OneSoft Solutions has an upside of 122 per cent, says Beacon Securities

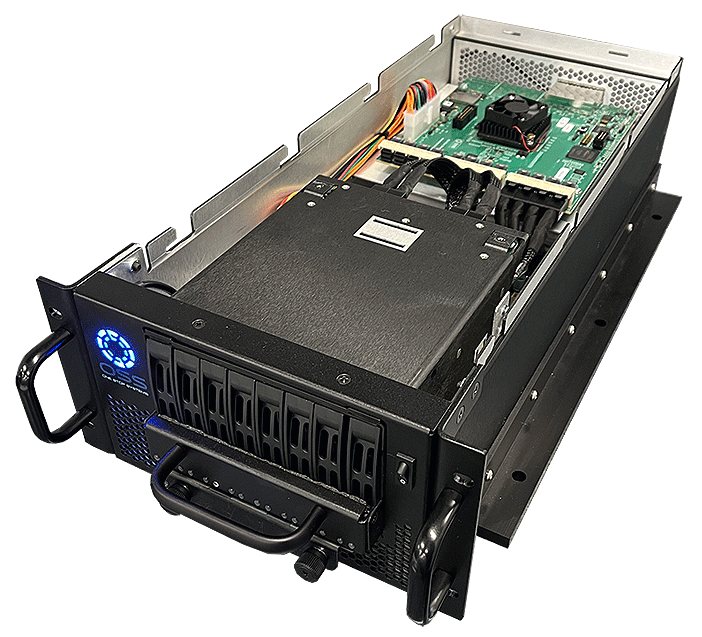

Edmonton-based OneSoft operates a cloud-based platform that uses data science and machine learning to apply predictive analysis to data received by oil and gas pipeline operators. Formed in 2015, the company participated in Microsoft’s first Accelerator program, with OneBridge launching its Cognitive Integrity Management (CIM) software in 2017.

In an industry in which pipeline incidents happen every 1.28 days and bear an average cost of $1.5 million, the market is significant, says Leung, who puts the US market opportunity for OneSoft at approximately $70 million in annual recurring revenues.

“We view OneSoft as having an important first mover advantage in terms of leveraging machine learning, data science and cloud computing to helping oil and gas pipeline operators identify potential pipeline failures,” says Leung in a coverage launch on Friday.

“OneSoft has generated strong traction to date with five oil and gas pipeline operators representing 32,800 pipeline miles now licensed to use CIM 3.0,” he says. “The company has software trials currently underway representing 116,200 pipeline miles and is in negotiations with customers to start trials representing 103,223 miles. We estimate the company’s signed customers and pipeline represents ~$25 million in annual recurring revenues (i.e., once data is deployed in platform).”

The analyst sees near-to-midterm catalysts for the stock as the following: new customer announcements; hitting cash flow break even (which Leung expects later this calendar year); acquisitions to augment the functionality of CIM 3.0; and entrance into new verticals such as sewerage, water and rail.

Leung sees potential risks in the following: lengthy sales cycles in the oil and gas industry; potential volatility around revenue recognition; ability to grow profitably; risk of share dilution attributed to further funding; and competitors coming into the field.

For a valuation, Leung uses a 15x EV/EBITDA multiple, which he says is in-line with SaaS comparables. Leung rates OneSoft Solutions a “Speculative Buy” and gives it a price target of $1.75, which represented a projected one-year return of 122 per cent at the time of publication.

Leung thinks OSS will post EBITDA off negative $2.0-million on revenue of $4.0-million in fiscal 2019. He expects those numbers will improve to EBITDA of positive $2.0-million on a topline of $10.0-million the following year.

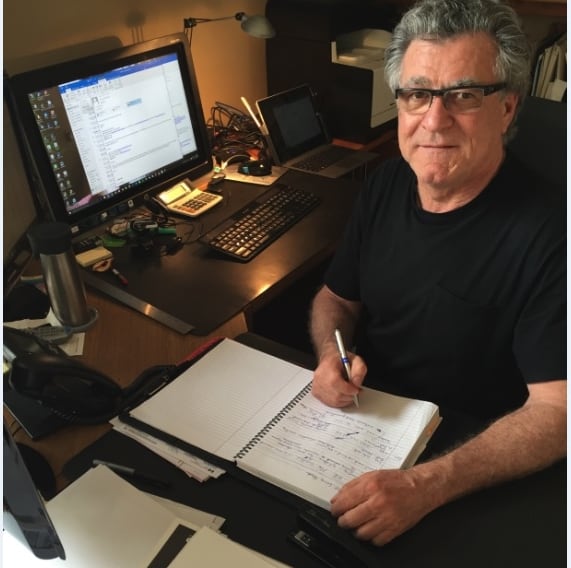

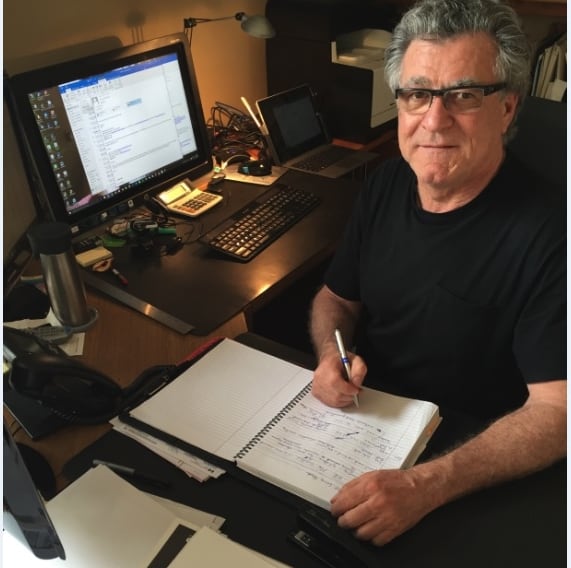

Nick Waddell

Founder of Cantech Letter

Cantech Letter founder and editor Nick Waddell has lived in five Canadian provinces and is proud of his country's often overlooked contributions to the world of science and technology. Waddell takes a regular shift on the Canadian media circuit, making appearances on CTV, CBC and BNN, and contributing to publications such as Canadian Business and Business Insider.