Beacon Securities analyst Ahmad Shaath on Friday delivered an update on Xebec Adsorption (Xebec Adsorption Stock Quote, Chart TSXV:XBC), saying that the stock is currently trading at an attractive valuation and that he is maintaining both his “Buy” recommendation and $1.90 target.

Beacon Securities analyst Ahmad Shaath on Friday delivered an update on Xebec Adsorption (Xebec Adsorption Stock Quote, Chart TSXV:XBC), saying that the stock is currently trading at an attractive valuation and that he is maintaining both his “Buy” recommendation and $1.90 target.

On Thursday, cleantech play Xebec Adsorption delivered its fourth quarter fiscal 2018 results for the period ended December 31, 2018, coming in with $2.2 million in revenue and negative $2.0 in EBITDA. Ahead of the release, Xebec management announced that it had updated its guidance for 2018 and 2019 due to the application of a new IFRS 15 accounting standard, which requires the company to forego recognition of revenues as a percentage of completion and calls for the company to wait until completion of projects occurs. As a result, $5.5 million in revenues expected to be accounted for in Q4 2018 are now pushed to 2019.

Shaath says that the Q4 results are largely immaterial to his thesis and argues that excluding the impact of IFRS 15, Xebec would have finished fiscal 2018 with a top line of $25.7 million and EBITDA of $1.3 million, which would have been largely in line with his expectations of $27.4 million and $1.9 million, respectively.

The analyst notes that Xebec indicated that it expects to announce its first contract in the new Infrastructure renewable natural gas (RNG) segment of RNG Generation Build and Operate business in Q2 of fiscal 2019, with the analyst saying that this is a highly lucrative (50 per cent EBITDA margin) and sticky business that should both accelerate XBC’s growth and add significant upside to his estimates.

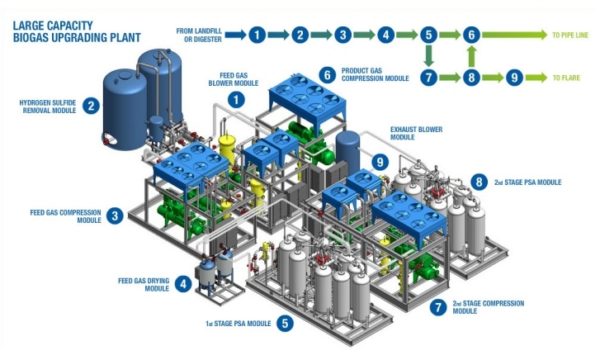

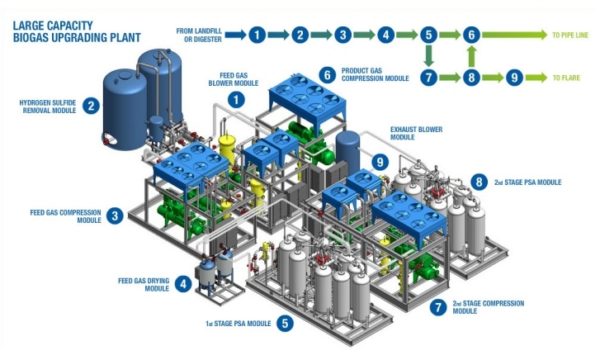

“FY19E will be the first year where XBC starts delivering on its largest RNG order where we expect the company to hit the milestone of $50 million in revenues,” says Shaath. “We continue to believe that showing this revenue run rate will help XBC land larger orders ($10-$20 million per project e.g. landfill gas upgrading), which makes our assumption of ~$20 million in new Clean Tech orders for FY20E very reasonable.”

“We continue to view XBC as a unique industrial-technology investment with exceptional growth profile (3-yr CAGR revenue, EBITDA and EPS of ~60 per cent, 80 per cent and ~300 per cent, respectively) at attractive valuation (9.4x FY20E EBTIDA vs. clean-tech peers at 11- 13x). XBC’s investment profile is boosted by its profitability, both at EBITDA and bottom-line levels,” says Shaath.

The analyst is calling for fiscal 2019 revenue and Adjusted EBITDA of $50.0 million and $6.0 million, respectively, and fiscal 2020 revenue and Adjusted EBITDA of $64.3 million and $9.0 million, respectively. His $1.90 target represented a projected return of 31 per cent at the time of publication.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment