Shares of space tech and satellite company Maxar dropped further in trading on Wednesday as investors reacted to the latest news involving the seemingly abrupt departure of CEO Howard Lance, now replaced by Daniel Jablonsky who is the current president of subsidiary company DigitalGlobe. Last week, DigitalGlobe revealed that one of its main revenue-generating satellites launched only two years ago is now experiencing a stability failure which is prevented it from recording data, effectively wiping about $85 million in revenue off Maxar’s books and causing a big drop in MAXR’s share price.

Those happenings come after a year in which the company experienced a write down in its satellite business while facing the brunt of a short-seller attack. In total, the stock is now down more than 90 per cent year-over-year, a sad predicament for one of Canada’s prized companies, says Sprung.

“This company is somewhat of a tragic story: the former MacDonald, Dettwiler and Associates, which the federal government blocked the sale of, saying that it was a strategic asset,” says Sprung, president of Sprung Investment Management, in conversation with BNN Bloomberg.

“So what did management do? They levered the company up, they bought a whole bunch of other assets, and we’ve seen the stock just take a beating — and it has taken a beating to such an extent that I really question its sustainability,” says Sprung. “I don’t know whether it’s likely to go under but I certainly think that with an 18 per cent dividend yield, I wouldn’t count on that remaining for any period of time.”

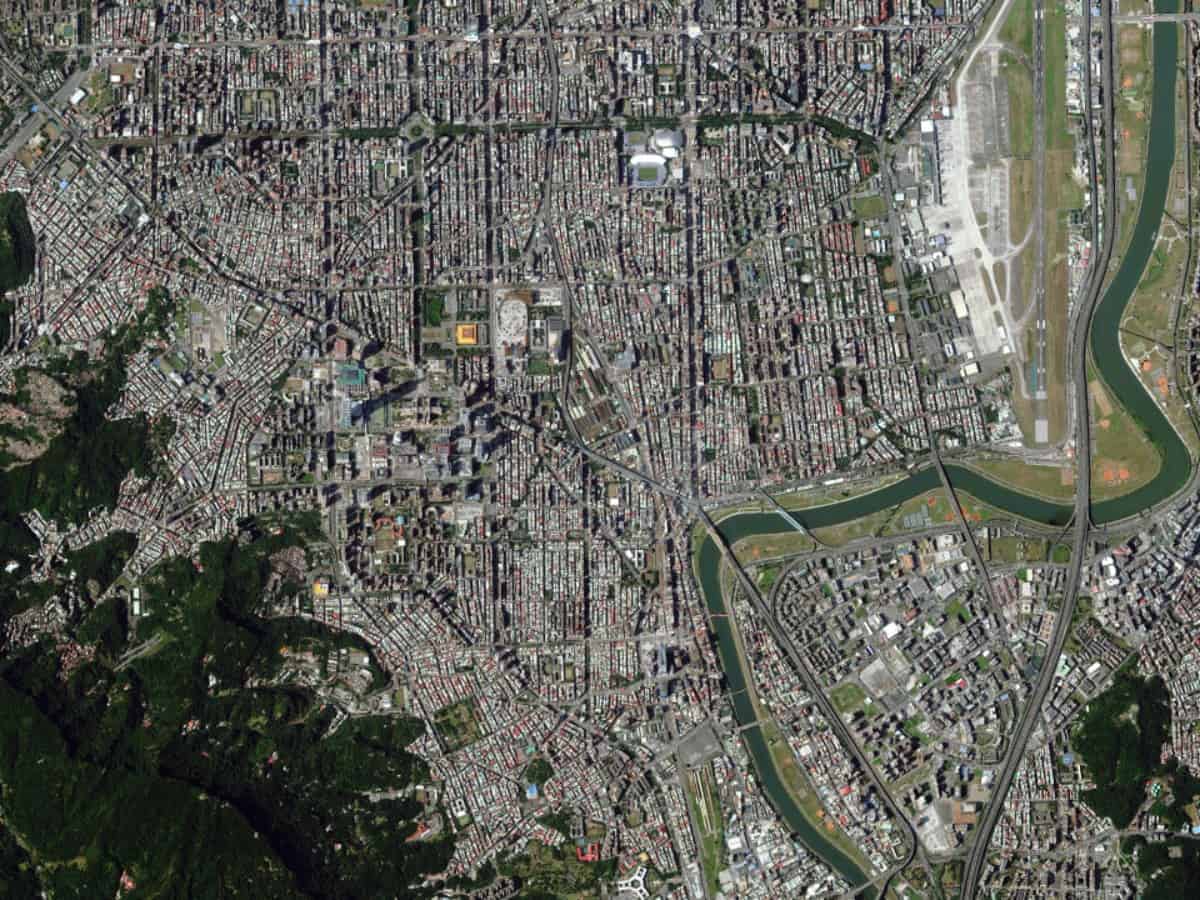

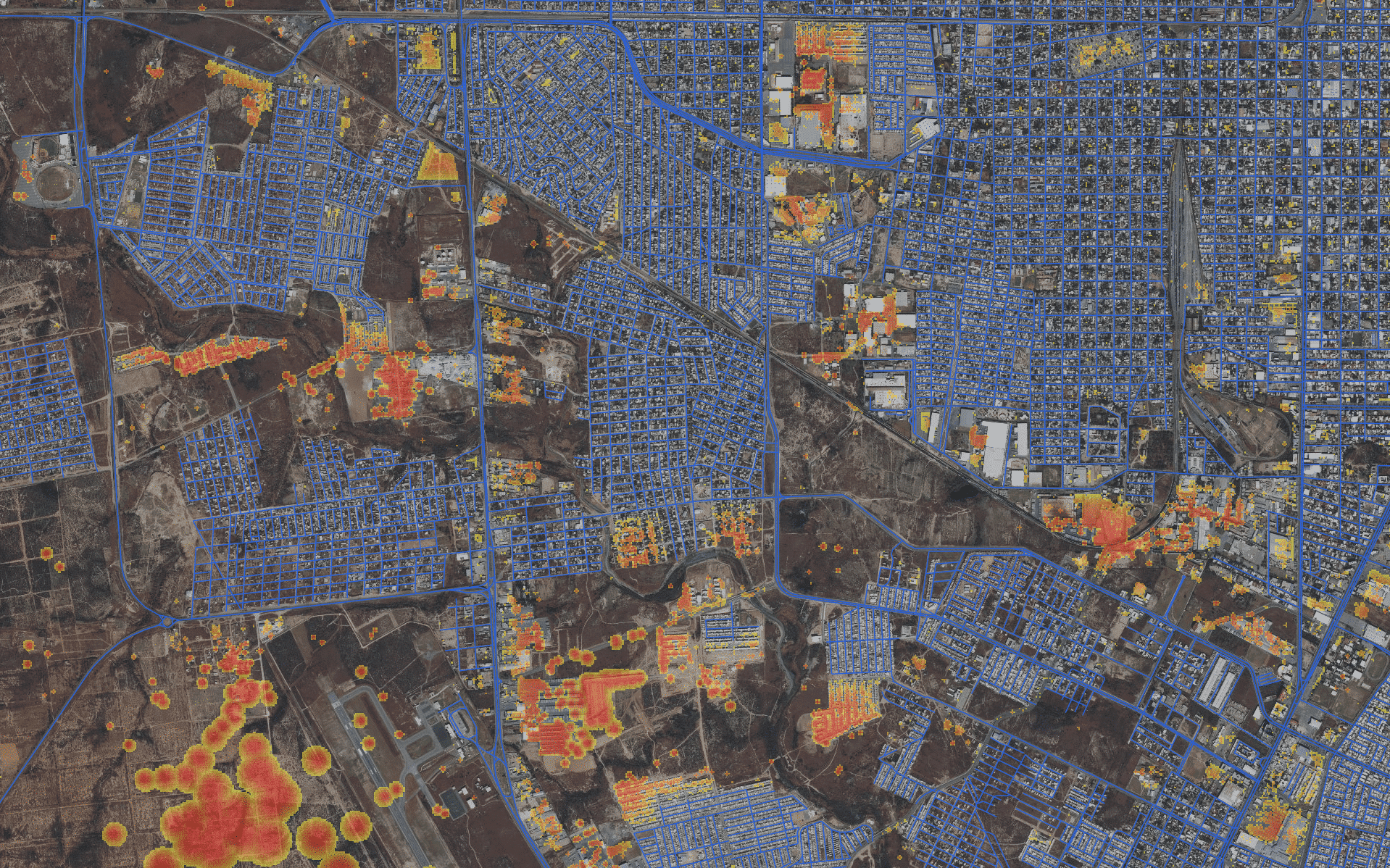

In 2008, the Conservative government under then Prime Minister Stephen Harper rejected a takeover of MDA, makers of the iconic Canadarm as well as the Earth observation satellite Radarsat-2, by US space company Alliant Techsystems (now part of Orbital ATK) in a $1.3-billion deal. More recently in 2017, MDA purchased DigitalGlobe in a US$2.4-billion deal and reformulated into Maxar Technologies while moving its headquarters to Colorado.

“It’s unfortunate that they wouldn’t allow the shareholders to benefit from the offer that was made —a US company that was offering to buy MDA— and I think if that had happened everybody would be much happier today,” Sprung says.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment