A better than expected first quarter has Paradigm Capital analyst Daniel Kim feeling expansive about Opsens Inc. (Opsens Stock Quote, Chart, News: TSX:OPS).

A better than expected first quarter has Paradigm Capital analyst Daniel Kim feeling expansive about Opsens Inc. (Opsens Stock Quote, Chart, News: TSX:OPS).

On Monday, Opsens reported its Q1, 2018 results. The company lost $936,000 on revenue of $6.36-million, a topline that was up 70 per cent over the same period last year.

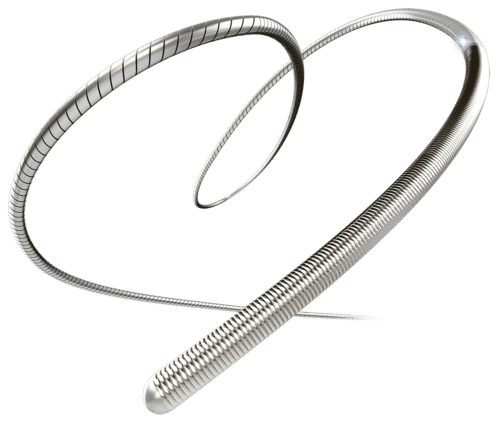

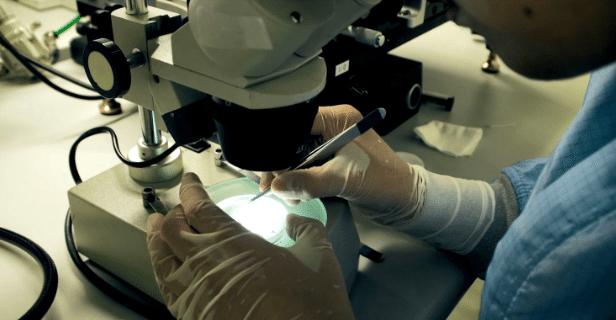

“We are convinced that the OptoWire’s distinctive features, widely recognized by industry key opinion leaders in the field of interventional cardiology, will enable us to capitalize on the fast-growing FFR market,” said CEO Louis Laflamme. We continue to focus on improving sales, production and innovation to capitalize on the FFR market.”

Kim says the quarter bested his expectations. He had modeled a topline of $5.5-million (the street consensus was $5.9-million). The analyst said things are looking up for the company.

“Opsens continues to demonstrate strong growth in its FFR business and the low market conversion to FFR gives us confidence in the business,” he says. “The U.S. is the company’s key focus for growth; we expect the U.S. sales team will grow this year which will help increase penetration across every distributor in this market. However, with a later-than-expected launch of the Gen 3, we have moderated our growth and profit expectations.”

In a research update to clients today, Kim maintained his “Buy” rating and one-year price target of $2.50 on Opsens, implying a return of 117 per cent at the time of publication, including dividend.

Kim thinks Opsens will generate EBITDA of negative $2.1-million on revenue of $23.7-million in fiscal 2018. He expects those numbers will improve to EBITDA of positive $1.8-million on a topline of $31.8-million the following year.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment