HEXO (HEXO Stock Quote, Chart TSX:HEXO) is getting a target price raise from analyst Russell Stanley of Beacon Securities, who rates the stock as a “Buy” (unchanged) with a target of $12.25 (was $11.00).

HEXO (HEXO Stock Quote, Chart TSX:HEXO) is getting a target price raise from analyst Russell Stanley of Beacon Securities, who rates the stock as a “Buy” (unchanged) with a target of $12.25 (was $11.00).

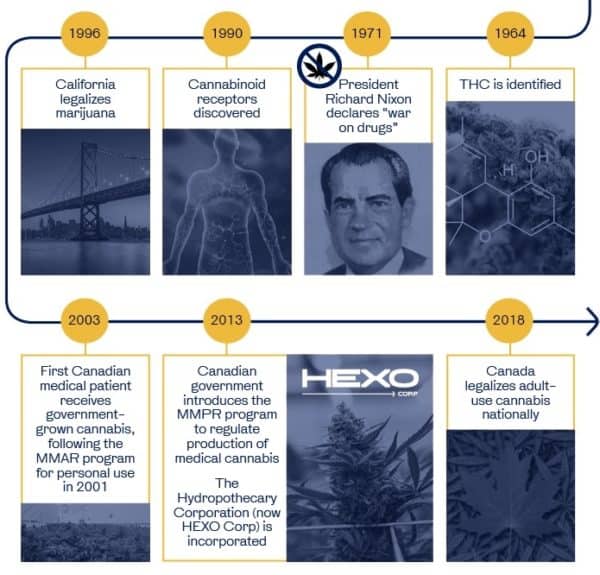

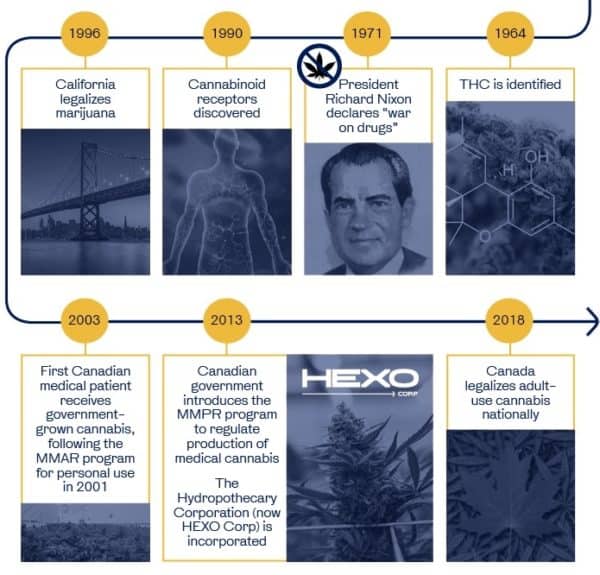

In a Tuesday update to clients, Stanley pointed to the cannabis company’s new NYSE listing and recent financing announcements as cause for the target raise.

Gatineau, Quebec’s HEXO announced in late January a marketed offering of 8.9 million shares at $6.50 per share, with net proceeds of approximately $54.7 million, to go towards general corporate purposes such as global growth initiatives and R&D.

As well, the company announced last week that it had entered into a syndicated credit facility co-led by CIBC and Bank of Montreal, with proceeds to go towards expansion of its cultivation and production facility in Gatineau as well as leasehold improvements at its Belleville, Ontario, facility.

As a result, Stanley has upped his multiple for HEXO from 20x to 23x his EV/2020 EBITDA estimate.

“We believe the multiple increase is justified following the recent listing on the NYSE, given that the handful of companies that trade there receive significant valuation premiums to their peers,” says Stanley. “Our 23x multiple is quite reasonable considering that it represents a 42 per cent discount to the 40x average amongst companies with a $1 billion-plus market capitalization, and an 67 per cent discount to the 70x average amongst companies that have a listing on a US exchange. Our new multiple is also in line with the broad peer group at 23x.”

Stanley estimates that HEXO will generate Adjusted EBITDA in fiscal 2019 of negative $3.7 million on revenue of $100.7 million and Adjusted EBITDA in fiscal 2020 of $117.2 million on a top line of $315.9 million. His new $12.25 target represented a projected 12-month return of 66 per cent at the time of publication.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment