exactEarth has too much uncertainty, says Paradigm Capital

exactEarth (exactEarth Stock Quote, Chart, News: TSX:XCT) has potential, but right now it’s a “show me” stock, says Paradigm Capital analyst Daniel Kim.

exactEarth (exactEarth Stock Quote, Chart, News: TSX:XCT) has potential, but right now it’s a “show me” stock, says Paradigm Capital analyst Daniel Kim.

Yesterday, exactEarth reported its Q2, 2017 results. The company lost $176,000 on revenue of $3.7-million, a topline that was down per cent from the $5.22-million in revenue the company posted in the same period a year prior.

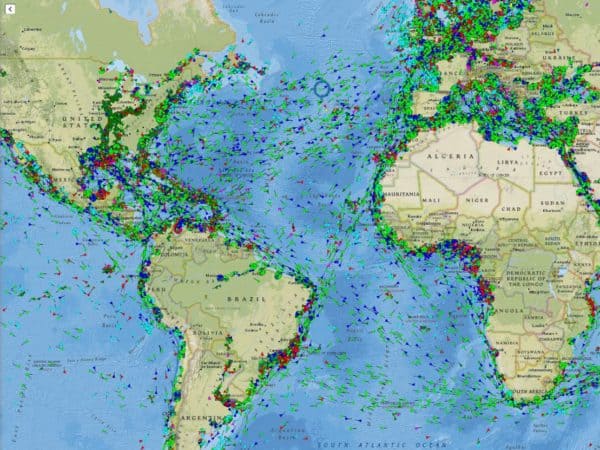

“Our order book was up again in Q2, led by a large renewal agreement with a key commercial customer and more than 30 new orders,” said CEO Peter Mabson. “We continue to build our sales pipeline in both the government and commercial markets while maintaining a close eye on expenses throughout the organization. The major milestone on our horizon, which we expect will further boost our pipeline opportunities, is achieving real-time global vessel tracking via our second-generation satellite constellation service, exactView RT. exactView RT is a system of more than 60 maritime satellite payloads, being deployed under our strategic agreement with Harris Corp., which is hosted on board the Iridium NEXT satellite constellation. Subsequent to quarter-end, we officially launched the exactView RT service with four satellite payloads now providing global real-time Satellite AIS (automatic identification system) data feeds alongside our first-generation constellation. With additional Iridium NEXT launches scheduled for 2017, the pace with which we are moving towards a continuous real-time vessel tracking capability is expected to accelerate through the remainder of the year.”

Kim says exactEarth’s results were in-line with his expectations. But the analyst says the company’s future rests on exactViewRT, the company’s real-time advanced ship tracking solution, and there is simply not enough information about that yet.

“We believe shares will remain range-bound until we see substantive evidence of what premium customers are willing to pay for real-time S-AIS data,” says the analyst.

In a research update to clients today, Kim maintained his “Hold” rating and one-year price target of $1.35 on exactEarth, implying a return of 3.8 per cent at the time of publication, including dividend.

Kin thinks exactEarth will post Adjusted EBITDA of negative $2.3-million on revenue of $14.4-million in fiscal 2017. He expects those numbers will improve to EBITDA of zero on a topline of $17.7-million the following year.

Nick Waddell

Founder of Cantech Letter

Cantech Letter founder and editor Nick Waddell has lived in five Canadian provinces and is proud of his country's often overlooked contributions to the world of science and technology. Waddell takes a regular shift on the Canadian media circuit, making appearances on CTV, CBC and BNN, and contributing to publications such as Canadian Business and Business Insider.