Canopy Growth Corp. and Hydropothecary are still buys, Bob McWhirter says

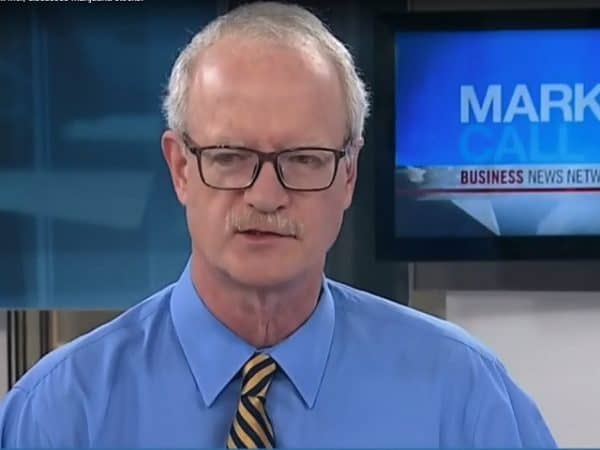

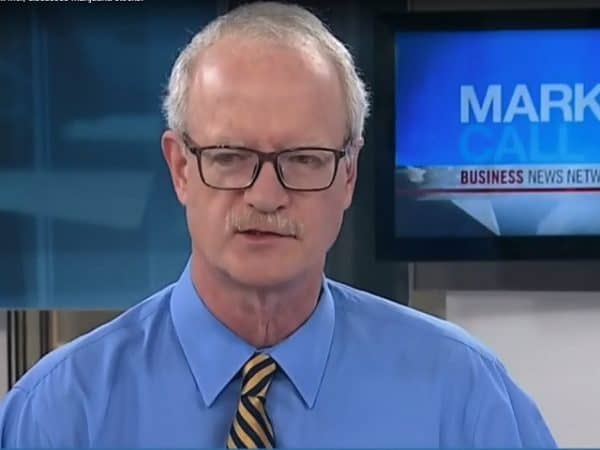

Even with all the heat in the cannabis space over the past year, there’s still some deals to be found, says Rob McWhirter, president of Selective Asset Management Inc., who points to Canopy Growth (Canopy Growth Stock Quote, Chart, News: TSX:WEED) and The Hydropothecary Corporation (The Hydropothecary Corp. Stock Quote, Chart, News: TSXV:THCX) as two still reasonably priced pot stocks.

Canada’s cannabis sector has exploded over the past year, where there are now over 80 publicly traded pot co’s with a combined market value of over $30 billion. The space had an amazing run in late December and early January, with share prices cooling off in the period since, yet valuations are still quite high, especially for an industry that has yet to sell its first gram of legal recreational product.

Many experts are saying that much of the real money in the marijuana sector has already been made, leaving investors wondering if there are any good deals left. Certainly, says McWhirter, who points to Canopy’s impressive build-up ahead of the legalization date.

“Canopy’s advantage is that they have locations in a lot of different provinces: Alberta, Ontario, Quebec and many others,” McWhirter said yesterday on BNN’s Market Call. “My guesstimate is that the total capacity they have is about 5.6 million sq. ft. either planned or underway, including a 700,000 sq. ft. greenhouse conversion in Quebec that will be expected to be in production by May of this year.”

In addition to hinting at an upcoming listing on NASDAQ, recent news from Canopy includes the signing of a supply agreement with Sunniva Inc. that will see Canopy purchase up to 90,000 kg of dried cannabis from the company’s wholly-owned Canadian subsidiary, Sunniva Medical.

“My guess is that their total square footage should allow them to produce 270,000 kg, which then becomes 270 million grams,” says McWhirter. “And at even a modest $4.00 a gram, that’s sales of $1.1 billion dollars. So, clearly a massive company in the space.”

The portfolio manager also spoke of Gatineau, Quebec’s The Hydropothercary Corp., who recently scored the largest of four supply agreements with the province of Quebec’s cannabis distributor, SAQ.

This week, THCX announced that it had chosen e-commerce company Shopify to help it sell its medical cannabis online, the second corporation to do so in recent weeks after the province of Ontario gave the nod to Shopify to sell its medical cannabis through the Ontario Cannabis Retail Corp.

McWhirter refers to a report from analyst Russell Stanley of investment company Echelon Wealth Partners, who said that THCX trades at about half the enterprise value EBITDA of 2019 compared to the larger companies, including Canopy.

“As a result, Stanley feels like the company in its own right should go up in price and it’s a potential acquisition target by the top five because it’s trading at such cheap multiples on a relative basis,” says McWhirter. “So, we’re still waiting for the actual market, come roughly September, but we think there are pretty good stocks that still seem to be reasonably priced within the space.”