Tech startups need to start thinking more about the bottom line, this founder says

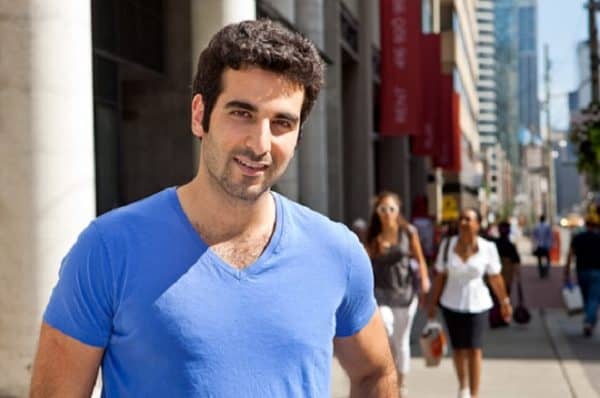

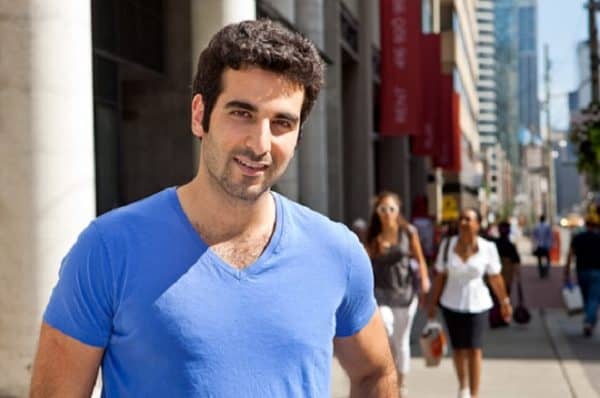

When it comes to scaling up, Emerge Commerce Inc. CEO Ghassan Halazon believes the prevailing philosophy in e-commerce is all wrong.

When it comes to scaling up, Emerge Commerce Inc. CEO Ghassan Halazon believes the prevailing philosophy in e-commerce is all wrong.

Go big or go home? No profits, no worries? It’s that very fixation on growth to the detriment of profitability which keeps loading up the tech graveyard with failed enterprises, even ones backed by plenty of capital, Halazon says.

“We’re taking a contrarian view on this,” said Halazon, who spoke with Cantech Letter about his company’s recent acquisitions.

“A lot of e-commerce companies, typically they aim to start turning a profit five to seven years out,” he says. “That’s a big problem not just because you’re so reliant on raising capital but you’re running on an unsustainable business model right from the start.”

Halazon should know. His company is making an art out of acquiring challenged but potentially undervalued e-commerce brands, dusting them off and getting them up and profitable in short order.

Only two years old, Emerge (formerly Transformational Capital) has already bought up five e-commerce companies across Canada, the UK and the US, including Shop.ca, Buytopia and its latest acquisition, staycation and online deal community Wagjag.com.

Halazon says that Wagjag’s one million-strong member base (most of whom are in the Greater Toronto Area) adds to Emerge’s combined portfolio of now four million members, and it’s that collaborative effort — five brands sharing the same infrastructure, the same member base — which allows him to keep costs down while still reaching out to more and more customers.

Call it the strength in numbers approach to staying profitable in the cutthroat online retail market.

In Canada, that scene has been witness to some major collapses of late. Companies like Shoes.com, BuildDirect and Beyond the Rack have all met their demise over the past year, underlining how tough scaling up can be for even well-financed companies.

Halazon says the carnage is a signal that profitability from the ground up needs to be more of a priority in the industry. “If you look at the brands we’ve acquired, each of these companies had unsustainable businesses,” he says. “Shop.ca had raised $72 million in the four years prior to our acquisition, for example, and they burned through it all.”

Halazon says, “When we acquired Shop.ca, we were essentially able to turn it into a break-even, cash flow positive business in our first year, simply because we were able to plug it into an infrastructure and a playbook that had group benefits. We now have four brands that share office space, they all share email costs, fraud prevention, hosting — the cost base is much lower,” he says.

Does this mean that small- and mid-market companies can thrive without needing to get bigger? Not exactly, says Halazon.

“We believe scale is still very important but instead of saying that we need to scale to a billion dollars a year in sales right away and then worry about profitability, we’re saying we’re going to be profitable as we scale up,” he says.

“In terms of e-commerce,” Halazon says, “I think a lot of the emphasis in the earlier years on building up hype and raising money, that’s starting to shift. People now realize the importance of a successful model, especially as markets get more challenging.”