The Celestica selloff is overdone, this investor says

Once a dot-com darling, Celestica saw its business shrink in the early 2000s, with its share price plummeting in turn. But the company managed an admirable recovery in the early 2010s and has been showing consistent growth for years now, in turn rewarding investors who saw CLS more than double in value between 2012 and 2017.

But after reaching a high of $19.94 in the spring of 2017, CLS proceeded to slip even lower this past year, starting in July where it tumbled from a high of $16.50 to where it currently sits in the $12.00 range. Celestica hasn’t participated in the new year rally to any measurable extent, either, leaving investors rightfully cagey. Not to worry, says Cockfield.

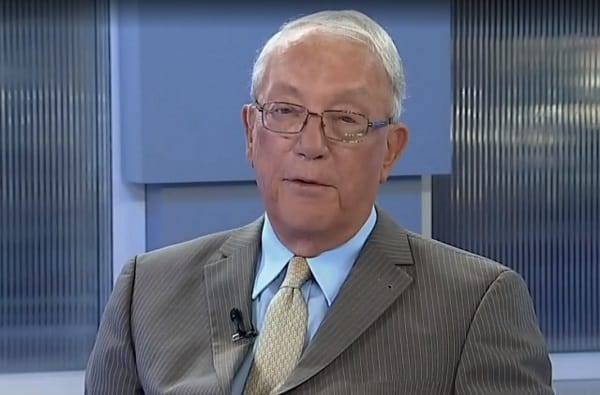

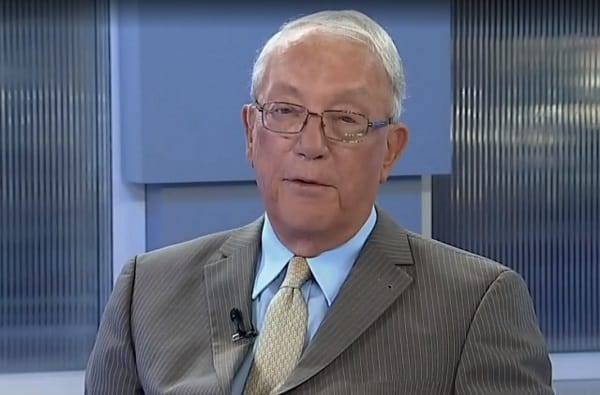

“This is a company that got sold off quite aggressively for no particular reason at all,” says Cockfield, managing director and portfolio manager for Northland Wealth Management, to BNN Bloomberg. “It’s a growth stock, and what often happens in a correction like this is, if you’ve got a reasonable dividend it tends to form a reasonable base for a [stock]. But if you’re not paying a dividend — and I don’t think Celestica does — and it’s a growth stock and if you’ve become concerned in a correction that somehow we’re going to have a recession and there’ll be no growth, these stocks become more volatile, usually on the downside.”

Celestica last reported its earnings in October, where the company posted third quarter results in line with expectations and including adjusted earnings of $0.26 on revenue of $1.71 billion, a 12 per cent year-over-year top line increase. At the time, CEO Rob Mionis said the realignments undertaken by the company in terms of cost efficiencies and focusing on the business strengths were bearing fruit and that Celestica would be entering 2019 in a strong position.

“Celestica delivered solid revenue growth in both our Advanced Technology Solutions and Connectivity & Cloud Solutions segments in the third quarter, as well as continued sequential expansion of our consolidated margin,” Mionis said. “We were particularly pleased with the performance of our CCS business, which delivered steady margin improvements each quarter this year. As we finish 2018, we are excited with the progress we are making on our strategy launched three years ago to diversify our revenue mix and deliver better overall financial performance.”

The company made news in October with the acquisition of Silicon Valley-based Impakt Holdings for US$329 million, a deal which was closed in November.

“There’s absolutely nothing wrong with Celestica,” says Cockfield. “Their prospects are quite good. If you own it, I’d certainly hold onto it, and I think you can even add to it at this particular point in time because the multiple is quite reasonable.”