Relay Ventures raises US$150 million third mobile technology fund

Toronto early stage venture capital firm Relay Ventures has announced a new US$150 million (C$200 million) venture capital fund, Relay Ventures III, focused exclusively on mobile software, services, technology and content.

Toronto early stage venture capital firm Relay Ventures has announced a new US$150 million (C$200 million) venture capital fund, Relay Ventures III, focused exclusively on mobile software, services, technology and content.

Limited Partners in the new fund include Northleaf Capital Partners, Kensington Capital Partners, Generation Capital, La Caisse de dépôt et placement du Québec, EDC, AEC, and Royal Bank of Canada.

“Canada has extremely talented entrepreneurs and best-in-class start-ups,” said Kevin Talbot, co-founder and managing partner of Relay Ventures. “And while not every company has to be located in Silicon Valley, we believe that Silicon Valley needs to be in every start-up. This is Relay’s differentiation, the rationale behind our full-time team in Silicon Valley, and why our entrepreneurs describe us as a top tier venture investor. It’s an anchor in our strategy that will continue with this new fund.”

Relay Ventures has already invested in 12 startups through the fund, including: Kelowna-based FreshGrade, which provides classroom communication and assessments for K-12 education; 7shifts, a Saskatoon-based startup that provides workforce scheduling solutions for the restaurant industry; Automat.ai, an artificial intelligence (AI) messaging and bot company based in Montreal; Carrot Insights, a wellness rewards and loyalty startup in Toronto; Kwik Commerce, the Sunnyvale and Tel Aviv-based one-touch commerce company; and UJet, a next generation mobile-first customer service technology company based in San Francisco.

“We are humbled by the support and calibre of the LPs in our new fund, the overwhelming majority of which are returning investors,” said John Albright, co-founder and managing partner of Relay Ventures. “We have a proven track record and a differentiated investment strategy focused exclusively on mobile – the largest man-made platform in history. The opportunity this rapidly growing market represents for both our investors and entrepreneurs is significant.”

With an office in Menlo Park, California, Relay Ventures is the most active Canadian software investor in the United States, with C$670 million under management, and the only Canadian venture capital fund with a permanent presence in the San Francisco Bay area.

With Relay Ventures’ exclusive focus on mobile technology, one out of two smartphones in the world today run software developed by Relay portfolio companies invested in over the last eight years.

Since its inception, Relay Ventures has invested C$355 million into 76 companies, 24 of which have exited, that have collectively raised over C$1.3B and employ 3,398 people.

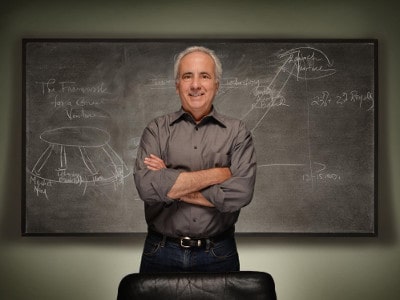

In May, Relay Ventures appointed Norman Winarsky, former president of SRI Ventures, as its first Executive-in-Residence in its Menlo Park office, acting as an advisor to its portfolio companies and assisting the firm’s investment team with the due diligence process.

SRI Ventures is part of SRI International, an independent, nonprofit research center which resulted in the development of more than 60 ventures worth over $25 billion, including Nuance, Intuitive Surgical and Siri, and was also co-founder and board member of Siri, the virtual assistant that was eventually sold to Apple in April 2010.

Originally founded in 2008 as Blackberry Partners Fund, Relay Ventures has raised several funds, all with a focus on investment opportunities in the information and communication technologies sector.

Terry Dawes

Writer