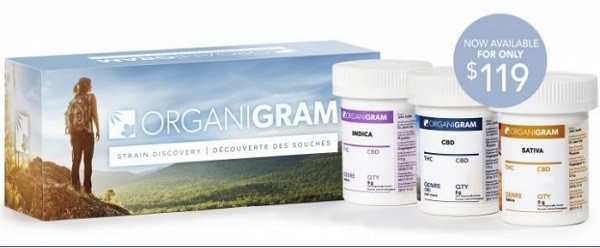

Organigram is undervalued, says Echelon Wealth Partners

Investors in the cannabis sector should take a look at Organigram (TSXV:OGI), Echelon Wealth Partners analyst Russell Stanley says.

Investors in the cannabis sector should take a look at Organigram (TSXV:OGI), Echelon Wealth Partners analyst Russell Stanley says.

In a research report to clients today, Stanley initiated coverage of OGI with a “Buy” rating and a one-year price target of $7.00, implying a return of 57 per cent at the time of publication.

The analyst thinks Organigram could be a takeout candidate.

“The Company is fully financed to take annualized production capacity from 36,000kg to 113,000kg by October 2019, and as of June 2018, it had over 15,000 registered patients with an active prescription,” he notes. “At the 2017 Lift Canadian Cannabis Awards, only one other producer received more awards as voted by medical cannabis patients (MedReleaf, recently acquired by Aurora Cannabis). With large scale production capacity and supply agreements with multiple provinces, we believe OGI could be an attractive candidate for potential strategic investors/acquirers.”

Stanley thinks OGI has a durable and defensible position in the space.

“While there may be initial shortages when the legal recreational market opens in October, we continue to expect dried cannabis to become increasingly commoditized through oversupply,” the analyst says. “The companies that prosper will be those that compete well in terms of ultra-low cost production and/or strength in developing and commercializing value-added products. We believe Organigram is one of a handful of companies positioned to compete well on both fronts. OGI’s fully funded planned capacity of 113,000kg uniquely positions it as one of a handful of producers with the scale needed to offer buyers reliable production at scale and competitive pricing. Through a number of production improvements and scale economies (due in part to its 3-tiered grow rooms) OGI has successfully reduced its cost per gram harvested by 47% from $2.75/gram in FQ118 to $1.47/gram in FQ218. With capacity expected to almost triple by October 2019, we expect continued cost improvement to enable OGI to compete very well on costs.”

Stanley thinks Organigram will generate Adjusted EBITDA of negative $4.6-million on revenue of $18.7-million in fiscal 2018. He expects those numbers will improve to EBITDA of $36.0-million on a topline of $109.8-million the following year.

Nick Waddell

Founder of Cantech Letter

Cantech Letter founder and editor Nick Waddell has lived in five Canadian provinces and is proud of his country's often overlooked contributions to the world of science and technology. Waddell takes a regular shift on the Canadian media circuit, making appearances on CTV, CBC and BNN, and contributing to publications such as Canadian Business and Business Insider.