Echelon Wealth Partners turns bullish on beaten down ProMetic Life Sciences

A new development for ProMetic Life Sciences (ProMetic Life Sciences Stock Quote, Chart TSX:PLI) has Echelon Wealth Partners analyst Douglas Loe raising his rating while lowering his price target on the stock.

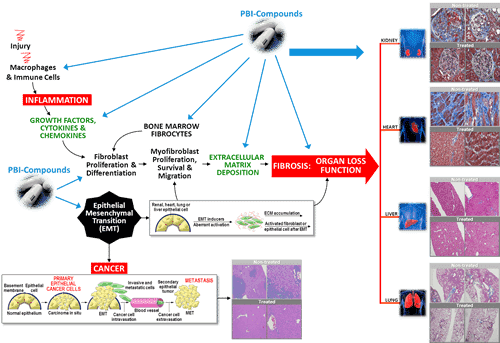

On Wednesday, ProMetic confirmed that following what management called “positive feedback” from its recent meetings with regulatory authorities, it would initiate a Phase 3 PBI-4050 clinical trial for Alstrom Syndrome, an extremely rare genetic syndrome that causes the dysfunction of multiple organs.

“We are very excited that Alstrom syndrome could be the first approved clinical indication for our lead anti-fibrotic drug candidate, PBI-4050,” said Dr. John Moran, MD, ProMetic’s chief medical officer. “Our ongoing United Kingdom phase 2 trial continues to generate encouraging safety and clinical activity data with patients averaging more than one year of drug exposure. We are confident in PBI-4050’s ability to reproduce similar positive clinical activity on specific key fibrotic clinical end points in the pivotal placebo-controlled phase 3 study.”

Loe says though he urges caution because he believes there is still risk in PLI’s balance sheet.

“We stand by our medium-term investment thesis that still advises caution on ProMetic’s lingering financial risk and on extended timelines to FDA review for lead plasmaderived plasminogen formulation Ryplazim, particularly with most other affinity-purified plasma products, other than IVIG, that we originally thought would be in active clinical testing by now (alpha-1-antitrypsin & C1 esterase inhibitor, to name two of many), not yet achieving clinical status,” he says.

But the analyst says there are, increasingly, reasons to like the stock, not the least of which is a share price that has fallen from over $1.70 last January to a recent low under forty cents.

“We have long since revised our model to solely reflect on IVIG, plasminogen/Ryplazim, and PBI-4050, and we remain positive about core scientific underpinnings of ProMetic’s capture affinity resin-purified plasma products program and on PBI-4050’s well-documented anti-fibrotic activity and the relevance of that activity to several metabolic/fibrotic disease markets, independent of financial risk percolating in the background,” he adds.

And Loe says ProMetic is in rare company with regards to PBI-4050.

“PBI-4050 has predictably been granted Rare Pediatric Disease designation in the US as well as Orphan Drug status in the US and Europe for both Alstrom Syndrome and IPF, so ‘4050 already has been granted most of the favourable regulatory regard that innovative clinical-stage therapies can be granted. None of which guarantee future clinical success of course, but they do collectively show us that US/European regulators do see the merits in developing new therapies for these medical markets. There is no denying that Alstrom Syndrome-targeted therapies almost by definition quality for any/all special regulatory status, since the disease is a genetic pediatric disorder (arises from mutations in the cilia-forming ALMS1 gene) and is exceedingly rare with only about 700 or so cases reported worldwide (so incidence of about one in a million individuals, according to a 2015 review in the journal The Application of Clinical Genetics).

In a research update to clients today, Loe raised his rating on ProMetic Life Sciences from “Hold” to “Speculative Buy” while simultaneously lowering his one-year price target on the stock from $1.00 to $0.60, implying a return of 54 per cent at the time of publication.

Loe thinks PLI will generate EBITDA of negative $101.2-million on revenue of $43.6-million in fiscal 2018. He expects those numbers will improve to EBITA of negative $63.6-million on a topline of $52.2-million the following year.

Nick Waddell

Founder of Cantech Letter

Cantech Letter founder and editor Nick Waddell has lived in five Canadian provinces and is proud of his country's often overlooked contributions to the world of science and technology. Waddell takes a regular shift on the Canadian media circuit, making appearances on CTV, CBC and BNN, and contributing to publications such as Canadian Business and Business Insider.