Baylin Technologies’ future is bright, Paradigm Capital says

After touring the company’s Advantech Wireless facility, Paradigm Capital analyst Kevin Krishnaratne is maintaining his “Buy” rating on Baylin Technologies (Baylin Technologies Stock Quote, Chart TSX:BYL).

After touring the company’s Advantech Wireless facility, Paradigm Capital analyst Kevin Krishnaratne is maintaining his “Buy” rating on Baylin Technologies (Baylin Technologies Stock Quote, Chart TSX:BYL).

“We are reviewing our recent tour of Baylin’s Advantech Wireless facility which was officially opened on April 2 in Kirkland, Quebec,” the analyst explains. “The facility houses both Alga and Advantech, acquisitions the company made in 2018 that bring strong experience and technical capabilities in the Satellite Communications sector. We gained an appreciation for how well Advantech is positioned to deliver high-power amplifiers for high bandwidth applications to its existing customers and learned about potential opportunities in other areas, including RADAR and LEO/MEO (low earth orbit/medium earth orbit) systems.”

Krishnaratne says Advantech is a well regarded name in the SATCOM industry, with more than thirty years experience. He says he gained an appreciation for how well the company is positioned in high power SATCOM products that have strong pricing power, little competition and high margins. The analyst also thinks there are more opportunities available to leverage Advantech’s expertise in applications such as weather sensing and object detection.

In a research update to clients today, Krishnaratne maintained his “Buy” rating and one-year price target of $5.75 on Baylin, implying a return of 47 per cent at the time of publication.

The analyst thinks BYL will post EBITDA of $22.9-million on revenue of $165.5-million in fiscal 2019. He expects those numbers will improve to EBITDA of $28.2-million on a topline of $180.3-million the following year.

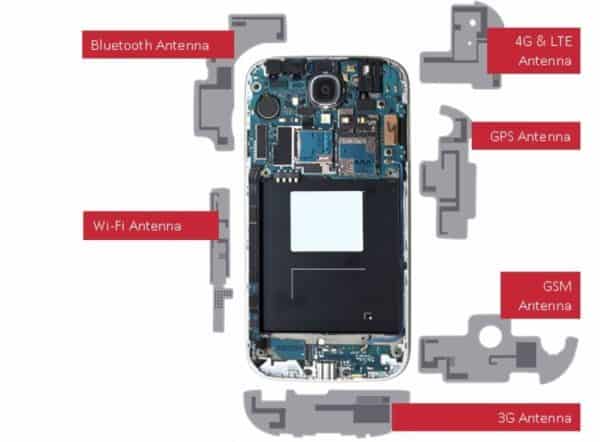

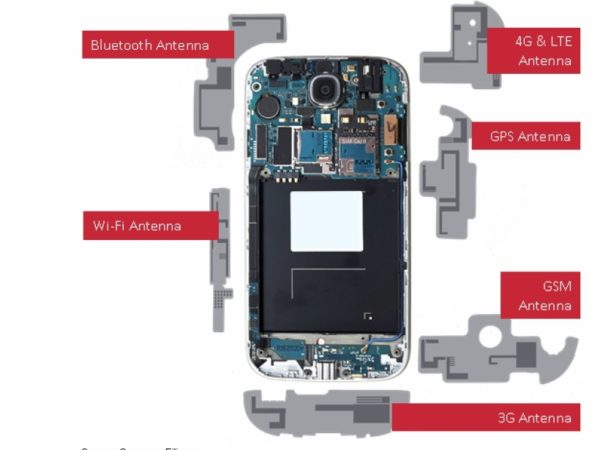

“We like the stock for its leverage to carrier densification plans in 4G, which should continue for several years, and for its potential to be a key supplier into the 5G capex upgrade cycle, while strength in carrier infrastructure sales alongside M&A into new markets continues to diversify the business and lower its reliance on Samsung in Mobile,” the analyst adds.

Nick Waddell

Founder of Cantech Letter

Cantech Letter founder and editor Nick Waddell has lived in five Canadian provinces and is proud of his country's often overlooked contributions to the world of science and technology. Waddell takes a regular shift on the Canadian media circuit, making appearances on CTV, CBC and BNN, and contributing to publications such as Canadian Business and Business Insider.