Nanotech Security Corp has turned a corner, Haywood Securities says

Nanotech Security Corp. (Nanotech Security Corp. Stock Quote, Chart, News: TSXV:NTS) is turning a corner in its development from an R&D-focused company into a profitable player in the lucrative anti-counterfeiting market. That’s the conclusion from analyst Pardeep Sangha of Haywood Securities.

On Monday, the analyst maintained his “Buy” recommendation and $2.00 target price for NTS.

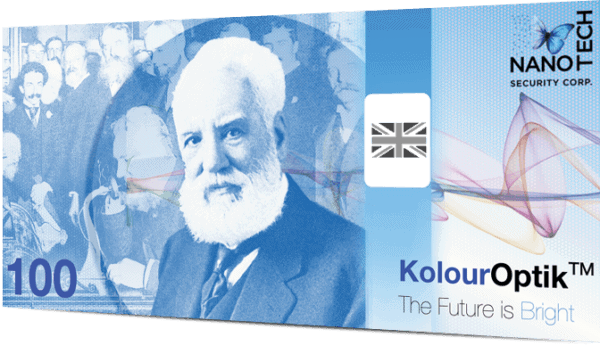

A Quebec-based producer of nano-optic materials used in authentication and brand enhancement, Nanotech recently unveiled a new corporate logo and new social media exposure at its AGM, where management reiterated its guidance for FY18 for 20 to 40 per cent revenue growth, excluding its large Asian customer, and EBITDA margins between 15 and 20 per cent.

Sangha says last year was a milestone for the company, with Nanotech becoming EBITDA and cashflow positive and more than doubling its revenue. “[Nanotech] landed the largest contract in the Company’s history, entered into new markets such as Tax Stamps in India, strengthened its balance sheet with an equity financing and ended the year with excess of $10 million cash in the bank without any debt,” says the analyst in a note to clients.

“We like Nanotech because the Company has developed disruptive technology that we believe will result in very lucrative, high-margin, long-term contracts for the Company in the banknote industry,” he says. “There is a large market for Nanotech’s proprietary technology as counterfeiting is a $650 billion per year problem across numerous industries including banknotes, secure documents, ticketing, commercial branding, and pharmaceuticals.”

Sangha says that NTS’s share price drop of 21 per cent this year stems from concerns over delays regarding the company’s large Asian customer. Once this customer goes into production, the share price should get a boost, meaning that investors are currently presented with a buying opportunity.

“Nanotech is currently trading at 5.1x EV/Revenue of our CY18 estimates, which is above its industry peer group average of 2.5x EV/Revenue of consensus CY18 estimates, due to the Company’s growth potential,” says the analyst. “Our target price is based on applying a 3.8x EV/Revenue multiple and a 10.3x EV/EBITDA multiple to our CY19 forecast.”

Sangha is forecasting 97 per cent revenue growth in FY18 followed by 111 per cent growth in FY19. His “Buy” recommendation comes with a “Very High” risk profile and a $2.00 target price, which represents a potential return of 68.1 per cent at the time of publication.