Following the company’s first quarter results, Paradigm Capital analyst Kevin Krishnaratne is maintaining his “Buy” rating on Baylin Technologies (Baylin Technologies Stock Quote, Chart TSX:BYL).

Following the company’s first quarter results, Paradigm Capital analyst Kevin Krishnaratne is maintaining his “Buy” rating on Baylin Technologies (Baylin Technologies Stock Quote, Chart TSX:BYL).

On Monday, Baylin reported its Q1, 2019 results. The company lost $5.9-million on revenue of $39.0-million, up 32.6 per cent over the same period last year.

“We are pleased with the Company’s progress in the first quarter of 2019. The Company’s revenue base has continued to diversify with revenue from the acquisitions of Advantech Wireless and Alga Microwave, completed in 2018”, CEO Randy Dewey said. “Gross margin(3) improved compared to the first quarter of 2018 but was somewhat lower than anticipated due to sales mix as well as certain costs incurred in our facility in Quebec, costs which we do not expect to incur during the balance of fiscal 2019”, added Mr. Dewey.

The analyst characterized the quarter.

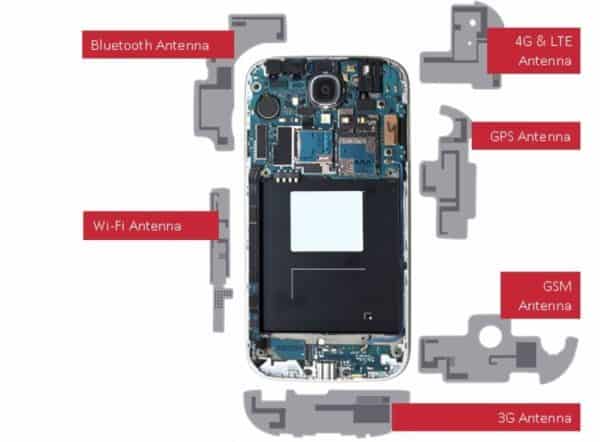

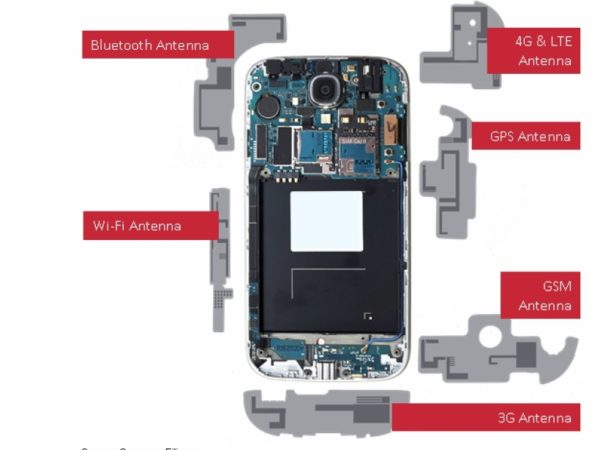

“Baylin’s Q1 was relatively in line, but the positive read-through was how results demonstrated the diverse revenue base that management has built over the past few years,” Krishnaratne said. “Although Infrastructure sales were soft (-6%), as carriers scaled back capex following trends seen in H2/18, this was offset by strength in Mobile (+33%), and at Advantech (+36%). The company’s profile is much more diverse than it was 3–4 years ago when Mobile represented +75% of the base versus our assumption of ~35% mobile revenue mix exiting 2018. Baylin continues to add customers (+800 moving toward 900), has entered new markets via M&A (SATCOM in 2018), while Advantech has extended its geographical reach into new regions such as Sweden and Brazil (Baylin now operates in +160 countries). We view the Q1 Infrastructure softness as largely relating to timing, with spending to accelerate over the coming quarters given the importance that carriers are placing on 4G densification strategies. Following the quarter, our estimates remain essentially unchanged.

In a research update to clients today, Krishnaratne maintained his “Buy” rating and one-year price target of $5.75 on Baylin, implying a return of 54 per cent at the time of publication.

The analyst thinks BYL will post EBITDA of $22.7-million on revenue of $166.1-million ninn fiscal 2019. He expects those numbers will improve to EBITDA of $28.5-million on a topline of $181.4-million the following year.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment