It’s been one of the hottest stocks on the TSX Venture exchange, but Beacon Securities analyst Gabriel Leung thinks there is still plenty of runway left in OneSoft Solutions (OneSoft Solutions Stock Quote, Chart TSXV:OSS).

It’s been one of the hottest stocks on the TSX Venture exchange, but Beacon Securities analyst Gabriel Leung thinks there is still plenty of runway left in OneSoft Solutions (OneSoft Solutions Stock Quote, Chart TSXV:OSS).

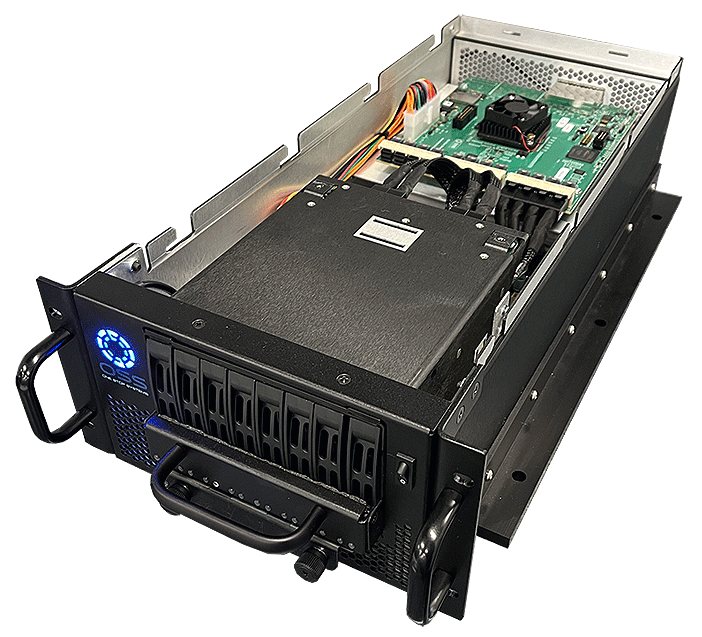

This morning, OneSoft announced that its wholly owned subsidiary OneBridge had enlisted another large U.S.-based pipeline operator for its Cognitive Integrity Management (CIM) software.

“The addition of this client signifies another significant milestone for OneSoft, for a few reasons,” President and COO Brandon Taylor said. “Firstly, we estimate that aggregate CIM usage amongst our commercial CIM clients will exceed 50,000 miles once this client loads all of their data, which meets our volume objective for fiscal 2019 early in the year. Secondly, working with this client provides us the opportunity to enhance regulatory-associated functionality of CIM, and thirdly, this client marks the first instance of long-term CIM use involving Canadian pipeline infrastructure.”

Leung says OSS is operating at all-systems-go right now.

“We believe this OneBridge’s sixth commercial customer and takes its CIM usage amongst commercial customers to over 50,000 pipeline miles once data is loaded onto OneBridge’s platform,” the analyst says. “At $100 per pipeline data mile, that would imply that OneSoft is on a ~$5M annualized recurring revenue run-rate (i.e. once data from clients are uploaded), which we believe takes the company to breakeven-to-slightly positive cash flow operations. We have been modeling ~$4M for 2019 so today’s contract gives us very good comfort with our estimates. As a reminder, the company has another ~$20M of annual recurring revenues in its pipeline of opportunities (i.e. customers in pilot programs or negotiating to enter pilots). Given the high ROI and early pace of adoption of CIM 3.0, we believe deal momentum could accelerate as the year progresses, which we view as a key catalyst for the stock.”

In a research update to clients today, Leung maintained his “Speculative Buy” rating and one-year price target of $1.75 on OneSoft, implying a return of 99 per cent at the time of publication.

Leung thinks OSS will post EBITDA of negative $2.0-million on revenue of $4.0-million in fiscal 2019. He expects those numbers will improve to EBITDA of positive $2.0-million on a topline of $10.0-million the following year.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment