Stay away from Concordia International, says Canaccord Genuity

Investors should avoid Concordia International (Concordia International Stock Quote, Chart, News: TSX:CXR, Nasdaq:CXRX) because it is facing strong headwinds, says Canaccord Genuity analyst Neil Maruoka.

Investors should avoid Concordia International (Concordia International Stock Quote, Chart, News: TSX:CXR, Nasdaq:CXRX) because it is facing strong headwinds, says Canaccord Genuity analyst Neil Maruoka.

Last Wednesday, Concordia reported its Q1, 2017 results. The company lost (U.S.) $78.82-million on revenue of $160.6-million, a topline that was down per cent from the $228.5-million the company posted in the same period a year prior.

“Concordia’s first quarter 2017 results demonstrate that the company’s focus on near-term stabilization is beginning to have a positive impact on the business,” said CEO Allan Oberman. “While the first quarter is only the beginning of an ongoing process, I believe we are making important headway against our business stabilization objectives. To that end, we are excited about the recent announcements that David Price will be joining Concordia as chief financial officer and that Itzhak Krinsky and Frank Perier Jr. have joined our board of directors. These individuals possess significant experience that we believe will help Concordia make progress against our stated goals over the remainder of the fiscal year, and beyond, as we focus on Concordia’s longer-term growth.”

Maruoka notes that Concordia’s Q1 results came in below both his and the street’s expectations. The analyst, who today maintained his “Sell” rating and one-year price target of (U.S.) $1.00 on the stock says the outlook is grim.

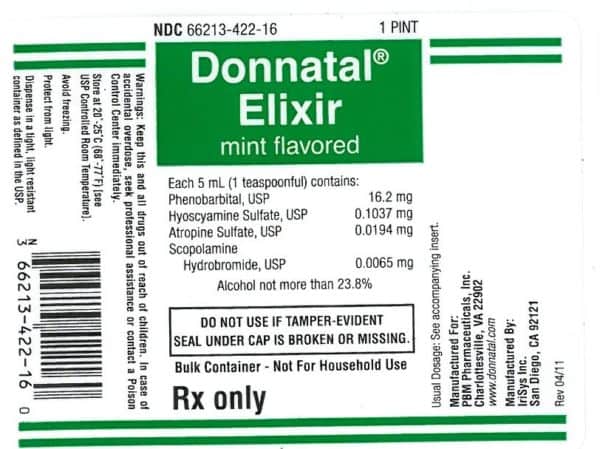

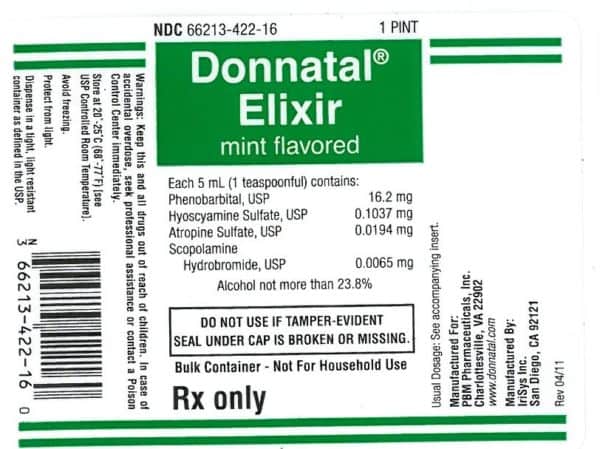

“Consistent with our SELL rating, we do not foresee any near-term fundamental catalysts that could turn the page for Concordia, he says. “Nonetheless, management continues to work to stabilize the business through 2017. Given Concordia’s high debt load and eroding performance, we currently see only limited value in the equity of the company. Although we had expected the company’s key US products, such as Donnatal, to see declining volumes in Q1, our forecasts had not captured the full impact of increased generic competition. In addition, the GBP F/X rate continues to weigh on the company’s international segment’s Q1 sales, which was not to our surprise. With continuing weakness in both the North American and International segments, we have lowered our forecasts for the remaining quarters.”

Maruoka thinks Concordia will post EBITDA of $353.5-million on revenue of $667.7-million in fiscal 2017. He expects these numbers will improve to EBITDA of $375.3-million on a topline of $675-million the following year.

Nick Waddell

Founder of Cantech Letter

Cantech Letter founder and editor Nick Waddell has lived in five Canadian provinces and is proud of his country's often overlooked contributions to the world of science and technology. Waddell takes a regular shift on the Canadian media circuit, making appearances on CTV, CBC and BNN, and contributing to publications such as Canadian Business and Business Insider.