Cardiome gets price target raise at Mackie Research

Cardiome Pharma Corp.’s (Cardiome Pharma Stock Quote, Chart, News: TSX:COM, NASDAQ:CRME) sale of its Canadian assets gets a thumbs up from analyst André Uddin with Mackie Research Capital, who calls the transaction a very smart move by management. In a client update on Tuesday, Uddin maintains his “Speculative Buy” rating for CRME but raises his target price from (US) $2.80 (all figures in US dollars unless noted) to $3.30.

Cardiome Pharma Corp.’s (Cardiome Pharma Stock Quote, Chart, News: TSX:COM, NASDAQ:CRME) sale of its Canadian assets gets a thumbs up from analyst André Uddin with Mackie Research Capital, who calls the transaction a very smart move by management. In a client update on Tuesday, Uddin maintains his “Speculative Buy” rating for CRME but raises his target price from (US) $2.80 (all figures in US dollars unless noted) to $3.30.

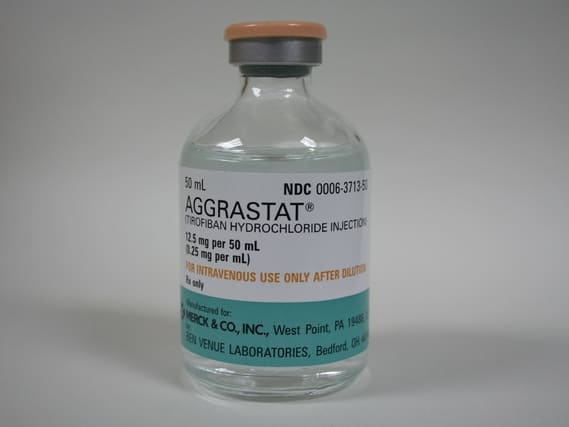

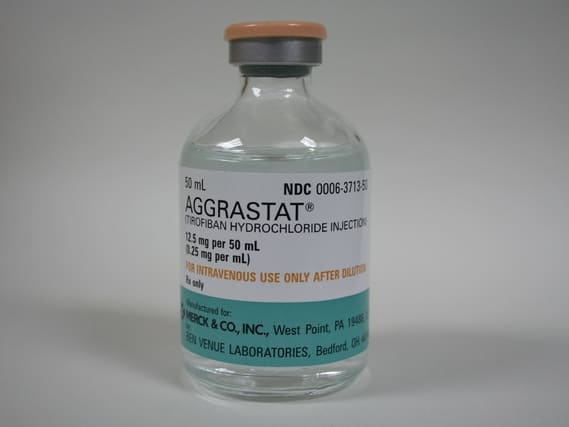

On Tuesday, specialty pharmaceutical company Cardiome announced the sale of its Canadian business portfolio to Mississauga-based Cipher Pharmaceuticals Inc. (Cipher Pharmaceuticals Stock Quote, Chart, News: TSX:CPH) for an upfront of C$25.5 million. The deal will see Cipher acquire commercial and pipeline hospital products administered in the acute care setting, including Brinavess (launched in June 2017), Aggrastat (launched in H2 2017), Xydalba (launched in November 2017) and Trevyent (expected in 2019).

For Cipher, the deal will mean establishing a new vertical with expansion into the hospitality speciality business, while for Cardiome, the extra cash will be put to good use, says William Hunter, MD, CEO and President of Cardiome.

“This transaction enables us to focus our internal resources on our rapidly growing European business and rest of world commercial initiatives, along with providing important financial flexibility for the execution of potential future business development transactions,” says Dr. Hunter in a press release. “It also allows us to secure important non-dilutive capital, while reducing our cash burn. We believe this new strategic path creates a more robust company and leaves us well positioned for long-term growth.”

Uddin recommends that shareholders vote in favour of the transaction at a special meeting scheduled for May 9, 2018.

“We believe this strategic move was very smart for several reasons: (i) CRME can now focus on growing its European and ROW business; (ii) its cash burn rate is likely to be reduced – CRME has two sales reps in Canada; (iii) the C$25.5 million upfront should provide CRME with some financial flexibility to acquire additional European products and (iv) it strengthens the company’s balance sheet. CRME may potentially in-license a legacy drug this year, which could turn CRME’s cash flow positive. CRME is working hard to in-license a drug to launch in 2019 – either an antibiotic, pain drug or an antispasmodic,” says the analyst.

Uddin has accordingly trimmed his sales estimates for CRME, now projecting FY18, FY19 and FY20 product revenues to be $28.8 million (down from $29.1 million), $43.3 million (down from $44.6 million) and $67.6 million (down from $69.5 million), respectively.

The analyst says that CRME has a favourable risk/reward profile and has been selected as one of Mackie Research’s 2018 top picks. His increased target price of $3.30 represents a projected one-year return of 110 per cent at the time of publication.