Quebec-based Opsens reported its second quarter fiscal 2019 results on April 11, generating revenue of $7.9 million, a 46 per-cent year-over-year increase and an eight per-cent beat over the consensus $7.3 million. On EBITDA, the company posted a loss of $0.4 million, which was better than the Street’s forecast of negative $0.8 million.

Sarugaser says that despite a challenging year for US sales in 2018, Opsens outperformed, signalling continued growth in the US and generating $6.5 million from the sector over Q2 and a 33-per-cent increase in its US medical revenue stream over the quarter.

The analyst notes that regulatory bodies in Japan, Europe and Canada have each approved diastolic pressure algorithm (dPR) technology for clinical practice in interventional cardiology, with approval of OPS’ dPR device in the US —the next key value-escalating milestone for the company— likely to occur during the second half of 2019.

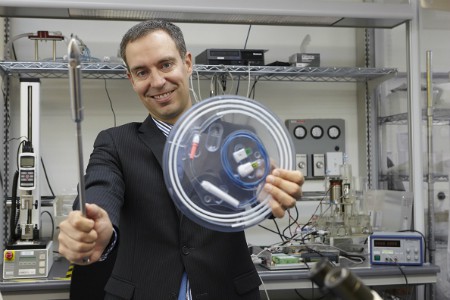

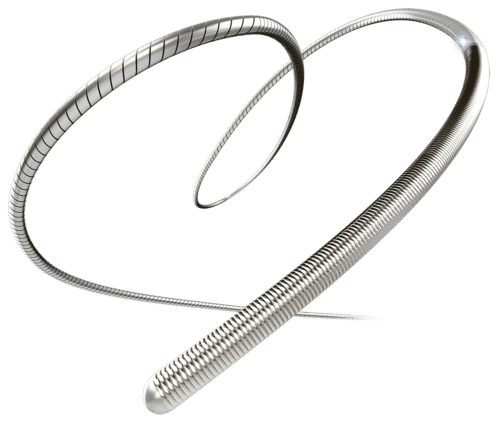

“We believe OPS offers an attractive risk/return investment opportunity because: 1) OptoWire is a first-in-class optical FFR product that view as functionally superior to current products; 2) regulatory approvals for OptoWire FFR have been obtained in its largest markets, the US and Japan; and 3) OPS’ prospects as an attractive take-over candidate for larger medical device companies,” says Sarugaser.

The analyst thinks OPS will have revenue and EBITDA in fiscal 2019 of $38.2 million and $0.8 million, respectively, and revenue and EBITDA in fiscal 2020 of $55.1 million and $2.9 million, respectively. His $1.75 target represents a projected return on investment of 94 per cent at the time of publication.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment