Cisco and MEMEX Partner to Win the Secure IIoT Market

This report was adapted by Cantech Letter from a piece prepared by Sophic Capital. For the original report, and more in-depth research, please visit Sophic Capital’s website, here.

This report was adapted by Cantech Letter from a piece prepared by Sophic Capital. For the original report, and more in-depth research, please visit Sophic Capital’s website, here.

Kicking Some Digital Ass in Las Vegas

99% of manufacturing machine data is trapped inside the machines. Real-time machine data is essentially non-existent because manufacturers fear security breaches in a networked machine environment. Unlocking this data via secure networks and allowing overall equipment effectiveness (OEE) analysis would weed out invisible and expensive inefficiencies.

This issue was at the forefront of IIoT experts in the Connected Machines pavilion at Cisco Live, Cisco’s annual technology conference. We saw Cisco’s secure network solution for manufacturing environments, which was exhibited with partner MEMEX’s Manufacturing Operations Management System platform. Mass adoption of using real-time, machine data analytics to create business outcomes is beginning, and MEMEX (a Sophic Capital client) is positioned to become the industry leader.

Why You Need to Read this Report

- Learn how MEMEX Inc., a Sophic Capital client, and Cisco are addressing the Industrial Internet of Things (IIoT) market;

- We present a real use case of the Cisco/MEMEX relationship, and;

- Discover how big the long-term IIoT market opportunity could be – hint: not “billions” but “trillions”.

Executive Summary

Most manufacturing facilities suffer inefficiencies because they refuse to network their machines to allow real-time machine monitoring. Security concerns are the reason for this reluctance; a hacker could steal sensitive machine/manufacturing information or disrupt the machines themselves. Without connected machines, applications cannot access machine data to extract information that can weed out costly inefficiencies.

Cisco, which provides equipment and services to 60% of the world’s networks, has created the IE4000, an industrial Ethernet switch that allows limited access to machine data. Cisco built these switches to deliver secure network access in the most extreme environments. However, it needed a solution to deliver its value proposition to manufacturers – a way to analyze machine data to weed out manufacturing inefficiencies.

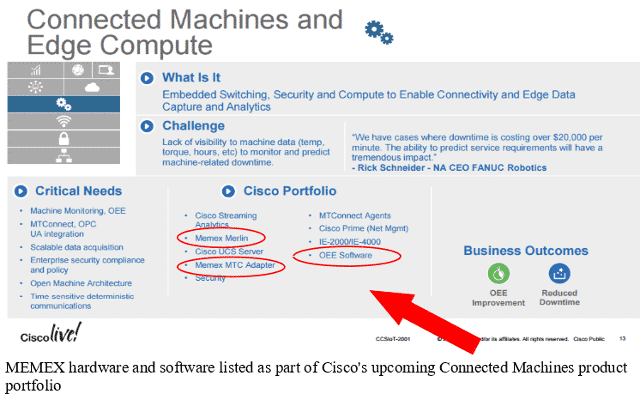

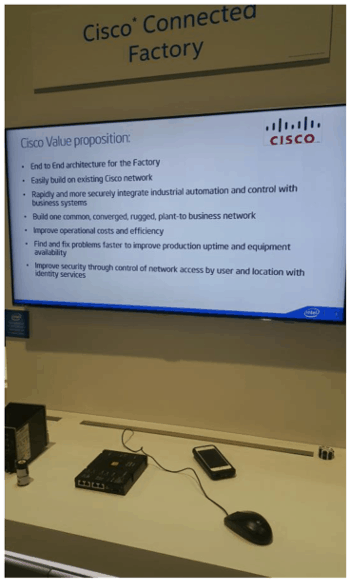

Improving operational costs and efficiency in manufacturing environments is part of Cisco’s value proposition. At Cisco Live, Cisco’s technology conference which occurred from July 10 through 14, Cisco revealed in presentations that MEMEX’s (OEE:TSXV) MERLIN Manufacturing Operations Management System platform would be part of its Connected Machines portfolio of solutions. A key component of Cisco’s value proposition is that MERLIN facilitates the real-time calculation of Overall Equipment Effectiveness (OEE), a critical manufacturing metric that is the product of machine availability, performance, and quality. Validated in over 100 manufacturing facilities, MERLIN-installed shop floors have seen an average 300% internal rate of return and payback in 4 months or less.

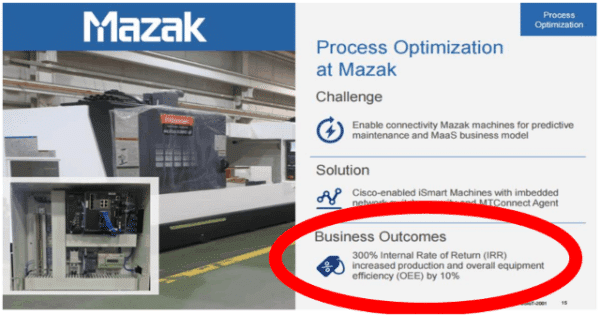

A use case of the Cisco / MEMEX relationship occurred when Mazak USA, one of the world’s largest machine tool and systems OEMs, announced SmartBox, an Industrial Internet of Things (IIoT) platform that incorporates Cisco’s IE4000 switch and MEMEX’s OEE solution. SmartBox provides real-time visibility and insights into factory floor data, process control, and operation monitoring.

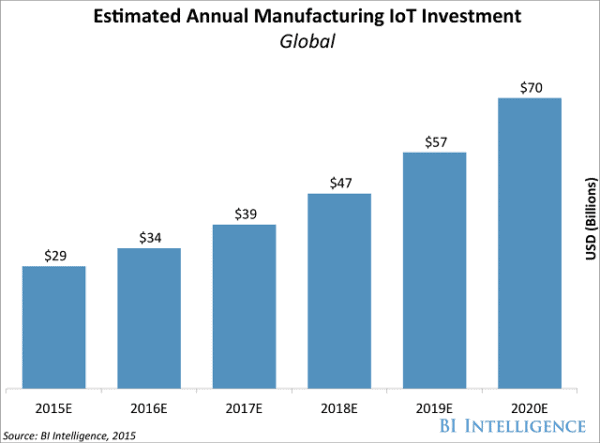

General Electric forecasts that IIoT investment could exceed $60 trillion over the next 15 years. Business Insider sees manufacturing IoT growing from $29 billion in 2015 to $70 billion by 2020. MarketsandMarkets see a $74.8 billion smart factory (digitized shop floors implementing technologies to parse inefficiencies, product defects, and downtime) market by 2020.

Investors seeking a pure-play IIoT company should consider MEMEX Inc. (OEE-TSXV), a Sophic Capital client, because:

-

large customer deployments and strategic partnerships confirm technology leadership;

-

large greenfield opportunity of manufacturers worth hundreds of millions of dollars along I-95;

-

revenue and financial metrics point to growth beginning to accelerate;

-

large insider ownership of ~44% leading to financing decisions that are aligned with shareholders, and;

Introduction

Most manufacturing facilities have hidden machines and plants waiting to be uncovered. Even some plants with the most modern machines suffer inefficiencies because real-time machine monitoring doesn’t extend beyond walking up to a machine and observing what it’s doing. Few machine monitoring applications exist, but due to data security concerns, most factories have refused to network their machines in the past and deploy these standalone and cloud-based applications.

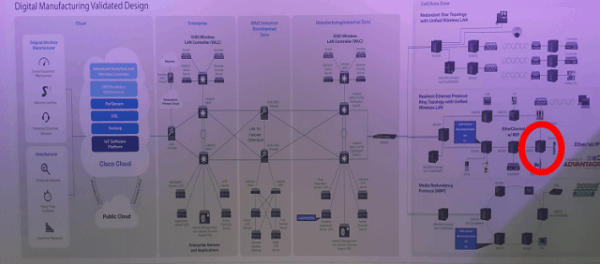

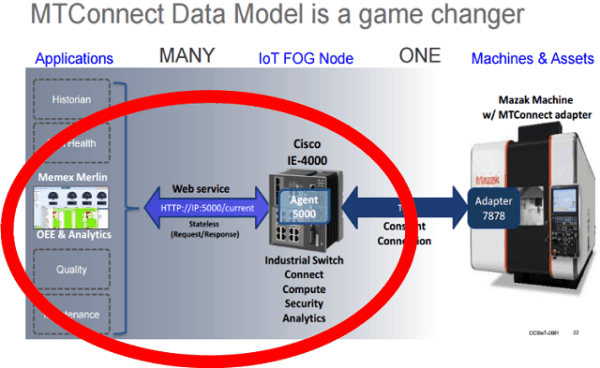

Fortunately, Cisco (CSCO:NASDAQ) has created the IE4000, a secure switch allowing limited access to machine data, and has partnered with MEMEX for its MERLIN, a Manufacturing Operations Management System (MOMS) platform that measures Overall Equipment Effectiveness (OEE), a critical manufacturing metric. Cisco invited MEMEX to present MERLIN at the Connected Machines pavilion at Cisco Live, Cisco’s annual technology conference, which took place from July 10th-14th. Sophic Capital attended the conference to speak with IIoT experts about Cisco and MEMEX. Based upon the diagram below, which Cisco presented at Cisco Live, it appears as though Cisco will be going to the IIoT market with MEMEX’s MERLIN at the forefront of its manufacturing solutions portfolio.

Cisco’s CEO Keynote at Cisco Live Conference

Cisco Live is Cisco’s premier education and training event for IT professionals. The conference hosts on-demand training focused on Cisco products, solutions and services, technical breakout sessions, and an exposition hall of Cisco-powered solutions. One of the conference’s themes was IoT’s influence on manufacturing – IIoT. Cisco presented connected machine solutions for data-driven manufacturing that optimizes factory floor performance.

Cisco Live is Cisco’s premier education and training event for IT professionals. The conference hosts on-demand training focused on Cisco products, solutions and services, technical breakout sessions, and an exposition hall of Cisco-powered solutions. One of the conference’s themes was IoT’s influence on manufacturing – IIoT. Cisco presented connected machine solutions for data-driven manufacturing that optimizes factory floor performance.

Security! Security! Security! Cisco CEO Chuck Robbins opened Cisco Live with a keynote speech detailing Cisco’s vision of how technology will change. In the past, technology was an afterthought for enterprises. Now, technology is a strategy to realize corporate goals. Data and network security are at the forefront of concerns that technology must address, and this was a recurring theme across Cisco’s business segments. Security must be easy to manage and consistent across enterprises to minimize breaches. For example, many IT departments are unaware that their security, data, and access policies are inconsistent within the enterprise. These inconsistencies represent potential points to hack – not necessarily at the nodes but at points internal to the network.

Cisco Recognizes the IIoT Opportunity at Cisco Live

Cisco’s IE4000 industrial, Ethernet switch was featured prominently at Cisco Live as a Smart Factory solution. The switches are built to withstand extreme environments while adhering to overall IT network design, compliance, and performance requirements. Most important, the IE4000 delivers secure network access, solving the data security concerns that had been preventing manufacturers from networking their machines to extract real-time data.

To solidify IIoT network security in manufacturing environments, Cisco strengthened its identity services engine (ISE). Cisco’s ISE creates and enforces security and accessibility for network endpoints. In a factory, for example, the ISE controls who has access to specific machines and computers; it even controls who has access to applications. This is one step to alleviate data security concerns expressed by manufacturers, which has been the main reason behind delaying the adoption of IIoT solutions.

And to make machine connectivity more convenient, Cisco has a mobile network solution. On February 3, 2016, Cisco announced the acquisition of Jasper Technologies for $1.4 billion in cash and equity awards. Jasper’s platform allows companies to connect to any device via cellular networks and manage those connections through its Software as a Service (SaaS) solution. The net result for manufacturers is ease of accessibility. For example, a shop floor manager could be offsite and receive secure, real-time reports about what’s going on with their machines. MEMEX’s MERLIN reads secure machine data and displays OEE metrics

Cisco Addresses IIoT Data Security Concerns

According to a Cisco Connected Manufacturing representative, there are 65 million machines around the world. The average age of a machine is 15 years old. Ninety percent of these machines are unconnected – that’s 58.5 million machines whose performance isn’t being monitored in real-time. That’s 58.5 million machines that aren’t optimized for production and therefore burning money. Those are machines that have no way to predict a downtime event. And when those machines have unscheduled downtime, the entire supply chain suffers, especially in just-in-time inventory environments where delays cascade through the supply chain. The Cisco representative said that these machines aren’t networked primarily because of security concerns.

Cisco’s IE4000 switch secures machine data access. Referring to Exhibit 1, Cisco’s IE4000 (circled in red) sends the data to the enterprise’s server then out to the cloud (far left). MEMEX’s MERLIN accesses the machine’s secure data via the IE4000, analyzes that data, and outputs OEE to a terminal dashboard (right picture).

MEMEX is Cisco’s Operational Efficiency Value Proposition

Improving operational costs and efficiency in manufacturing environments is part of Cisco’s value proposition (right picture). To achieve this, Cisco has chosen MEMEX’s (OEE:TSXV) MERLIN MOMS platform as part of Cisco’s manufacturing solutions portfolio (Exhibit 2).

Validated in over 100 manufacturing facilities, MERLIN essentially makes every shop floor machine a node on the enterprise network. By monitoring production as it happens in real-time, companies can increase their productivity by reducing downtime between jobs. Leading manufacturers purchasing MEMEX’s MERLIN are seeing unbelievable returns: an average Internal Rate of Return of 300%, which means payback in 4 months or less. And MEMEX has the executive team to become the leader in improving operational costs and efficiency:

MEMEX’s CTO Dave Edstrom was the co-founder of the MTConnect standard, an open-source communications protocol that is becoming the de facto communication protocol for machine data (an MTConnect agent resides within Cisco’s IE4000). He was also the former President and Chairman of the MTConnect Institute. Mr. Edstrom is not the only expert at MEMEX with MTConnect expertise: President and Chief Executive Officer Dave McPhail co-chaired the MTConnect Legacy machine tool connectivity working group. He also developed and released the “Getting Started With MTConnect: Connectivity Guide” to specifically address the real-world questions raised when considering the implementation of MTConnect in shops or plants.

Management, directorship, and insiders are also aligned with shareholders as they collectively own ~44% of the Company. Their financing decisions are also aligned with all shareholders; recently, management and directors exercised out of the money options to pay back a loan, resulting in a reduction of long-term payments by the Company and increasing shareholder value.

An Important Use Case of the Cisco/MEMEX Relationship

On October 15, 2015, Mazak USA (private), one of the world’s largest machine tool and systems OEMs, announced an IIoT platform called SmartBox that incorporates MEMEX’s MERLIN MTConnect compliant hardware adapter, dashboard and analytical software and Cisco’s Industrial Ethernet IE4000 switch. SmartBox provides real-time visibility and insights into factory floor data, process control, and operation monitoring. It builds upon Mazak’s iSMART Factory concept, which uses advanced manufacturing cells and systems, MTConnect, and full digital integration. The picture to the right shows a SmartBox reading data from a Mazak machine. The Cisco IE4000 switch embedded within SmartBox makes the data available to authorized applications including MEMEX’s MERLIN.

According to a Cisco network engineer at Cisco Live, Cisco’s solutions and services drive over 60% of the world’s networks. Manufacturers are receptive to SmartBox due to Cisco’s strong association with network security. A Mazak spokesperson told us that manufacturers have hesitated to network shop floor machines due to fears of hacking, malware, and data theft1. SmartBox addresses these concerns, and the challenge for Mazak is to build the business case that SmartBox provides a large return on investment.

For example, machine downtime is critical, and one Cisco presenter noted that a Detroit auto-manufacturer charges one machine OEM $22,000 per minute of unscheduled downtime. In such a case, MEMEX’s MERLIN could have secured machine data via Cisco’s IE4000 switch and monitored OEE to reduce unscheduled machine downtime, resulting in savings far beyond the cost of SmartBox. The number of potential business outcomes due to secure, real-time machine data access enables factories to weed out the smallest inefficiencies and unlock hidden machines, assembly lines, and even entire plants.

One Mazak representative shared his vision of how SmartBox would evolve. He stated that Mazak would likely integrate SmartBox into Mazak’s family of machine tools, likely within 4 years. This doesn’t mean that the current, standalone SmartBox would become obsolete. In fact, we believe the market for the standalone SmartBox is larger since most of the 65 million machines out there don’t have integrated network access features.

We spoke with Mazak representatives. They noted that they first became aware of MEMEX when they saw hardware MEMEX used to read data from older Mazak machines. The Mazak folks like MERLIN because it works, and when we asked if other companies had OEE analytical platforms similar to MERLIN, they said “yes” but could not think of any competitor names. MEMEX’s MERLIN may not be the only MOMS platform on the market, but we believe its first mover status, management expertise, and industry-leading partners position the Company to capture significant share in a market whose growth is expected to accelerate.

Potential Upside for MEMEX

With Security Comes the Cloud

Overcoming manufacturers’ data security concerns opens the possibility to new services previously not available. Cloud services could allow easy access to business outcome modules, software updates, and data analytics. For example, cloud services could remotely monitor machines for OEE and health. Manufacturers could also analyze the secure data to decide when to schedule machine downtime for maintenance or to tie factory performance to the income statement. Preventative maintenance could be scheduled in advance of an unintended event occurring. And with remote monitoring, less field support and employees are required, resulting in further cost savings for smart factories.

MERLIN MOMS platform could become a Cisco cloud service, transitioning MEMEX into a big data analytics company – possibly an industry standard. Hosting a solution on Cisco’s cloud could transform MEMEX into a data analytics play. It took MEMEX five years to become a Cisco partner. As we wrote earlier, it appears as though Cisco is moving towards making MEMEX a permanent Connected Machines solution. Cisco lists MEMEX as part of its portfolio, meaning MEMEX is the application and value proposition best suited to “pull” MTConnect compliant secure factory floor networking into the sphere of manufacturing. If the relationship progresses such that MERLIN becomes a Cisco cloud application as well as standalone, MEMEX could become the de facto manufacturing MOMS platform, especially for OEE. This could make MEMEX a big data analytics play. MEMEX already has access to data collected from its current installed base; however, becoming a Cisco cloud application would multiply the amount of data collected several times over, allowing the Company to create manufacturing footprints that could be licensed to manufacturers.

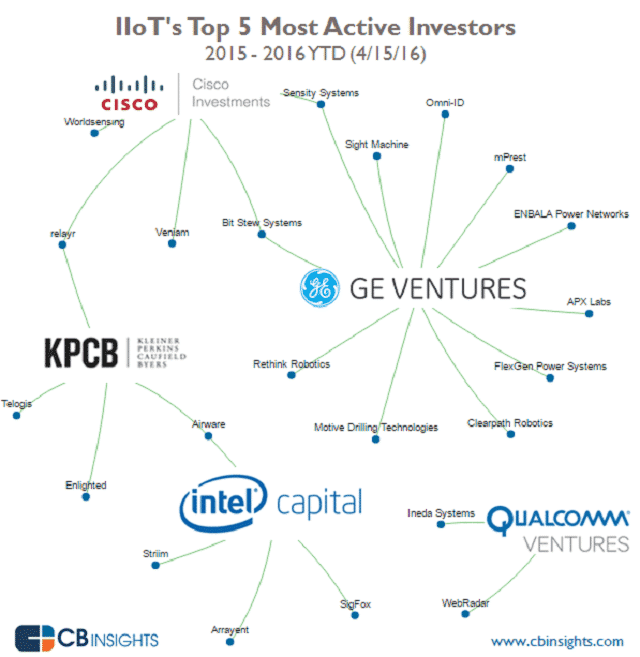

Cisco is an Active IoT Investor

Cisco is making significant investments in the IIoT market. Cisco Investments is Cisco’s $2 billion strategic investment arm that seeks to invest in disruptive technology aligned with Cisco’s long-term business strategy. Exhibit 3 shows the top 5 manufacturing IoT investors, including Cisco.

IIoT– Expected to be One of the Biggest Tech Markets

One reason that Cisco may be one of the most active IIoT investors is because manufacturers are embracing IIoT. Independent research firms and technology companies have accumulated data from the manufacturing world, and several have created their own IIoT market forecasts. The numbers are impressive and represent one of the largest technology markets we’ve encountered.

According to research firm MarketsandMarkets, the IIoT market was worth US93.99 billion in 2014 and could grow to US$151.01 billion by 2020. The firm also believes that by 2020, smart factories (digitized shop floors implementing technologies to parse inefficiencies, product defects, and downtime) could be a US$74.8 billion market.

According to research firm MarketsandMarkets, the IIoT market was worth US93.99 billion in 2014 and could grow to US$151.01 billion by 2020. The firm also believes that by 2020, smart factories (digitized shop floors implementing technologies to parse inefficiencies, product defects, and downtime) could be a US$74.8 billion market.

Research and consulting firm IndustryARC estimates a $123.89 billion global IIoT market by 2021. IndustryARC noted that manufacturing will lead this growth and that Europe was the market leader in 2015.

A study conducted by Fraunhofer IAO and BITKOM forecasted that Industry 4.0, (what Europe generally calls IIoT), could increase productivity by €78 billion across six sectors by 2022.

Research and Markets sees a US$74.80 billion smart factory market size by 2020. Between 2016 and 2022 the firm sees 10.4% CAGR in this market. The smart factory market is driven by factors such as wide adoption of IoT and technological advancements in machine-to-machine communication in the industrial sector, increasing focus on saving energy, and improving process efficiency.

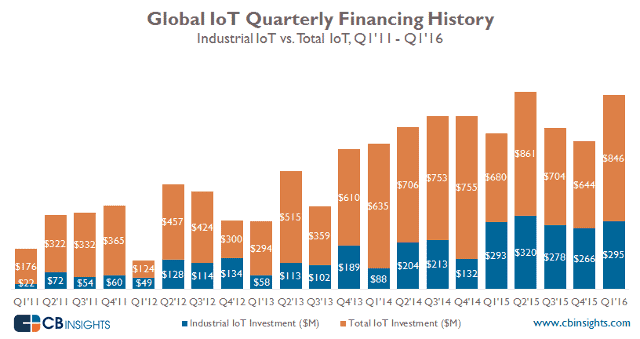

IIoT investment has been steady since 2012 (Exhibit 4). According to market research firm CBInsights, IIoT accounted for 17% of 2011 IoT investments. This scaled to 40% by 2015.

Data from research firm eMarketer (Exhibit 5) indicates that Industrial Manufacturing was the second largest IoT spender in April 2015. No commentary surrounded this data point since the article concerned IoT spending in the consumer packaged goods industry.

In terms of manufacturing analytics, MarketsandMarkets forecasts this sector will grow from US$3.14 billion 2016 to US$8.45 billion in 2021.

Business Insider sees annual manufacturing IoT investment growing from $29 billion in 2015 to $70 billion in 2020 (Exhibit 6). The firm predicts that overall IoT (which includes IIoT) solution investment over the next 5 years will reach $6 trillion.

General Electric is more bullish about IIoT; GE expects IIoT investment to top $60 trillion over the next 15 years.

Wasted Manufacturing Resources

A fundamental issue in the machine manufacturing environment is that machines aren’t accurately monitored. For example, if a machine has unscheduled downtime, the machinist resolves the issue and typically enters the machine’s downtime on a clipboard. If she forgets to note the time that she began her diagnosis and completed her repair, she’ll have to estimate the machine’s downtime. Sometimes, she returns from a coffee break to find her machine stopped and without knowing how long the unscheduled stoppage has been, she’ll guestimate. Perhaps a worker doesn’t want to remove a nearly completed project because it’s close to quitting time, so he slows the machine’s rotation speed so the work order takes longer and overlaps with the next shift of workers. These types of inefficiencies are real and costly.

To eliminate these types of errors, manufacturers require real-time, machine data-reading solutions. “Real-time” reports are often a misnomer, as the examples in the preceding paragraph indicate. And many of those “real-time” reports aren’t read for hours or until days later. The usefulness of old “real-time” data is anything but useful, but this is what many shop floors rely upon to improve their operations.

Large Savings from IIoT Manufacturing Solutions

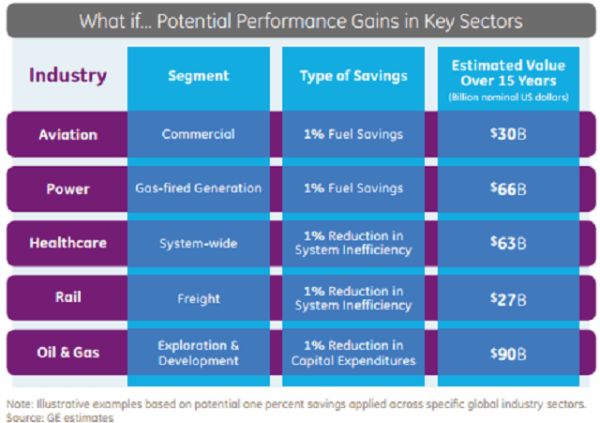

As an example of the types of potential gains manufacturers could see from IIoT, General Electric (GE:NYSE) estimated the potential savings IIoT could create in its global facilities. The company believes that a 1% improvement in its productivity across its global manufacturing base translates to $500 million in annual savings. GE expanded its findings by forecasting the 15-year value created across select industries that could precipitate from a 1% savings improvement of certain costs (Exhibit 7). All told, the savings is over $275 billion.

Security is a Major Issue when Networking Machines

Machines need real-time analytics software and secure network connectivity. Cisco estimates that there are 65 million machines globally, and 90% of them aren’t networked. Ninety-nine percent of the data generated by these machines is trapped. All that data represents insight into machine availability, quality, and performance issues, but manufacturers fear networking those machines for real-time data access would expose operations to security breaches. Secure networks are required to allow Manufacturing Operations Management Systems (MOMS) applications access to machine data to see what those machines are doing in real-time.

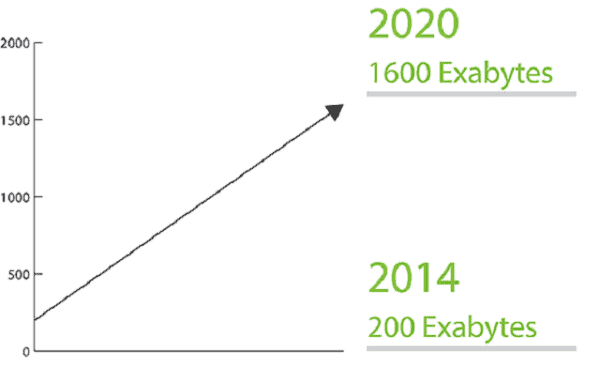

According to Business Insider, data security is the largest concern facing executives considering IoT adoption; 37% of executives issues cited data security as a problematic issue. Managers worry about hackers breaching machine data, stealing company intellectual property or causing havoc with the machines. However, they cannot ignore that IIoT data growth will continue (Exhibit 8). As factories transition into digitized smart factories, applications will analyze zettabytes of data to squeeze the last bits of efficiencies out of every machine, not only within the factories but also through the supply chain. Machines will generate a lot of data and unless there is a way to securely access, analyze, and action on that data, the disconnected factory of today risks obsolescence.

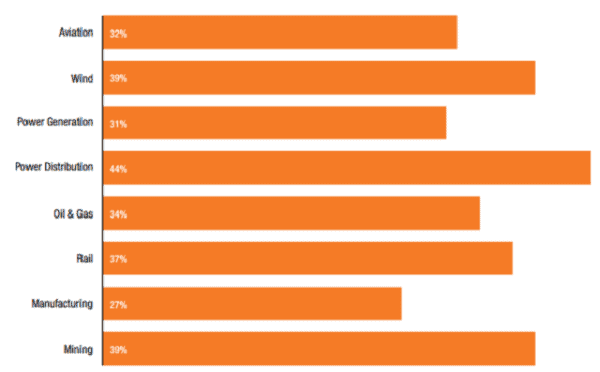

Executives understand the importance of data. Genpact Research Institute in collaboration with GE Digital and others found that 81% of organizations (173 executives) surveyed believe that IIoT adoption is critical to future success. Only 25% have a mapped an IIoT strategy, and 51% stated that data security was the biggest concern. In fact, 58% of the leaders surveyed believed that IIoT increased the risk of cyberattacks. General Electric uncovered data security concerns by industry (Exhibit 9) and found that 27% of manufacturers cited this as an issue.

Research firm MarketsandMarkets foresees a 36.1% CAGR for the broader IoT security market from 2016 through 2021. The firm estimates IoT security investment will grow from $7.9 billion in 2016 to $36.95 billion in 2021.

Most Manufacturers Lack the Ability to Measure OEE

Overall Equipment Effectiveness (OEE) is the product of Availability, Performance, and Quality and measures how effectively a machine is utilized. “Availability” relates how much downtime the machine had during a scheduled period of time. “Performance” is how much of the machine’s speed was lost during a product run compared to the speed it was programmed to operate at. “Quality” refers to how many pieces were scrapped versus what should have been produced as good salable parts. Factoring these three ratios:

OEE = (Availability) x (Quality) x (Performance)

OEE is a priority for the digitization of manufacturing. It is a key metric that will give manufacturers their first successes as they transition to smart, connected factory floors. But there are three problems impeding real-time OEE calculation. The first is the lack of secure network to access machine data. Second, 70% of machines are at least 15 years old, presenting numerous, non-standardized interfaces for accessing machine data. Tapping into these older machines’ data is challenging but not impossible; it requires designing an adapter and wiring it into the machine to pull data. Finally, these older machines need to have their data converted to a standard communication protocol. MTConnect is an open-source communications protocol that is becoming the de facto communication protocol for machine data. MTConnect is almost exclusive within the machine tool and aerospace industries. Newer machines already have already implemented MTConnect, but older machines need a third-party adapter to convert their data into the MTConnect standard.

Conclusion

The Industrial Internet of Things represents a trillion-dollar market opportunity and blue chip companies are positioning themselves to capture large share of the market. Cisco is clearly backing MEMEX’s MERLIN MOMS platform, as evidenced by inviting MEMEX to present MERLIN at Cisco’ Connected Machine booth at Cisco Live. Cisco featured MEMEX and MERLIN in a manufacturing presentation, indicating that the relationship is solid and likely to expand. Investors seeking a pure IIoT company should look at MEMEX.

Acronyms Used in this Report

IIoT Industrial Internet of Things

IoT Internet of Things

ISE identity services engine

MOMS Manufacturing Operations Management System

OEM original equipment manufacturer

SaaS Software as a Service

Disclaimers

The information and recommendations made available here through our emails, newsletters, website, press releases, collectively considered as (“Material”) by Sophic Capital Inc. (“Sophic” or “Company”) is for informational purposes only and shall not be used or construed as an offer to sell or be used as a solicitation of an offer to buy any services or securities. You hereby acknowledge that any reliance upon any Materials shall be at your sole risk. In particular, none of the information provided in our monthly newsletter and emails or any other Material should be viewed as an invite, and/or induce or encourage any person to make any kind of investment decision. The recommendations and information provided in our Material are not tailored to the needs of particular persons and may not be appropriate for you depending on your financial position or investment goals or needs. You should apply your own judgment in making any use of the information provided in the Company’s Material, especially as the basis for any investment decisions. Securities or other investments referred to in the Materials may not be suitable for you and you should not make any kind of investment decision in relation to them without first obtaining independent investment advice from a qualified and registered investment advisor. You further agree that neither Sophic, its employees, affiliates consultants, and/or clients will be liable for any losses or liabilities that may be occasioned as a result of the information provided in any of the Company’s Material. By accessing Sophic’s website and signing up to receive the Company’s monthly newsletter or any other Material, you accept and agree to be bound by and comply with the terms and conditions set out herein. If you do not accept and agree to the terms, you should not use the Company’s website or accept the terms and conditions associated to the newsletter signup. Sophic is not registered as an adviser under the securities legislation of any jurisdiction of Canada and provides Material on behalf of its clients pursuant to an exemption from the registration requirements that is available in respect of generic advice. In no event will Sophic be responsible or liable to you or any other party for any damages of any kind arising out of or relating to the use of, misuse of and/or inability to use the Company’s website or Material. The information is directed only at persons resident in Canada. The Company’s Material or the information provided in the Material shall not in any form constitute as an offer or solicitation to anyone in the United States of America or any jurisdiction where such offer or solicitation is not authorized or to any person to whom it is unlawful to make such a solicitation. If you choose to access Sophic’s website and/or have signed up to receive the Company’s monthly newsletter or any other Material, you acknowledge that the information in the Material is intended for use by persons resident in Canada only. Sophic is not an investment advisory, and Material provided by Sophic shall not be used to make investment decisions. Information provided in the Company’s Material is often opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. Sophic and/or its principals and employees may have positions in the stocks mentioned in the Company’s Material, and may trade in the stocks mentioned in the Material. Do not consider buying or selling any stock without conducting your own due diligence and/or without obtaining independent investment advice from a qualified and registered investment advisor.

Sean Peasgood

Writer