Buy OrganiGram on weaknesss, says Canaccord Genuity

A pullback in shares of OrganiGram (OrganiGram Stock Quote, Chart, News: TSV:OGI) creates for a compelling entry point for investors, says Canaccord Genuity analyst Neil Maruoka.

A pullback in shares of OrganiGram (OrganiGram Stock Quote, Chart, News: TSV:OGI) creates for a compelling entry point for investors, says Canaccord Genuity analyst Neil Maruoka.

In a research report to clients Monday, Maruoka initiated coverage of OrganiGram with a “Buy” rating and a one-year price target of $3.25.

The analyst says OrganiGram’s recent stumble is a relatively minor bump in the road that has left it undevalued compared to its peers.

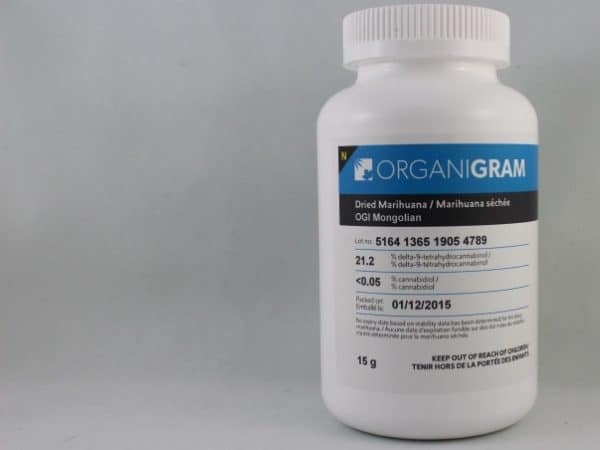

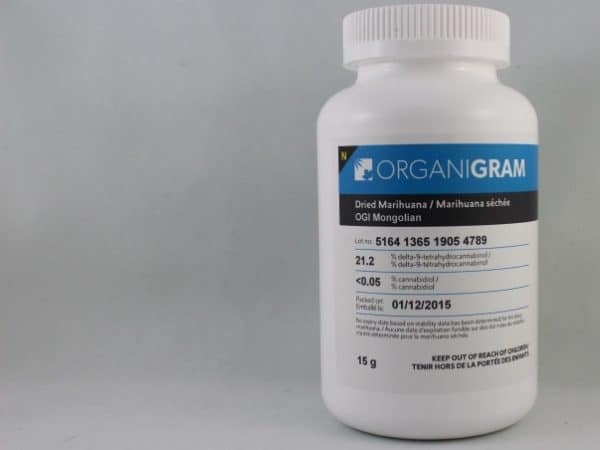

“After announcing a sizable product recall and a pending lawsuit following discovery of a pesticide not approved by Health Canada, OrganiGram has seen its share price trade down ~18% thus far in 2017 (vs. its peer group, which is +15% YTD). However, we believe the company still lines up nicely to many of its peers with a 5x facility expansion currently underway and a leading oil/extract strategy,” notes the analyst. “At its current valuation, we believe these recent troubles could serve as a compelling entry point as the company takes remedial action to safeguard its production practices and looks to repair its reputation and reinstate its Ecocert certification.”

Maruoka says OrganiGram has a number of advantages, including a good relationship with TGS, a leader in cannabis cultivation and extraction, a “prime location for low-cost indoor cultivation” in New Brunswick location, aggressive expansion plans, and the potential upside from the recreational market.

Maruoka thinks OrganiGram will generate EBITDA of $1.2-million on revenue of $10-million in fiscal 2017. He expects these numbers will improve to EBITDA of $12.2-million on a topline of $36-million the following year.

At press time, shares of OrganiGram were down 1.7 per cent to $2.34.

Nick Waddell

Founder of Cantech Letter

Cantech Letter founder and editor Nick Waddell has lived in five Canadian provinces and is proud of his country's often overlooked contributions to the world of science and technology. Waddell takes a regular shift on the Canadian media circuit, making appearances on CTV, CBC and BNN, and contributing to publications such as Canadian Business and Business Insider.