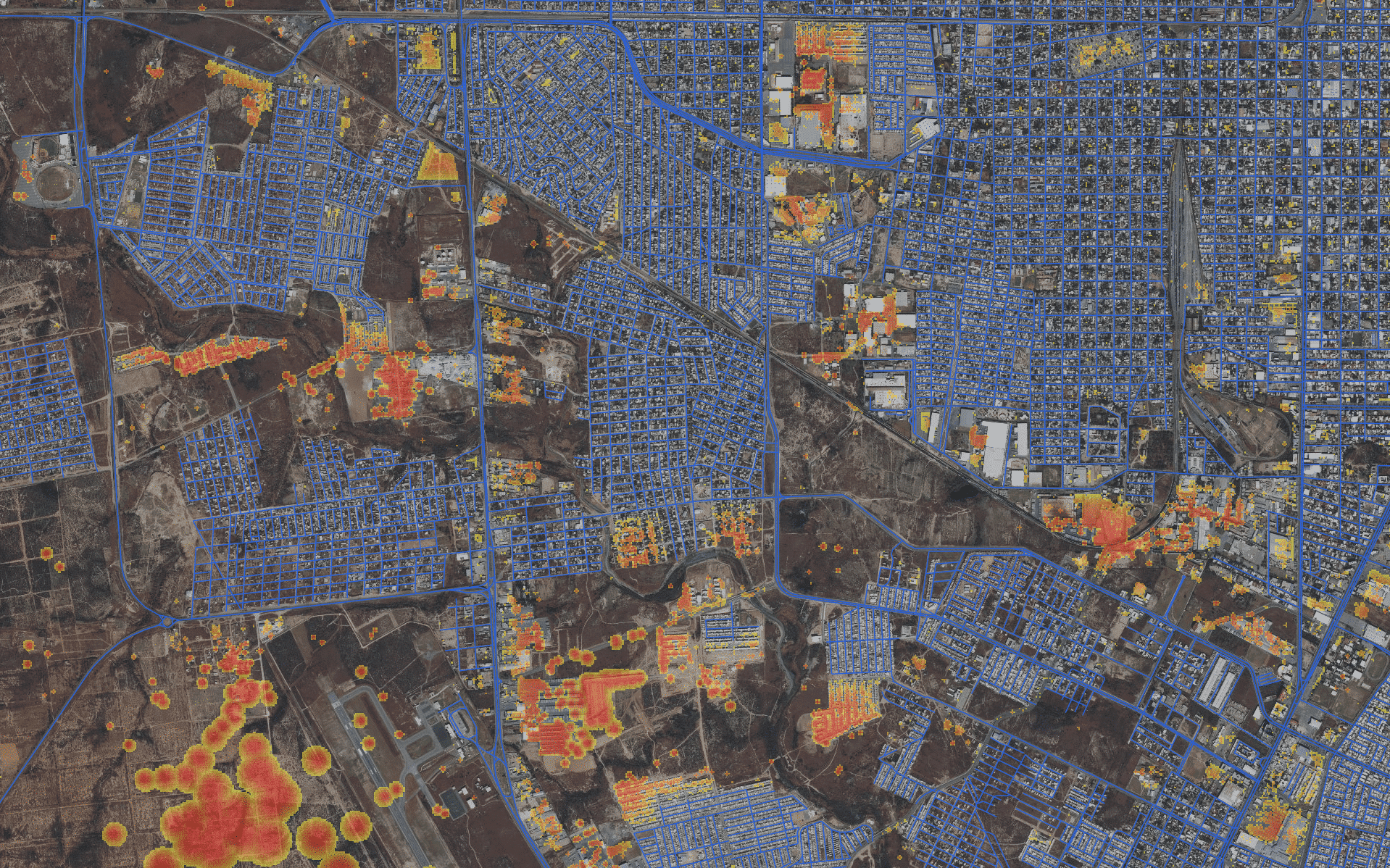

Maxar announced in January that it had sustained a fatal defect in its WorldView4 satellite, set to be the company’s primary money-maker in its Imagery segment. Since then, Maxar has stated that it will receive $183 million from insurance proceeds, yet Tse says that the money covers only “a fraction” of the potential value contribution lost and that debt remains a serious issue for the company.

“While Management has laid out another round of actions including further cost reduction and restructuring along with the insurance proceeds of $183 million from the failure of WorldView4, recent history suggests investors should stay clear until we see some steady execution,” says Tse.

The analyst is calling for 2019 revenue and EBITDA of $1.97-billion and $491 million, respectively, while his $7.00 target represented a projected return of six per cent at the time of publication.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment