Ahead of its third quarter financials due next week, analyst Gianluca Tucci of Echelon Wealth Partners is maintaining his “Buy” rating and $90.00 target price for Cargojet Inc (Cargojet Stock Quote, Chart TSX:CJT), saying the company’s natural monopoly in Canada’s air cargo space gives it a sustainable competitive advantage.

Ahead of its third quarter financials due next week, analyst Gianluca Tucci of Echelon Wealth Partners is maintaining his “Buy” rating and $90.00 target price for Cargojet Inc (Cargojet Stock Quote, Chart TSX:CJT), saying the company’s natural monopoly in Canada’s air cargo space gives it a sustainable competitive advantage.

So far, CJT has had an impressive run in 2018, currently up 34.5 per cent year-to-date. On Tuesday, the company announced it had closed on its $75 million bought deal offering of 5.75 per cent listed senior unsecured hybrid debentures, which management says will help to pay down the revolving credit facility the company drew up to support capital expenditure and to fund anticipated capex growth in the future.

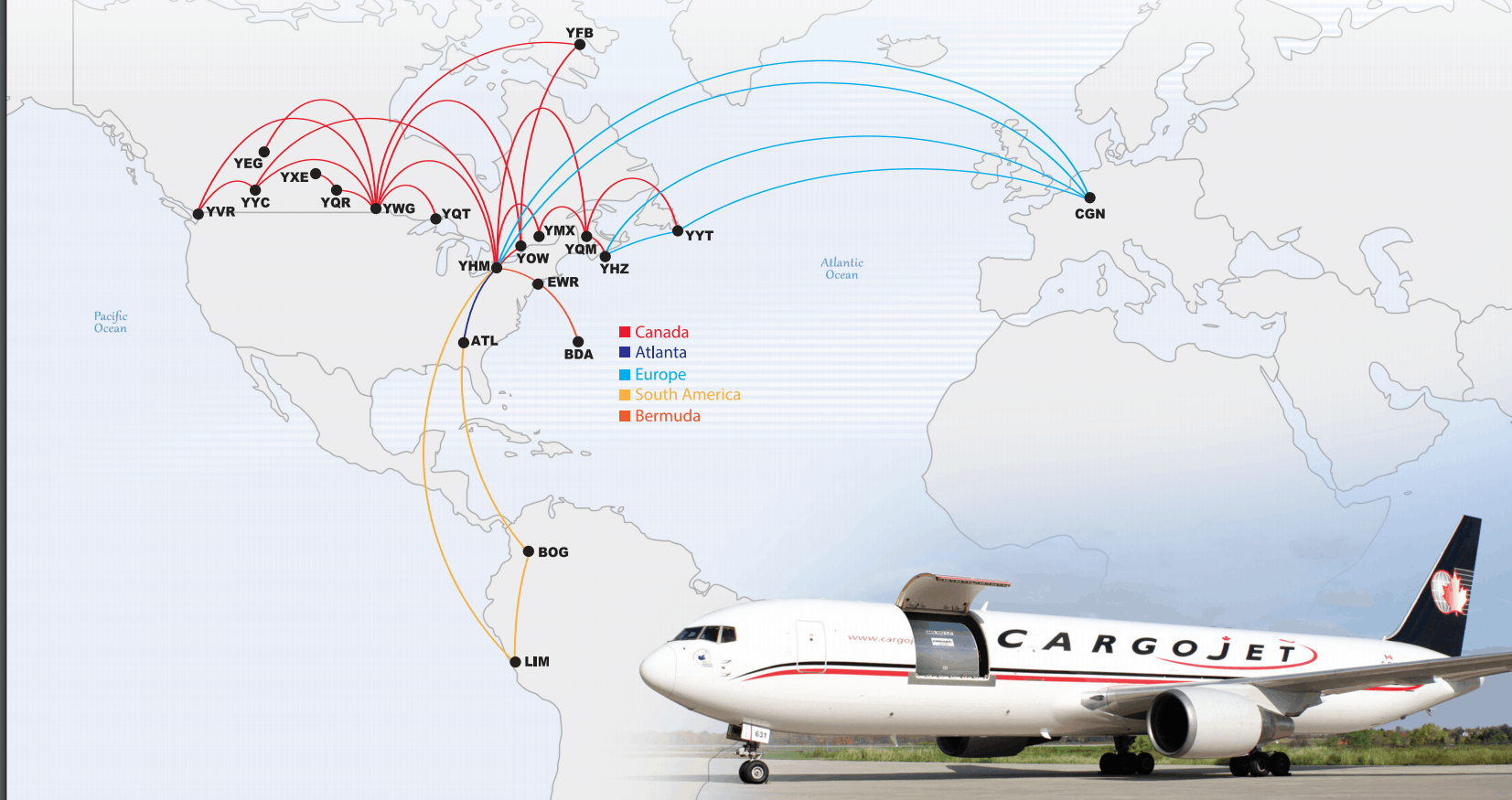

Tucci says he expects the company will be adding additional aircraft to its fleet over the near term to fuel incremental charter/ACMI routes where international demand for cargo exists. Tucci says he’s leaving his 2019 and 2020 forecasts unchanged at the moment but expects that he’s erring on the conservative side.

The analyst is expecting Q3 revenue and Adjusted EBITDA of $105.5 million and $30.2 million, respectively, with the consensus coming in at $104.5 million and $29.5 million, respectively.

Tucci claims that along with Cargojet’s first-mover advantage in Canada’s large and sparely populated footprint, the company has a number of focal points, namely: a regulatory environment restricting foreign freight airlines in Canada, an exclusive deal with Canada Post on time-sensitive airfreight services, a potential benefit from the new USMCA which raises Canada’s duty-free limit from $20 to $150 and, finally, Cargojet’s position within the growing e-commerce environment.

“E-commerce represents less than 3 per cent of total Canadian retail sales and less than 10 per cent of total US retail sales,” says Tucci in a research update to clients on Tuesday.

“CJT remains one of the prime beneficiaries of this secular shift to e-commerce from bricks-and-mortar. The penetration of e-commerce in Canada is still in its very early innings and its growth should continue to benefit the likes of CJT in the years to come.”

Between 2018 and 2019, Tucci expects Cargojet’s revenue and Adjusted EBITDA to grow from $440 million and $124 million, respectively, to $464 million and $139 million, respectively.

The analyst’s $90 target for CJT represents a projected 12-month return of 14 per cent at the time of publication.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment