A new acquisition has Laurentian Bank Securities analyst Nick Agostino feeling bullish about Solium Capital (Solium Capital Stock Quote, Chart, News: TSX:SUM).

A new acquisition has Laurentian Bank Securities analyst Nick Agostino feeling bullish about Solium Capital (Solium Capital Stock Quote, Chart, News: TSX:SUM).

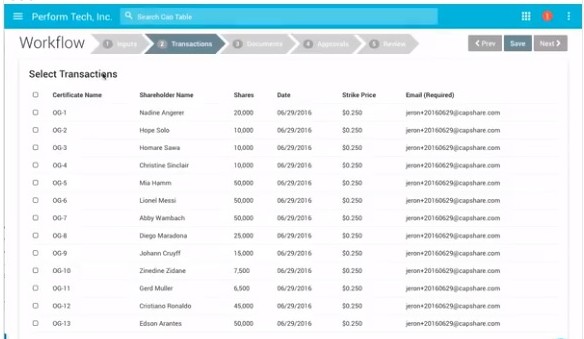

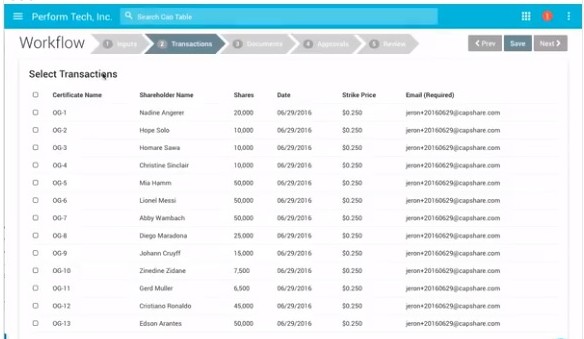

On Tuesday, Solium Capital announced that it had acquired Capshare, which it described as a “a high-growth cloud platform for cap-table management, electronic-share tracking, modelling and waterfall analysis, and compliance for private companies.”

“Capshare has built an incredible product for early-stage companies that enables them to service their target audience better than any other company in the market,” said Solium CEI Marcos Lopez. “Together with Solium’s Shareworks platform, we are now able to bring the best technology and service to companies from inception through [initial public offering].”

Agostino says this acquistion is remininscent of previous private market transcations Solium has done.

“We view the acquisition as consistent with Solium’s strategy to increase its large share in the private market, and believe it fits the company’s North American strategy of simultaneously tackling the market from both the public and private ends,” the analyst says. “We note that SUM made three acquisitions in the private market in 2012. We view this transaction as complementary given Solium’s aim to acquire, grow, and scale with fastgrowing private customers, subsequently benefiting as these companies increase their product usage and add employees. Ultimately, some of these customers may move through an IPO process at which time the company can further drive increased revenue per user. Solium aims to maintain Capshare as an independent operating entity with its existing management team, but will invest in its development and expects that as they grow, Capshare’s customers will transition to the higher-revenue Shareworks platform.”

In a research update to clients today, Agostino reiterated his “Buy” rating on Solium Capital, but raised his one-year price target from $11.75 to $12.75, implying a return of 16 per cent at the time of publication.

Agostino thinks Solium will generate EBITDA of $10.5-million on revenue of $88.7-million in fiscal 2017. He expects those numbers will improve to EBITDA of $16.3-million on a topline of $111.1-million the following year.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment