But the company’s troubles go deeper than one dysfunctional orbiter, says James Hodgins of Curvature Hedge Strategies, who claims the difficulties in running a space systems business combined with its unwieldy debt load have made Maxar an investor no-go zone for the time being.

Shares of Maxar were down a further ten per cent in early trading on Tuesday as the markets continue to dwell on the company’s misfortunes concerning one of its main revenue-generating satellites, the WorldView-4, launched into orbit just two years ago.

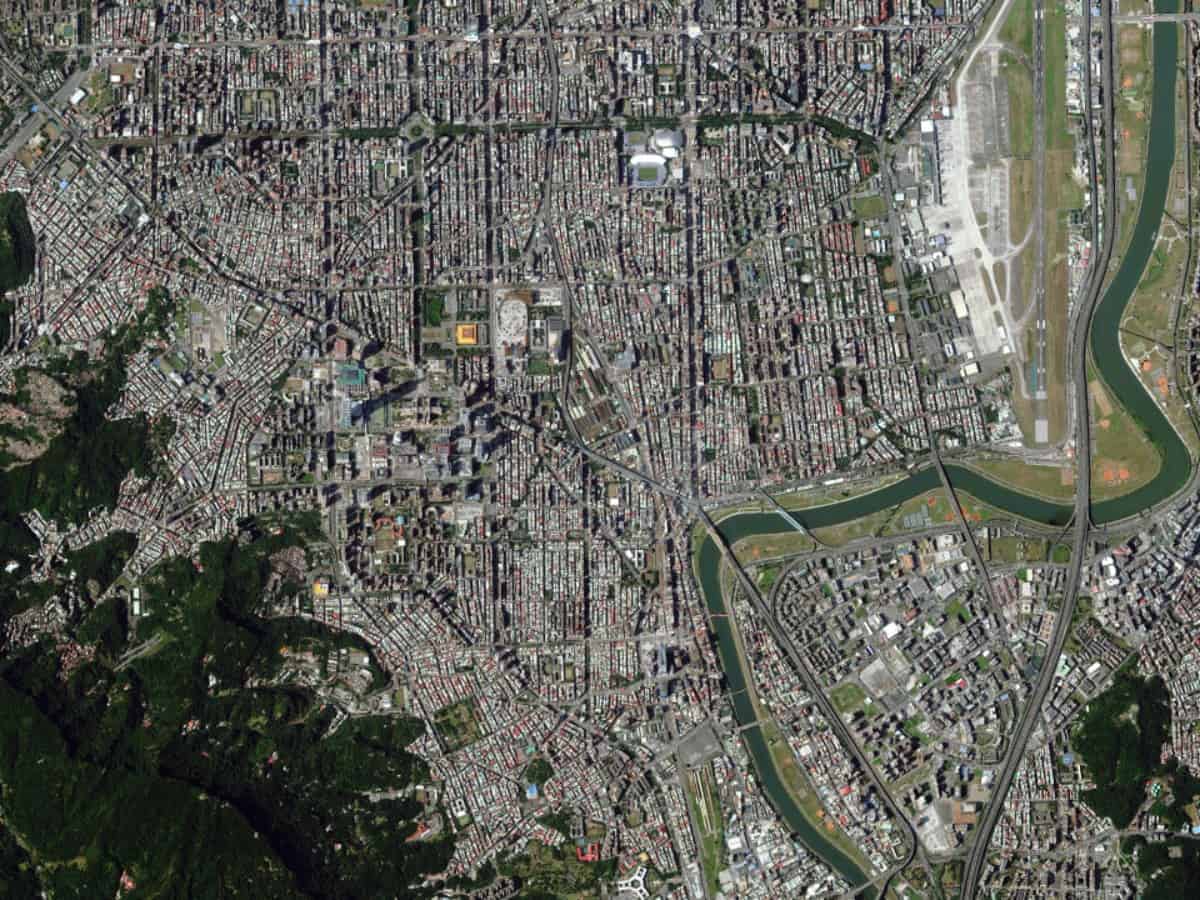

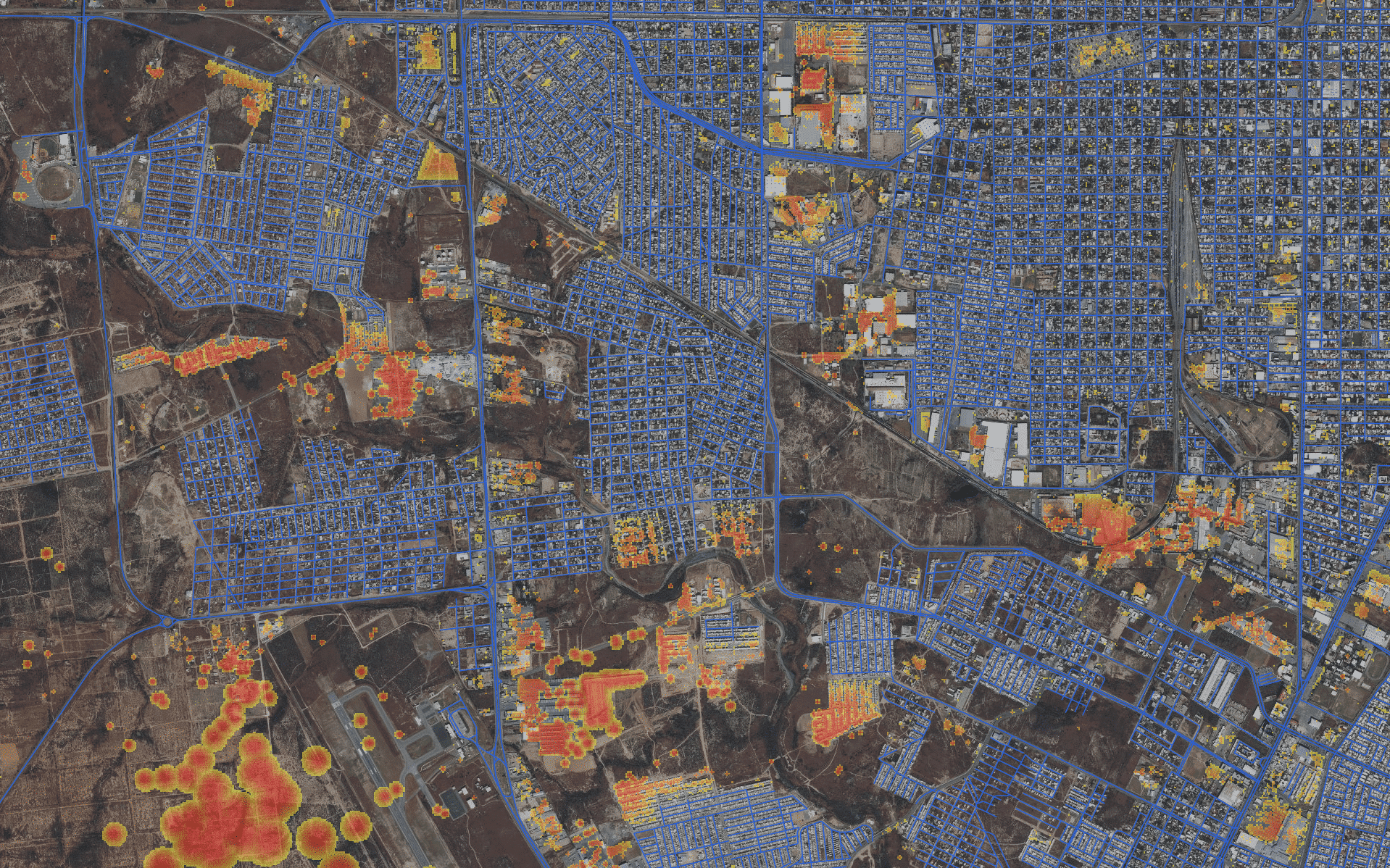

On January 7, Maxar announced that the satellite had experienced a stability failure which is preventing it from taking pictures, its main function and one which generated $85 million in revenue last year, according to the company. Maxar says that it intends to seek full recovery for the losses through its insurance policies but that the company “believes that WorldView-r will likely not be recoverable and will no longer produce usable imagery.”

The news comes after a trying year which saw the company face a short-seller attack, an earnings miss and a write down of its satellite business. Hodgins says that Maxar’s problems are now part and parcel to the satellite industry itself, which became a focus for Maxar (formerly MacDonald, Detweiler) when it acquired Space Systems/Loral (SSL) in 2012.

“The company has a huge amount of debt,” says Hodgins, Chief Investment Officer at Curvature, to BNN Bloomberg. “This used to be MacDonald, Detweiler and then they bought [SSL] and took on that business and had a good run with it. But launching satellites is expensive and technically difficult, and so the space systems business is proving to be quite challenging for them.”

“The other issue is that given that the credit markets have ticked over and credit spreads are now much wider, companies that are heavily indebted like Maxar are in the penalty box,” he says. “Fundamentally, they might fix the business and get that satellite up and running again but in terms of the type of company that we’re looking to invest in through this upcoming cycle, it would not be one of them.”

Yesterday, Maxar announced that CEO Howard Lance had resigned effectively immediately and would be replaced by Daniel Jablonshky, former president of DigitalGlobe, which was acquired by MacDonald, Dettwiler in 2017.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment