Canadian Bioceutical’s delays will be short lived, Echelon says

Filing delays for Canadian Bioceutical (Canadian Bioceutical Stock Quote, Chart, News: CSE:BCC) won’t be a long-term problem, says Echelon Wealth Management analyst Russell Stanley.

Filing delays for Canadian Bioceutical (Canadian Bioceutical Stock Quote, Chart, News: CSE:BCC) won’t be a long-term problem, says Echelon Wealth Management analyst Russell Stanley.

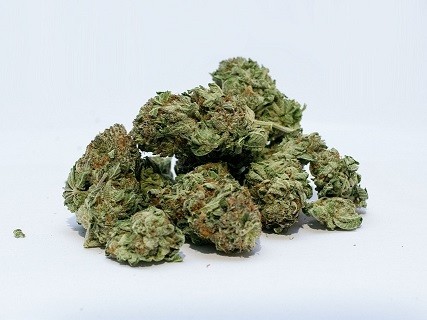

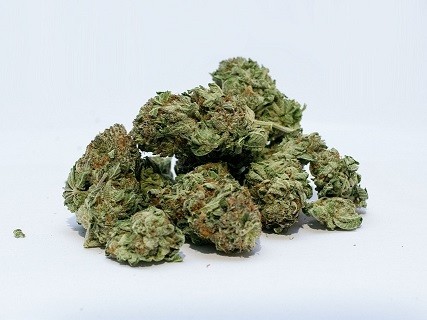

This morning, Canadian Bioceutical announced it had applied to the Ontario Securities Commission to approve a management cease trade order. The company said its inability to meet filing deadlines was due to delays from the integration of its HFL and Soothing Options acquisitions, in part due to the transition from U.S. GAAP to IFRS.

Stanley says the situation is not ideal, but thinks it will prove to be a relatively minor inconvenience.

“In late January, the Company acquired the Arizona operations for US$25M in cash and promissory notes,” the analyst explains. “The integration of those accounting and operational systems, and the conversion of processes from US GAAP to IFRS, has taken longer than management expected. Cannabis company accounting, particularly with respect to inventory, can be more complex than one would expect. We view any filing delay as negative, although in this case we expect it to be relatively short,” he adds. “We are therefore leaving our estimates and valuation unchanged at this time, and we continue to rate BCC as one of our Top Picks.”

In a research update to clients today, Stanley maintained his “Buy” rating and one-year price target of $0.65 on The Canadian Bioceutical Corp., implying a return of 81 per cent at the time of publication.

Stanley thinks Canadian Bioceutical will generate EBITDA of $4.8-million on revenue of $29.4-million in fiscal 2018. He expects those numbers will improve to EBITDA of $11.9-million on a topline of $47.9-million the following year.

Nick Waddell

Founder of Cantech Letter

Cantech Letter founder and editor Nick Waddell has lived in five Canadian provinces and is proud of his country's often overlooked contributions to the world of science and technology. Waddell takes a regular shift on the Canadian media circuit, making appearances on CTV, CBC and BNN, and contributing to publications such as Canadian Business and Business Insider.