With sales increasing in the United States, M Partners analyst Andrew Hood thinks investors should be looking at Opsens (Opsens Stock Quote, Chart TSX:OPS)

With sales increasing in the United States, M Partners analyst Andrew Hood thinks investors should be looking at Opsens (Opsens Stock Quote, Chart TSX:OPS)

In a research update to clients today, Hood resumed coverage of Opsens with a “Buy” rating and a one-year price target of $1.20, implying a return of 48 per cent at the time of publication.

The analyst says OPS offers a chance for exposure to two sectors.

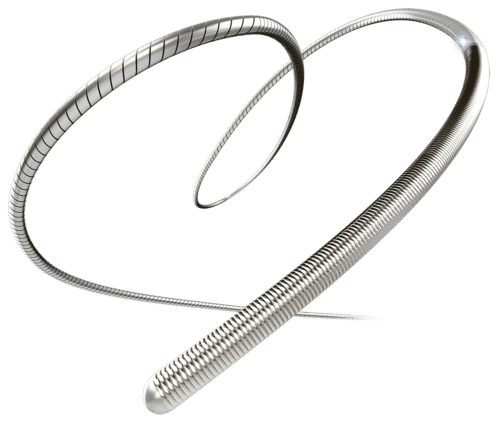

At current levels we believe Opsens shares offer a compelling entry point to gain exposure to the Company’s continued penetration in the global medical device market,” Hood says. “Opsens develops, manufactures and supplies fiber optic sensors to the medical and industrial sectors, with its primary focus on the Fractional Flow Reserve (FFR) cardiovascular device market through its OptoWire product. In fiscal 2018, the Company generated $21.9M in revenue in its medical segment and $2.1M in its industrial segment, vs. $16.3M and $1.5M in those respective segments in 2017. In 2019 it is evident Opsens is continuing to generate significant traction, reporting $8.5M in medical revenues and $0.6M in industrial revenues in the first quarter. We believe growth will continue to accelerate, especially in the U.S. market.”

Hood thinks Opsens will post EBITDA of $1.9-million on revenue of $32.1-million in fiscal 2019.

“There is plenty of room for growth in the FFR industry – and Opsens is in a position to capture a bigger piece of the pie,” the analyst adds. “The overall industry is expected to grow at a 10-15% CAGR, from ~$520M in 2018 to over $1B within 5 years. Management estimates Opsens currently has a 3% market share in Fractional Flow Reserve, while more traditional electrical wires have a 90% share. As leading cardiologists continue to tout the superiority of the OptoWire in terms of accuracy and ease of use vs. traditional guidewires, Opsens should manage to capture meaningfully higher market share moving forward, with a goal of 20% share long-term. Even if Opsens were to simply maintain its current share of the market, this will translate to a big boost in revenues.”

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment