Cresco Labs has a 46 per cent upside, says Beacon Securities

Beacon Securities analyst Russel Stanley says Cresco Labs (Cresco Labs Stock Quote,Chart CSE:CL) is poised to gain from progress towards cannabis reform in the United States.

Beacon Securities analyst Russel Stanley says Cresco Labs (Cresco Labs Stock Quote,Chart CSE:CL) is poised to gain from progress towards cannabis reform in the United States.

In a coverage launch on Thursday, Stanley rates Cresco Labs a “Buy” with a 12-month target price of C$22.00.

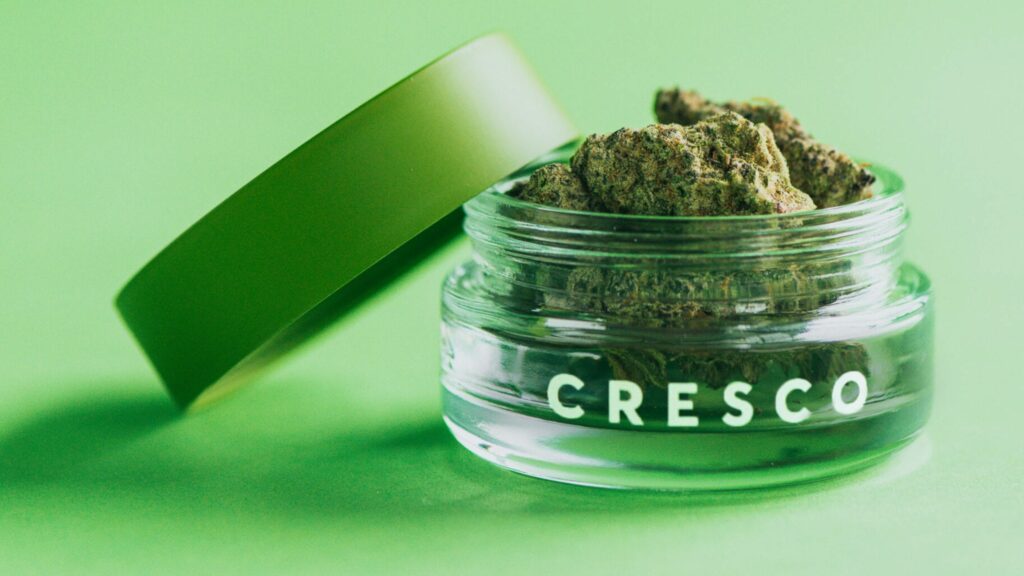

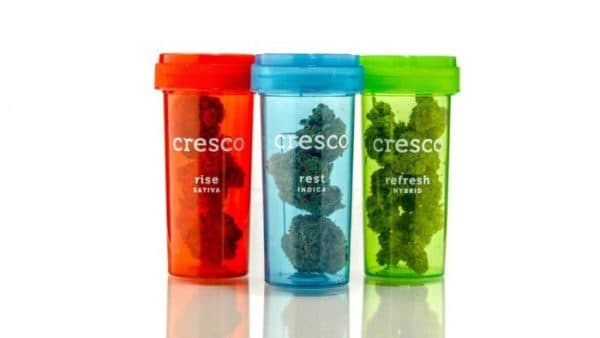

Chicago-based Cresco has seen its share price rise over 75 per cent since it began trading on the CSE on December 3. Stanley says that the company is intent on expanding its leadership position in Illinois and Pennsylvania, along with opening cultivation and retail operations in Ohio and Massachusetts. The company also has an dominant edibles position in Nevada, three dispensaries in Pennsylvania and the recent acquisition of VidaCann in Florida.

Stanley points to what he calls the massive multiple discount at which US cannabis companies are currently valued compared to their Canadian peers, figuring that the discrepancy won’t last forever.

“US operating cannabis companies now trade at approximately 14x 2020E EBITDA, representing an 63 per cent discount to the 37x average for companies that are operationally focused on Canada. We continue to believe that the only rational justification for any discount is cannabis’ current federal status. Given the public comments made by virtually every presidential candidate (including current President Trump), we believe supportive federal reform is inevitable,” says Stanley.

“It is our view that supportive legislation would unleash a massive flow of funds from both financial and strategic investors that should drive re-ratings across the space,” he says.

As for catalysts for Cresco, aside from progress at the federal level, Stanley says that moves towards adult-use legalization in the core states of Illinois and Pennsylvania should benefit the stock, as would the closing of several acquisitions in Florida (VidaCann), New York (Valley Agriceuticals), Massachusetts (Hope Heal Health), the opening of further dispensaries in Illinois, additional M&A activity and buildout progress.

Stanley sees Cresco generating revenue and EBITDA Net NCI of $41 million and $8 million in fiscal 2018, $239 million and $51 million in fiscal 2019 and $551 million and $165 million in fiscal 2020. (All figures in US dollars unless noted otherwise.)

The analyst has arrived at his C$22.00 target using a 30x multiple of his EV/2020 EBITDA estimate, which represents an 18 per cent discount to the 37x average among companies with a plus-C$1 billion market cap. Stanley’s target represents a projected return of 46 per cent at the time of publication.

Nick Waddell

Founder of Cantech Letter

Cantech Letter founder and editor Nick Waddell has lived in five Canadian provinces and is proud of his country's often overlooked contributions to the world of science and technology. Waddell takes a regular shift on the Canadian media circuit, making appearances on CTV, CBC and BNN, and contributing to publications such as Canadian Business and Business Insider.