Oncolytics Biotech has 194% upside, Paradigm Capital says

Its stock has been on an extended upswing since last July, but Paradigm Capital analyst Rahul Sarugaser thinks there is plenty of upside left in Oncolytics Biotech (Oncolytics Biotech Stock quote, Chart, News: TSX:ONC).

Its stock has been on an extended upswing since last July, but Paradigm Capital analyst Rahul Sarugaser thinks there is plenty of upside left in Oncolytics Biotech (Oncolytics Biotech Stock quote, Chart, News: TSX:ONC).

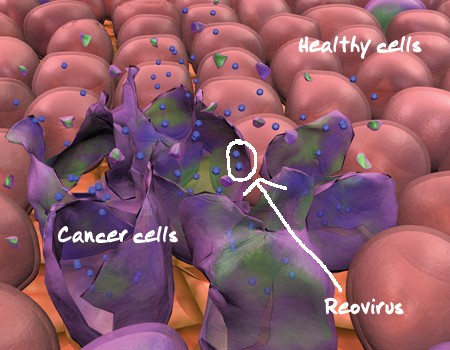

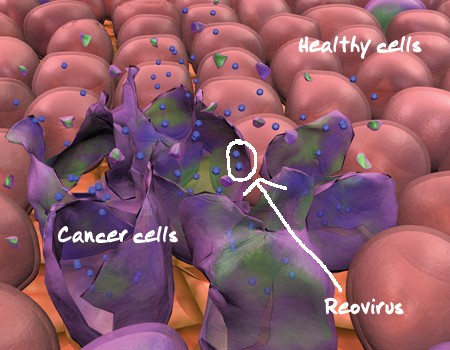

Oncolytics Biotech recently published data that demonstrated early signs that its proprietary REO drug may be effective in enabling I/O drugs to treat both pancreatic and brain cancer, which are notoriously difficult to treat diseases.

Sarugaser says there are two ways to look at what Oncolytics Biotech is worth, and thinks one of them would send its shares soaring.

“We have valued ONC based on both a top-down (comparables) and bottom-up (rNPV) analysis of the probability of REO reaching market for the treatment of metastatic breast cancer patients,” the analyst explains. “With FDA Phase III authorization imminent, we calculate a current value for ONC at $409M, or $2.47/sh (rounded to $2.50). Without a partner, we calculate a valuation of $540M ($3.25/sh) at the start of a Phase III trial; however, with a “validating” partner, our valuation escalates to >$800M ($4.80/sh). Our valuation does not take into account potential therapeutic applications in pancreatic and brain cancer, but, with further clinical data, future analyses will move toward incorporating these indications.”

In a research update to clients today, Sarugaser maintained his “Speculative Buy” rating and one-year price target of $2.50 on Oncolytics Biotech, implying a return of 194 per cent at the time of publication.

Sarugaser thinks ONC will generate EBITDA of negative $14.0-million on revenue of $5.3-million in fiscal 2017. He expects those numbers will improve to EBITDA of positive $12.1-million on a topline of $25.0-million the following year.

Nick Waddell

Founder of Cantech Letter

Cantech Letter founder and editor Nick Waddell has lived in five Canadian provinces and is proud of his country's often overlooked contributions to the world of science and technology. Waddell takes a regular shift on the Canadian media circuit, making appearances on CTV, CBC and BNN, and contributing to publications such as Canadian Business and Business Insider.