New data from Oncolytics Biotech (Oncolytics Stock Quote, Chart, News: TSX:ONC) has Paradigm Capital analyst Rahul Sarugaser feeling more bullish about the stock.

New data from Oncolytics Biotech (Oncolytics Stock Quote, Chart, News: TSX:ONC) has Paradigm Capital analyst Rahul Sarugaser feeling more bullish about the stock.

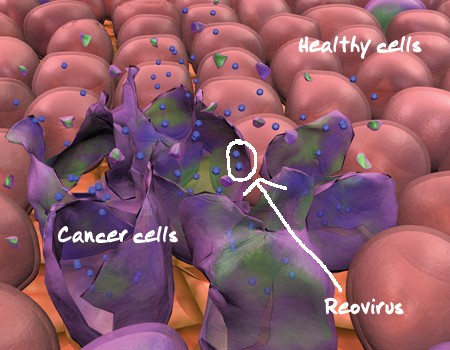

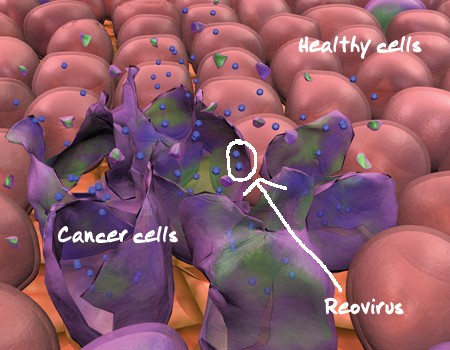

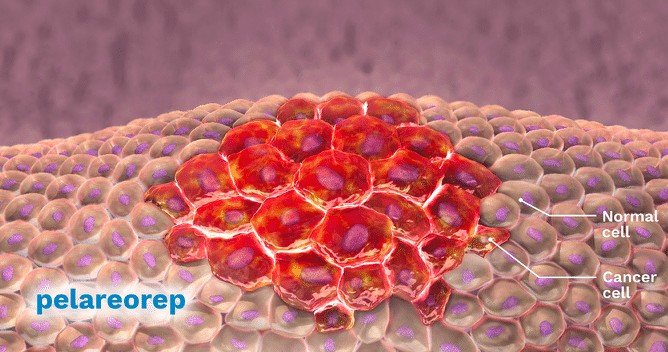

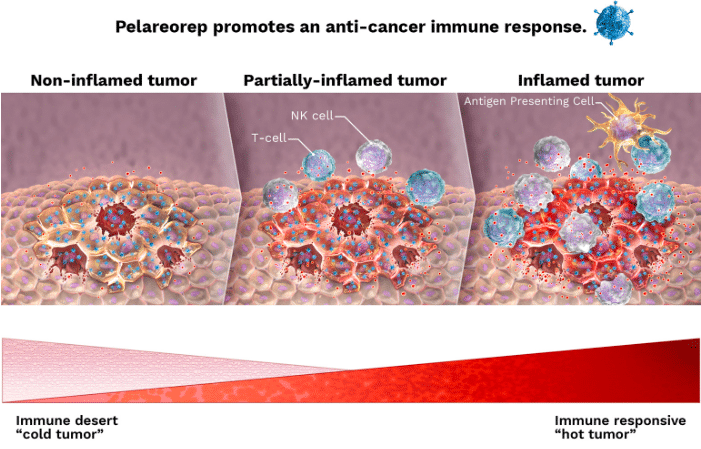

Yesterday, in Madrid, Oncolytics Biotech presented sub-group data from its Phase II trial testing REOLYSIN in metastatic breast cancer patients at the European Society for Medical Oncology (ESMO). The company revealed that, of the 74 patients in its intention to treat group, 47 were human epidermal growth factor receptor 2 negative and hormone receptor positive. Within this sub-group of HER2(-)/HR(+) patients, treatment with REO resulted in a doubling of survival from 10.8 months to 21.8 months, with a p-value of 0.003.

Sarugaser says this means REOLYSIN, in his mind, has a much higher chance of success.

“We had previously valued ONC based on both a top-down (comparables) and bottomup (rNPV) analysis of the probability of REO reaching market for the treatment of metastatic breast cancer patients,” the analyst explains. “With an extension of survival from 10.4 months to 17.4 months, and a p-value of 0.1 in the ITT group, we determined that the relative risk of REO reaching market was 4x higher (10.5% probability of success in Phase III) than the average breast cancer drug asset (42% probability of success in Phase III). With this newly presented data however, we have narrowed our estimate of the addressable patient population to only HER(-)/HR(+) patients, which represent 43% of all metastatic breast cancer patients. At the same time, we have removed our 4x higher risk weighting, and applied the average probability of success (42% probability of success in Phase III).”

In a research update to clients today, Sarugaser maintained his “Speculative Buy” rating on Oncolytics Biotech, but raised his one-year price target on the stock from $1.50 to $2.50, implying a return of 355 per cent at the time of publication.

Sarugaser thinks ONC will post EBITDA of negative $13.6-million on revenue of zero in fiscal 2017. He expects those numbers will improve to EBITDA of positive $12.1-million on a topline of $25.0-million the following year.

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment