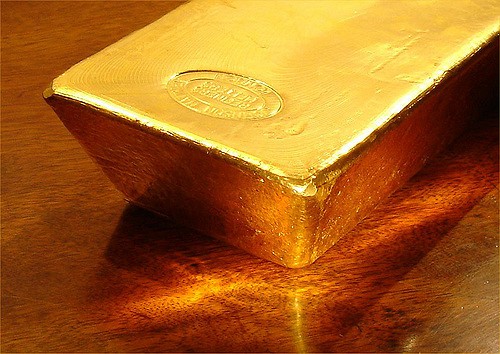

Goldmoney’s (Goldmoney Stock Quote, Chart, News: TSX:XAU) most recent quarterly results demonstrate that the company knows how to make money from crypto, Mackie Research Capital analyst Nikhil Thadani says.

Goldmoney’s (Goldmoney Stock Quote, Chart, News: TSX:XAU) most recent quarterly results demonstrate that the company knows how to make money from crypto, Mackie Research Capital analyst Nikhil Thadani says.

On Friday, Goldmoney reported its Q3, 2017 results. The company earned $4.1-million on revenue of $150.4-million.

“This was a truly fantastic quarter for Goldmoney Inc., which is the direct result of hard work and the long-term strategic planning that guides our company,” CEO Roy Sebag said. “On the operational side, we saw record gross margin for the group at $2.5-million, a near 55-per-cent increase QoQ, and the normalization of our margins on the holding line of business. While it has been widely reported that the precious metal industry has experienced a significant slowdown in sales, revenue in our precious metal businesses (holding and coins) continued to grow QoQ through the second half of CY 2018, a period of some of the lowest realized volatility in decades. I believe this can be attributed to our superior technology and trusted brand, which enables our company to continue gaining market share globally, even before the phased-in growth of new sales channels through Mene and the Goldmoney China JV to be realized in the March 31, 2018, and June 30, 2018, quarters, respectively.”

Thadani says there are a some solid reasons to own Goldmoney.

“We expect XAU stock could benefit if crypto sentiment improves as the company has already demonstrated an impressive ability to profit from crypto (unlike many newly launched & pre-product crypto and blockchain related companies),” the analyst says, “XAU’s cash allows the company to develop new products, fund the recently announced China JV open branches etc., which also enables the company to invest in enhanced customer support, expanding to new assets, renewed marketing, opening physical branches, merchant integrations. Most importantly, we expect XAU could benefit meaningfully as further details emerge on the company’s expansion into China.

In a research update to clients today, Thadani maintained his “Speculative Buy” rating and one-year price target of $8.25 a share on Goldmoney.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment