Canadian cannabis play HEXO Corp (HEXO Stock Quote, Chart TSX:HEXO) just closed on the acquisition of Newstrike Brands, an event which Beacon Securities analyst Russell Stanley is treating as a positive for the stock. In a client update on Monday, Stanley has reiterated his “Buy” recommendation and $14.00 target, which represented a projected return of 36 per cent at the time of publication.

Canadian cannabis play HEXO Corp (HEXO Stock Quote, Chart TSX:HEXO) just closed on the acquisition of Newstrike Brands, an event which Beacon Securities analyst Russell Stanley is treating as a positive for the stock. In a client update on Monday, Stanley has reiterated his “Buy” recommendation and $14.00 target, which represented a projected return of 36 per cent at the time of publication.

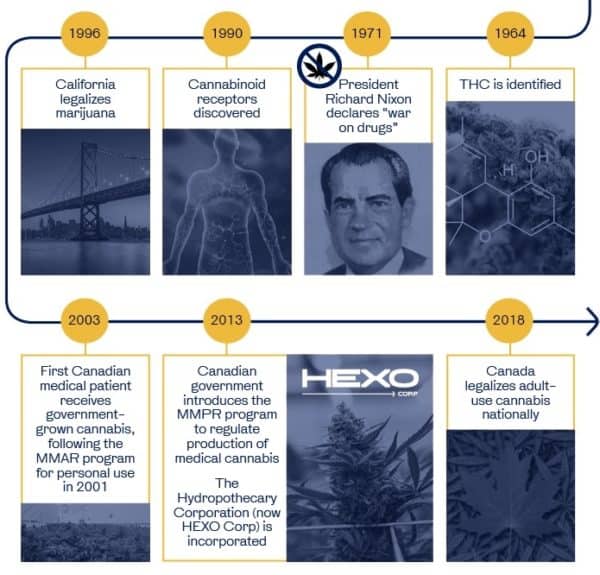

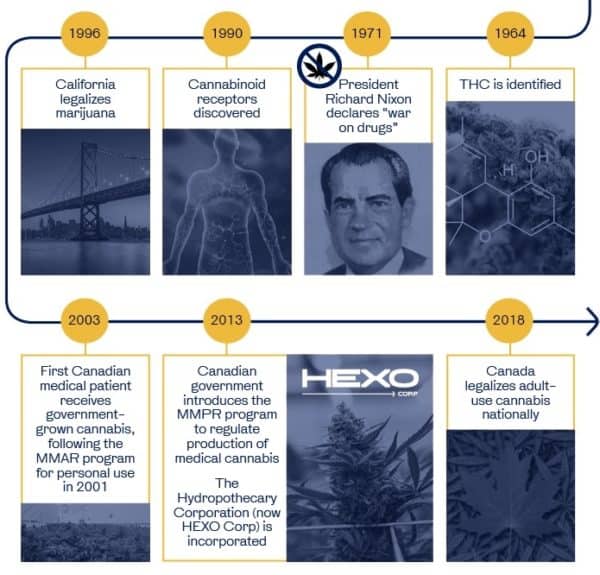

Last Friday, HEXO and Newstrike announced the closing of the previously-announced all-stock deal, with HEXO to issue 0.06332 shares per share of Newstrike, amounting to $321 million at current prices ($263 million at the time of original announcement).

Stanley says, “This acquisition expands HEXO’s aggregate annualized cultivation capacity from 108,000kg to 150,000kg and it adds sales relationships with Alberta, Saskatchewan, Manitoba, Nova Scotia, PEI and New Brunswick. This gives HEXO sales relationships in all Canadian provinces, excluding Newfoundland and Labrador. As we believe that only three companies have sales relationships into all ten provinces, HEXO is extremely well-positioned relative to the pack.”

Stanley says that an update from management on its fiscal third quarter (due in early June) should be supportive of the stock. Currently, management has called for flat revenues compared to its Q2.

The analyst contends that HEXO is now trading at 14x his C2020 EBITDA estimate, which would represent a 33-per-cent discount to the 22x average of its broader peer group, a 53-per-cent discount to the 31x average among companies with a plus-$1 billion market cap and a 71-per-cent discount to the 50x average for other US-listed cannabis companies.

“We therefore view HEXO as significantly undervalued, particularly given that it stands out amongst Canadian LPs for issuing formal revenue guidance (gross revenue of $479 million in F2020, or $400 million net of excise taxes). We continue to believe that HEXO is also uniquely positioned as a potential partner (and acquisition candidate) for CPG companies looking for a platform transaction for cannabis expansion,” Stanley writes.

The analyst is calling for fiscal 2019 revenue and Adjusted EBITDA of $59.5 million and negative $21.3 million.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment