A proposed move to acquire Newstrike Brands could be a winner for HEXO Corp (HEXO Stock Quote, Chart TSX:HEXO), but there’s a real risk that the deal won’t go through, says GMP Securities analyst Robert Fagan.

A proposed move to acquire Newstrike Brands could be a winner for HEXO Corp (HEXO Stock Quote, Chart TSX:HEXO), but there’s a real risk that the deal won’t go through, says GMP Securities analyst Robert Fagan.

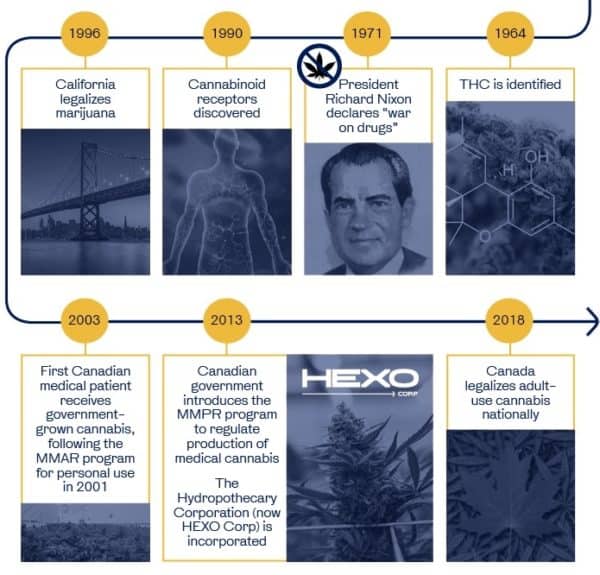

Quebec-based cannabis company HEXO last Wednesday announced the agreement for the all-stock transaction, valued at $263 million, to acquire Newstrike. The terms would see Newstrike shareholders receive a relatively small premium for their shares, amount to roughly $0.504 per HIP share (the stock closed trading on Friday at $0.510).

Fagan figures that with an anticipated capacity of 42 tonnes in 2020, Newstrike could add about 20 per cent to HEXO’s valuation, if the deal closes.

“With the minor premium offered and HEXO’s management seemingly unwilling to enter a bidding war should other buyers emerge, we believe this presents some risks to the acquisition closing. HEXO nonetheless expects the transaction to close within 60 days following a HIP shareholder vote,” says Fagan in a equity research update to clients on March 15.

Last week, HEXO also released its second quarter fiscal 2019 financials, generating net revenues of $13.4 million, a 137 per cent increase from the previous quarter but slightly below the consensus of $14.1 million and Fagan’s forecast for $14.3 million. An Adj. EBITDA loss of $6 million was in line with consensus and slightly ahead of Fagan’s $6.6 million forecast.

“Based on Health Canada data, we estimate HEXO captured ~11 per cent recreational market share between Nov. 2018 and Jan. 2019. This would position HEXO’s REC market share amongst the ranks of the industry’s largest producers such as Aurora and Aphria, despite supplying only three provinces during the quarter. In addition, we estimate HEXO’s REC market share in Quebec at ~50 per cent over the same period, demonstrating strong execution for HEXO in its core market,” says Fagan.

In reflection of the potential accretion from the Newstrike acquisition, the analyst has raised his estimates as well as his target price. He is maintaining his “Buy” rating with the new target of $10.50 (previously $8.75), which represents a projected return of 29.5 per cent at the time of publication.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment