Are shares of Amazon overpriced?

Are shares of Amazon overpriced?

Across the internet these days, you can find a lot of punditry and analysis arguing that the stock has gotten way too frothy.

History has shown that companies priced to perfection provide poor future returns even when they successfully execute on their business plan.

How does one establish a reasonable valuation framework to figure out if Amazon is wildly overvalued, accurately priced, or, in fact cheap?

“It’s a great cloud leadership story and probably has some of the best fundamentals in the group. The problem is at the current price, I think it’s just a hold,” tech investor Paul Meeks said in an interview with CNBC’s “Power Lunch.”

Keep in mind that Meeks’s comments came almost a year ago, when the stock was in the $750 range. Today, it is 40 per cent more expensive, having closed Wednesday at 1052.80. Surely, the stock has gotten ahead of the company’s considerable progress by now, right?”

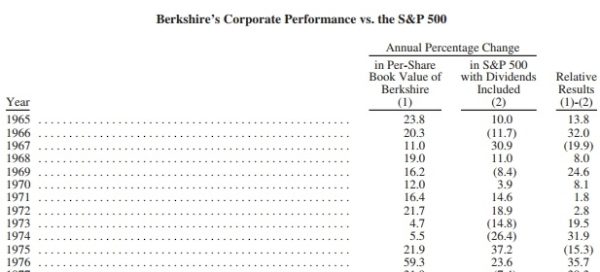

In order to get started on this problem we turned to Warren Buffett for some tips. We copied the chart that appears near the front of every Berkshire Hatahway annual report. It compares the growth in value of Berkshire to the S&P 500.

We decided to compare Amazons earnings (intrinsic value) to its stock price to see if the company’s stock was getting ahead of the fundamental performance of the company. We tried these approaches and quickly fell flat on our face –Amazon has barely any earnings! It continually re-invests its cash flows into new business ideas and report little in the way of net income.

Amazon, along with other ‘New Economy’ technology stocks, has defied traditional earnings or cash flow based valuation methodologies. It has been a bane to value investors who can’t stomach buying a stock with such a high P/E ratio, and then watch as it out-performs the market. Value investing just doesn’t work when it comes to high-flying tech stocks. Sorry, Warren.

Or does it?

When these investing methodologies were developed, most stocks were from the ‘Old Economy’. When a company wanted to invest to grow earnings it built a new production plant or opened new stores. This was capitalized on the company’s balance sheet and only showed up on the income statement in future years as depreciation. In contrast, technology companies hire workers to develop products that will endure for multiple years, yet they flow the expense through the income statement and absorb it all in year one.

What would happen if we treated Amazon’s investment into new businesses as a ‘Capital Expenditure’ instead of a ‘Technology Expense’? With this little adjustment we can get better insight into Amazon’s true value and compare it, more or less apples to apples, to the S&P 500, the same way Berkshire Hathaway does every year.

We approached Amazon as if their technology expenses were capital expenditures (like building a plant or opening a store) and depreciated them over five years.

So what happened? Well it turned out the result wasn’t funny at all. In fact, as a value investor I came away with the impression that Amazon isn’t really that expensive of a stock below. The results were stunning.

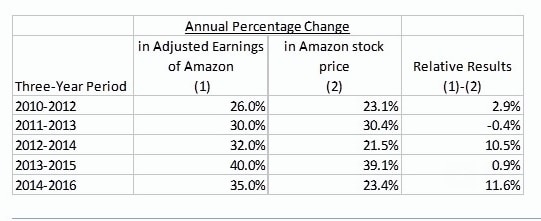

Look at the three year period ending in 2012 where Amazon grew its adjusted earnings by 26% a year and the stock price followed suit, returning 23.1 percent per year, a difference of only 2.9% per year. A similar phenomenon occurred in the next three years, ending in 2015 where the stock price appreciation over the period matched the adjusted earnings growth to within one per cent!

After converting Amazon’s ‘New Economy’ earnings into ‘Old Economy’ earning, the stock price growth closely tracked earnings over a series of three-year periods. In fact, over the last three years, the stock price growth has underperformed the earnings growth by over 10% a year, suggesting that Amazon may not be so overvalued after all.

Disclosure: Nick Waddell owns share of Amazon

Leave a Reply

You must be logged in to post a comment.

Share

Share Tweet

Tweet Share

Share

Comment