Xebec Adsorption has world-beating technology, this portfolio manager says

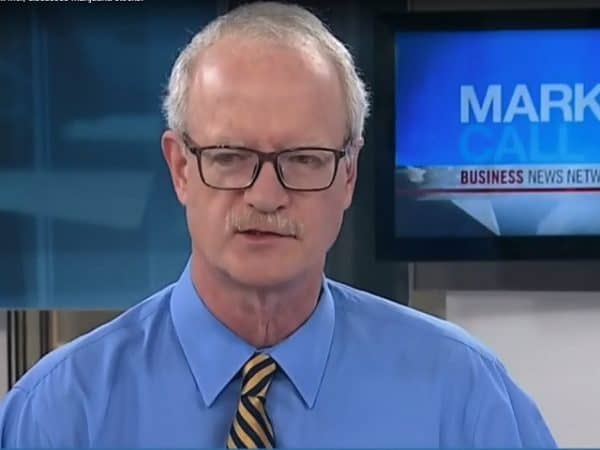

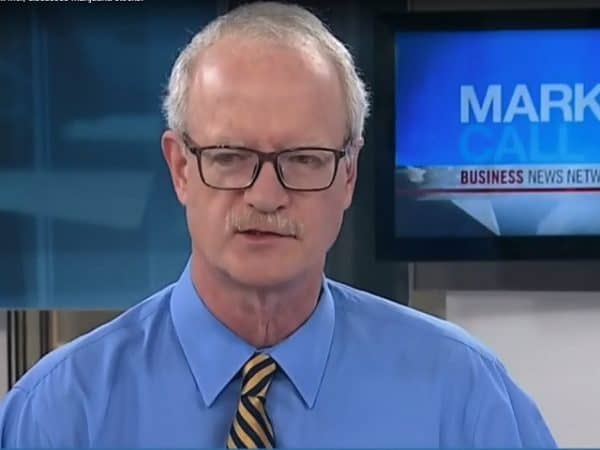

Cleantech company Xebec Adsorption (Xebec Adsorption Stock Quote, Chart TSXV:XBC) looks poised for growth in the renewable natural gas market, says Robert McWhirter of Selective Asset Management, who likes the hefty backlog that the company has built up.

Cleantech company Xebec Adsorption (Xebec Adsorption Stock Quote, Chart TSXV:XBC) looks poised for growth in the renewable natural gas market, says Robert McWhirter of Selective Asset Management, who likes the hefty backlog that the company has built up.

“It’s a company that extracts gas from rotting garbage dumps and for the City of Toronto’s Green Bin process, as well,” said McWhirter, president and portfolio manager at Selective Asset Management, in conversation with BNN Bloomberg on Friday. “The reason I’m comfortable with Xebec is that they have a backlog of approximately $60 million, the majority of that with a large Italian conglomerate which basically says it’s a three-year $15-million each year take or pay contract.”

“[They have] excellent technology, it’s world-beating. We think that they’re going to do very, very well,” he says.

Xebec’s stock had been rising over the first month and a half of 2019, climbing 36 per cent in the process. The company announced at the end of January that its first project in Italy, a biogas upgrading plant in Modena, is now operational, with the company saying that after France (where Xebec has more than 20 pressure swing adsorption systems), Italy is becoming its second European market.

In December, Xebec announced the acquisition of Ontario-based Compressed Air International for $2.2 million, while last summer, the company signed an agreement with the City of Toronto for a biogas upgrading system. McWhirter says the Toronto deal will be a boon for Xebec.

“The deal they’ve struck with the City of Toronto is important because typically you get $3 for natural gas in Alberta, $40 in France, and $21-25 is now the price for renewable natural gas in Canada —and Fortis is an aggressive buyer of it— and if you’re in California you can get as much as US$75 for it,” he says.

“We’re waiting for their fourth quarter numbers and we’re expecting similar to the third quarter that sales may be up as much as 100 per cent year-over-year, [and] it appears to be reasonably priced,” he says.

Xebec Adsorption last reported its quarterly financials on November 8, 2018, generating EBITDA of $1.1 million for its third quarter in comparison with $0.3 million in Q3/17. Revenue was $8.2 million, a 100 per cent year-over-year increase.