Acreage Holdings has an 88 per cent upside, Beacon Securities says

New York-based Acreage Holdings (Acreage Holdings Stock Quote, Chart CSE:ACRG.U) just opened its third dispensary in the state, a testament to the company’s ability to execute, says analyst Russell Stanley of Beacon Securities.

New York-based Acreage Holdings (Acreage Holdings Stock Quote, Chart CSE:ACRG.U) just opened its third dispensary in the state, a testament to the company’s ability to execute, says analyst Russell Stanley of Beacon Securities.

In a Thursday note to clients, Stanley reiterated his “Buy” rating and US$40.00 target price, representing a projected return of 88 per cent at the time of publication.

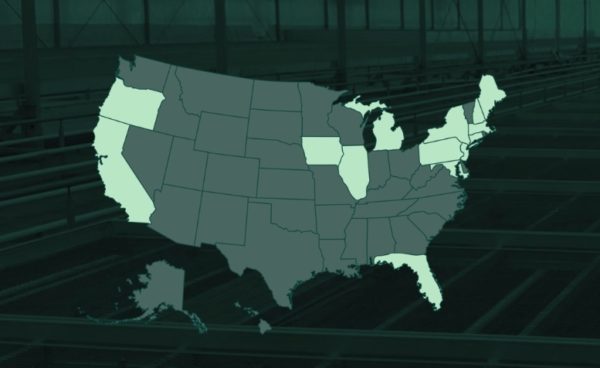

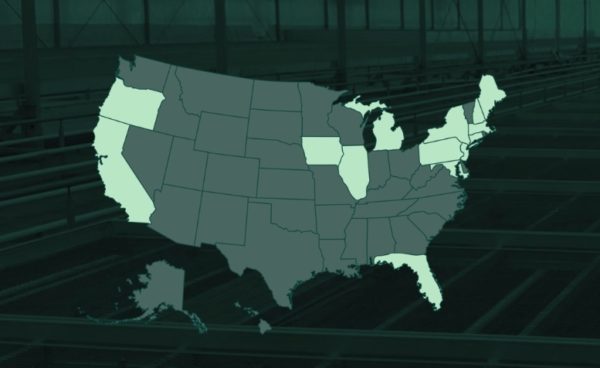

Acreage, which has cannabis cultivation, production and retail interests across 19 states, is now operating one of three stores in the borough of Queens.

“This dispensary is one of just three operating in Queens (pop. 2.4 million), so we expect the foot traffic to be impressive,” says Stanley. “We view the development positively, as it represents continued execution against management’s November prediction that it would open all four New York dispensaries this winter.”

Stanley notes that New York’s medical-only market has approximately 91,000 certified patients, where Acreage is one of ten companies currently licensed to operate in the state. The analyst sees major expansion in New York, however, as the patient count has expanded 135 per cent since December of 2017 and could reach a penetration level of 2.6 per cent, representing over 500,000 patients.

As well, Stanley points out that given the movement towards adult-use legalization in surrounding states such as New Jersey, Connecticut, Vermont and Pennsylvania, legal rec weed shouldn’t be far off in New York.

“We believe adult-use legalization in New York is at the ‘when’ rather than ‘if’ stage. Depending on how the final rules shake out, this should mean a significant increase in the state’s market potential,” says Stanley.

The analyst estimates that Acreage will generate 2019 Adjusted EBITDA of $60 million on revenue of $272 million and 2020 Adjusted EBITDA of $158 million on a top line of $533 million.